The following information is available for Sandhill Corporation for 2019 (its first year of operations). 1. Excess of tax depreciation over book depreciation, $40,400. This $40,400 difference will reverse equally over the years 2020–2023. 2. Deferral, for book purposes, of $19,900 of rent received in advance. The rent will be recognized in 2020. 3. Pretax financial income, $284,700. 4. Tax rate for all years, 20%.

The following information is available for Sandhill Corporation for 2019 (its first year of operations). 1. Excess of tax depreciation over book depreciation, $40,400. This $40,400 difference will reverse equally over the years 2020–2023. 2. Deferral, for book purposes, of $19,900 of rent received in advance. The rent will be recognized in 2020. 3. Pretax financial income, $284,700. 4. Tax rate for all years, 20%.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 7DQ

Related questions

Question

The following information is available for Sandhill Corporation for 2019 (its first year of operations).

| 1. | Excess of tax |

|

| 2. | Deferral, for book purposes, of $19,900 of rent received in advance. The rent will be recognized in 2020. | |

| 3. | Pretax financial income, $284,700. | |

| 4. | Tax rate for all years, 20%. |

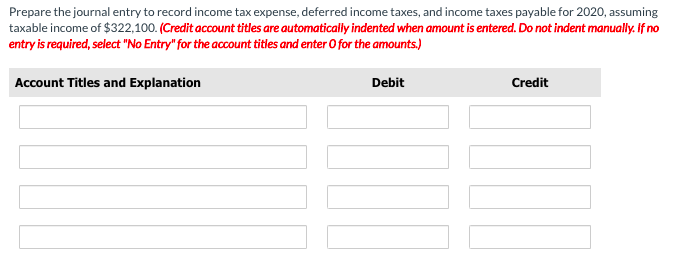

Transcribed Image Text:Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020, assuming

taxable income of $322,100. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no

entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning