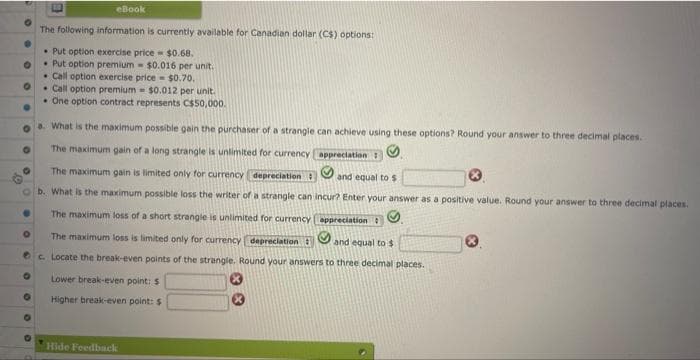

The following information is currently available for Canadian dollar (CS) options: Put option exercise price $0.68. Put option premium $0.016 per unit. Call option exercise price $0.70. Call option premium $0.012 per unit. One option contract represents C$50,000. a. What is the maximum possible gain the purchaser of a strangle can achieve using these options? Round your answer to three decimal places. The maximum gain of a long strangle is unlimited for currency appreciation 1

The following information is currently available for Canadian dollar (CS) options: Put option exercise price $0.68. Put option premium $0.016 per unit. Call option exercise price $0.70. Call option premium $0.012 per unit. One option contract represents C$50,000. a. What is the maximum possible gain the purchaser of a strangle can achieve using these options? Round your answer to three decimal places. The maximum gain of a long strangle is unlimited for currency appreciation 1

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 33QA

Related questions

Question

J1

Transcribed Image Text:O

0

o. What is the maximum possible gain the purchaser of a strangle can achieve using these options? Round your answer to three decimal places.

The maximum gain of a long strangle is unlimited for currency

appreciation

O

0

eBook

The following information is currently available for Canadian dollar (C$) options:

. Put option exercise price $0.68.

Put option premium $0.016 per unit.

• Call option exercise price $0.70.

Call option premium $0.012 per unit.

. One option contract represents C$50,000.

O

O

The maximum gain is limited only for currency depreciation

and equal to $

b. What is the maximum possible loss the writer of a strangle can incur? Enter your answer as a positive value. Round your answer to three decimal places.

The maximum loss of a short strangle is unlimited for currency

appreciation

and equal to $

The maximum loss is limited only for currency depreciation

c. Locate the break-even points of the strangle. Round your answers to three decimal places.

Lower break-even point: $

Higher break-even point: $

Hide Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you