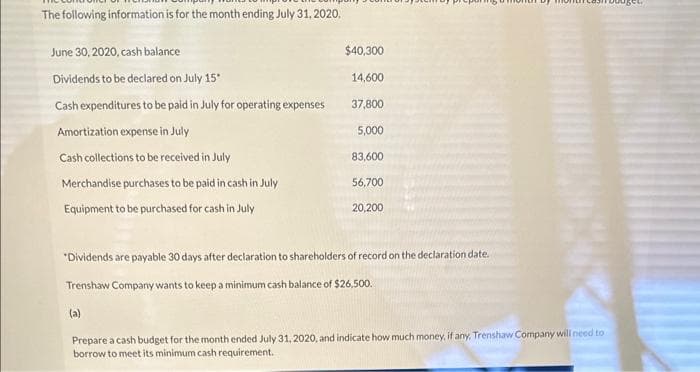

The following information is for the month ending July 31, 2020. June 30, 2020, cash balance Dividends to be declared on July 15 Cash expenditures to be paid in July for operating expenses Amortization expense in July Cash collections to be received in July Merchandise purchases to be paid in cash in July Equipment to be purchased for cash in July $40,300 14,600 37,800 5,000 83,600 56,700 20,200 "Dividends are payable 30 days after declaration to shareholders of record on the declaration date. Trenshaw Company wants to keep a minimum cash balance of $26,500. (a) Prepare a cash budget for the month ended July 31, 2020, and indicate how much money, if any, Trenshaw Company will need to borrow to meet its minimum cash requirement.

The following information is for the month ending July 31, 2020. June 30, 2020, cash balance Dividends to be declared on July 15 Cash expenditures to be paid in July for operating expenses Amortization expense in July Cash collections to be received in July Merchandise purchases to be paid in cash in July Equipment to be purchased for cash in July $40,300 14,600 37,800 5,000 83,600 56,700 20,200 "Dividends are payable 30 days after declaration to shareholders of record on the declaration date. Trenshaw Company wants to keep a minimum cash balance of $26,500. (a) Prepare a cash budget for the month ended July 31, 2020, and indicate how much money, if any, Trenshaw Company will need to borrow to meet its minimum cash requirement.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 41E: Determining Cash Flows from Investing Activities Burns Companys 2019 and 2018 balance sheets...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:The following information is for the month ending July 31, 2020,

June 30, 2020, cash balance

Dividends to be declared on July 15*

Cash expenditures to be paid in July for operating expenses

Amortization expense in July

Cash collections to be received in July

Merchandise purchases to be paid in cash in July

Equipment to be purchased for cash in July

$40,300

14,600

37,800

5,000

83,600

56,700

20,200

*Dividends are payable 30 days after declaration to shareholders of record on the declaration date.

Trenshaw Company wants to keep a minimum cash balance of $26,500.

(a)

Prepare a cash budget for the month ended July 31, 2020, and indicate how much money, if any, Trenshaw Company will need to

borrow to meet its minimum cash requirement.

Transcribed Image Text:O:

0:

A

O

O

O

O

O

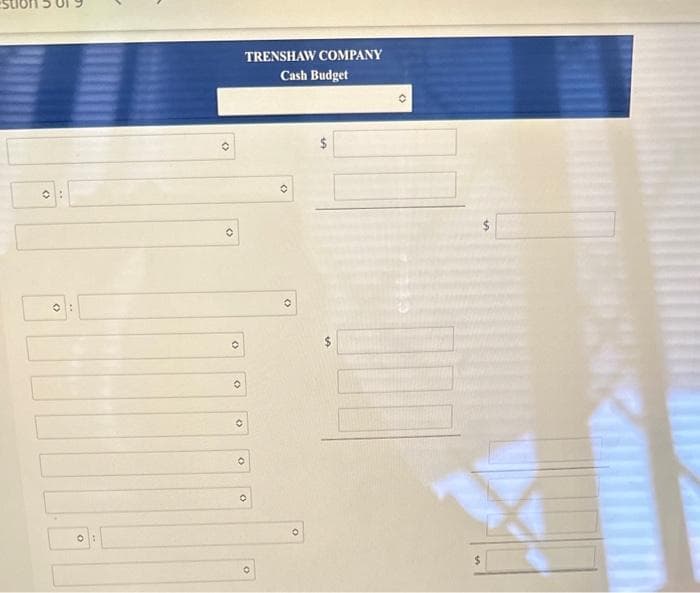

TRENSHAW COMPANY

Cash Budget

O

O

O

0

O

$

$

(

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College