The following information is taken from Marsh Marsh Supermarkets Supermarkets annual report: During the first quarter, we made several decisions resulting in a $13 million charge to earnings. A new accounting pronouncement, FAS 121, required the Company to take a $7.5 million charge. FAS 121 dictates how companies are to account for the carrying values of their assets. This rule affects all public and private companies. The magnitude of this charge created a window of opportunity to address several other issues that, in the Company’s best long term interest, needed to be resolved. We amended our defined benefit retirement plan, and took significant reorganization and other special charges. These charges, including FAS 121, totaled almost $13 million. The result was a $7.1 million loss for the quarter and a small net loss for the year. Although these were difficult decisions because of their short term impact, they will have positive implications for years to come. Marsh Supermarkets’ net income for the current and previous years are $8.6 million and $9.0 mil- lion, respectively. Required: What earnings management strategy appears to have been used by Marsh Supermarkets in con- junction with the FAS 121 charge (note, the $7.5 million charge from adoption of FAS 121 is not avoidable)? Why do you think Marsh pursued this strategy?

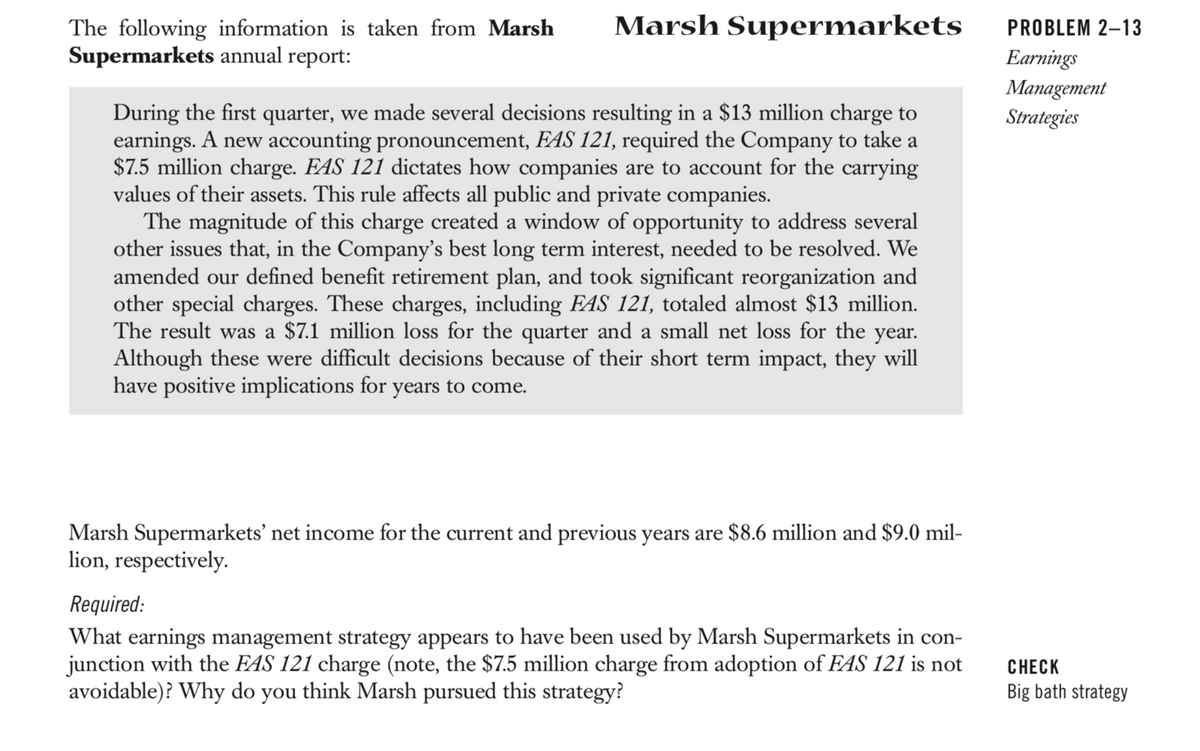

The following information is taken from Marsh Marsh Supermarkets Supermarkets annual report:

During the first quarter, we made several decisions resulting in a $13 million charge to earnings. A new accounting pronouncement, FAS 121, required the Company to take a $7.5 million charge. FAS 121 dictates how companies are to account for the carrying values of their assets. This rule affects all public and private companies.

The magnitude of this charge created a window of opportunity to address several other issues that, in the Company’s best long term interest, needed to be resolved. We amended our defined benefit retirement plan, and took significant reorganization and other special charges. These charges, including FAS 121, totaled almost $13 million. The result was a $7.1 million loss for the quarter and a small net loss for the year. Although these were difficult decisions because of their short term impact, they will have positive implications for years to come.

Marsh Supermarkets’ net income for the current and previous years are $8.6 million and $9.0 mil- lion, respectively.

Required:

What earnings management strategy appears to have been used by Marsh Supermarkets in con- junction with the FAS 121 charge (note, the $7.5 million charge from adoption of FAS 121 is not avoidable)? Why do you think Marsh pursued this strategy?

Step by step

Solved in 3 steps