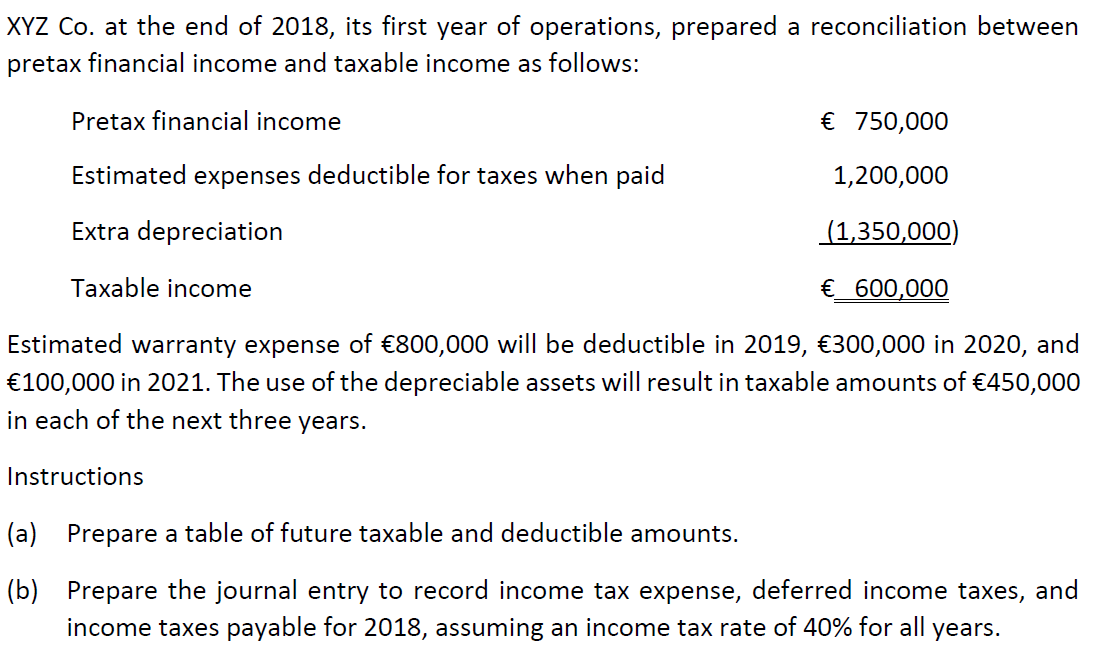

XYZ Co. at the end of 2018, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income € 750,000 Estimated expenses deductible for taxes when paid 1,200,000 Extra depreciation (1,350,000) Taxable income €_ 600,000 Estimated warranty expense of €800,000 will be deductible in 2019, €300,000 in 2020, and €100,000 in 2021. The use of the depreciable assets will result in taxable amounts of €450,000 in each of the next three years. Instructions (a) Prepare a table of future taxable and deductible amounts. (b) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2018, assuming an income tax rate of 40% for all years.

XYZ Co. at the end of 2018, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income € 750,000 Estimated expenses deductible for taxes when paid 1,200,000 Extra depreciation (1,350,000) Taxable income €_ 600,000 Estimated warranty expense of €800,000 will be deductible in 2019, €300,000 in 2020, and €100,000 in 2021. The use of the depreciable assets will result in taxable amounts of €450,000 in each of the next three years. Instructions (a) Prepare a table of future taxable and deductible amounts. (b) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2018, assuming an income tax rate of 40% for all years.

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 56P

Related questions

Question

Transcribed Image Text:XYZ Co. at the end of 2018, its first year of operations, prepared a reconciliation between

pretax financial income and taxable income as follows:

Pretax financial income

€ 750,000

Estimated expenses deductible for taxes when paid

1,200,000

Extra depreciation

(1,350,000)

Taxable income

€ 600,000

Estimated warranty expense of €800,000 will be deductible in 2019, €300,000 in 2020, and

€100,000 in 2021. The use of the depreciable assets will result in taxable amounts of €450,000

in each of the next three years.

Instructions

(a) Prepare a table of future taxable and deductible amounts.

(b) Prepare the journal entry to record income tax expense, deferred income taxes, and

income taxes payable for 2018, assuming an income tax rate of 40% for all years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning