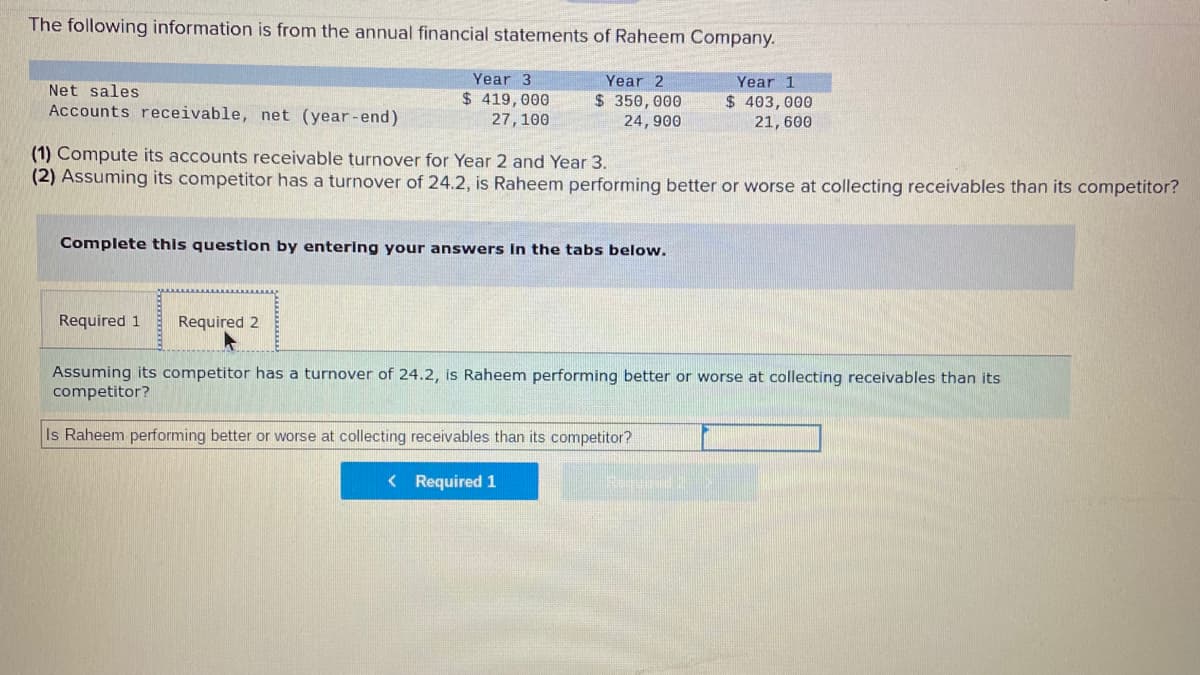

The following information is from the annual financial statements of Raheem Company. Year 3 Year 2 Year 1 Net sales Accounts receivable, net (year-end) $ 419, 000 27, 100 $ 350,000 24,900 $ 403,000 21, 600 (1) Compute its accounts receivable turnover for Year 2 and Year 3. (2) Assuming its competitor has a turnover of 24.2, is Raheem performing better or worse at collecting receivables than its competitor? Complete this question by entering your answers In the tabs below. Required 1 Required 2 Assuming its competitor has a turnover of 24.2, is Raheem performing better or worse at collecting receivables than its competitor? Is Raheem performing better or worse at collecting receivables than its competitor?

The following information is from the annual financial statements of Raheem Company. Year 3 Year 2 Year 1 Net sales Accounts receivable, net (year-end) $ 419, 000 27, 100 $ 350,000 24,900 $ 403,000 21, 600 (1) Compute its accounts receivable turnover for Year 2 and Year 3. (2) Assuming its competitor has a turnover of 24.2, is Raheem performing better or worse at collecting receivables than its competitor? Complete this question by entering your answers In the tabs below. Required 1 Required 2 Assuming its competitor has a turnover of 24.2, is Raheem performing better or worse at collecting receivables than its competitor? Is Raheem performing better or worse at collecting receivables than its competitor?

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 9SPA: FINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8A. All sales...

Related questions

Topic Video

Question

Transcribed Image Text:The following information is from the annual financial statements of Raheem Company.

Year 3

Year 2

Year 1

Net sales

$ 419,000

27,100

$350,000

$ 403,000

21, 600

Accounts receivable, net (year-end)

24, 900

(1) Compute its accounts receivable turnover for Year 2 and Year 3.

(2) Assuming its competitor has a turnover of 24.2, is Raheem performing better or worse at collecting receivables than its competitor?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Assuming its competitor has a turnover of 24.2, is Raheem performing better or worse at collecting receivables than its

competitor?

Is Raheem performing better or worse at collecting receivables than its competitor?

< Required 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning