of the VLN, acquisition cost would NOT include: A. Purchase price. B. Transportation cost to get the asset ready to be used. C. Sales taxes. D. Cost incurred to operate the asset

of the VLN, acquisition cost would NOT include: A. Purchase price. B. Transportation cost to get the asset ready to be used. C. Sales taxes. D. Cost incurred to operate the asset

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 29BE

Related questions

Question

From page 7-1 of the VLN, acquisition cost would NOT include:

A. Purchase price.

B. Transportation cost to get the asset ready to be used.

C. Sales taxes.

D. Cost incurred to operate the asset.

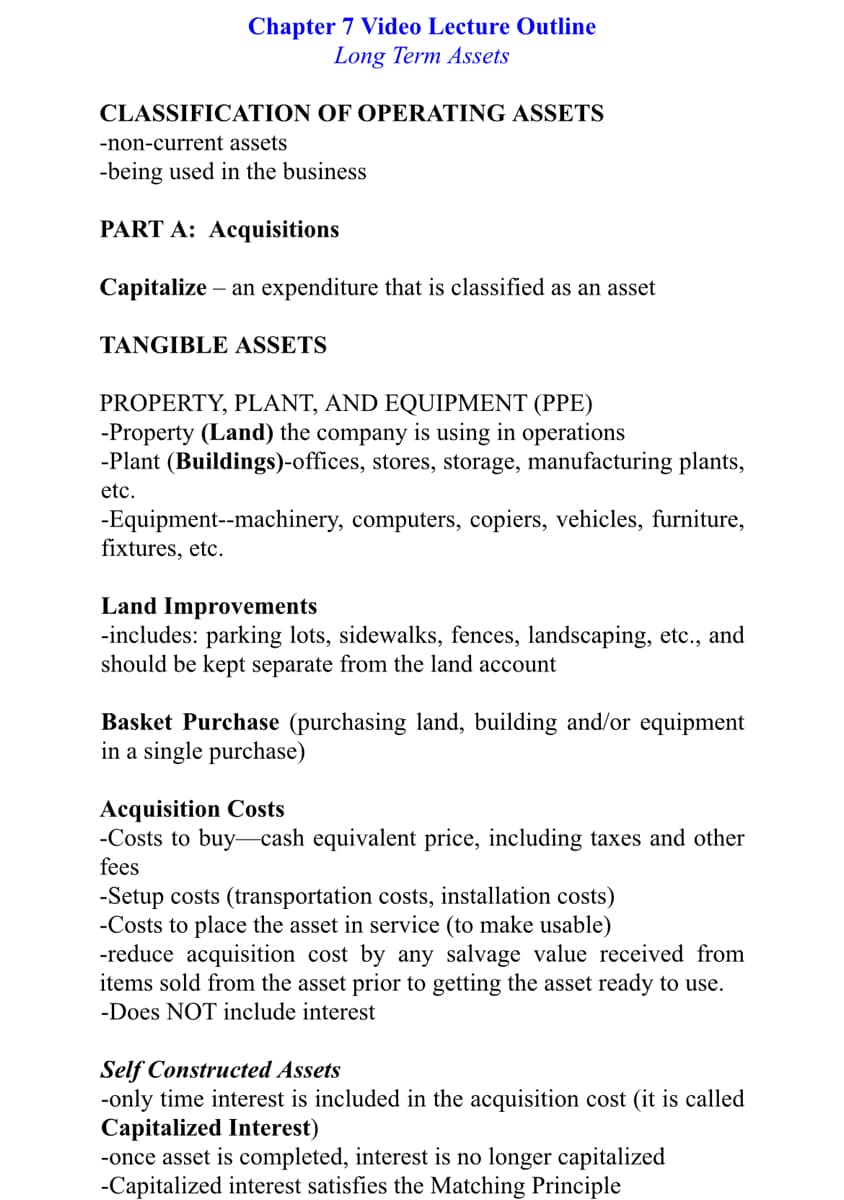

Transcribed Image Text:Chapter 7 Video Lecture Outline

Long Term Assets

CLASSIFICATION OF OPERATING ASSETS

-non-current assets

-being used in the business

PART A: Acquisitions

Capitalize – an expenditure that is classified as an asset

TANGIBLE ASSETS

PROPERTY, PLANT, AND EQUIPMENT (PPE)

-Property (Land) the company is using in operations

-Plant (Buildings)-offices, stores, storage, ma

ing plants,

etc.

-Equipment--machinery, computers, copiers, vehicles, furniture,

fixtures, etc.

Land Improvements

-includes: parking lots, sidewalks, fences, landscaping, etc., and

should be kept separate from the land account

Basket Purchase (purchasing land, building and/or equipment

in a single purchase)

Acquisition Costs

-Costs to buy-cash equivalent price, including taxes and other

fees

-Setup costs (transportation costs, installation costs)

-Costs to place the asset in service (to make usable)

-reduce acquisition cost by any salvage value received from

items sold from the asset prior to getting the asset ready to use.

-Does NOT include interest

Self Constructed Assets

-only time interest is included in the acquisition cost (it is called

Capitalized Interest)

-once asset is completed, interest is no longer capitalized

-Capitalized interest satisfies the Matching Principle

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning