The following information is taken from the accounts of Foster Corp. The entries in the T-accounts are summaries of the transactions that affected those accounts during the year. Manufacturing Overhead (a) 428,000 (b) 470,000 42,000 Bal. Work in Progress 117,000 (c) Bal. 820,000 222,000 127,000 (b) 470,000 Bal. 116,000 Finished Goods Bal. 178,000 (d) 874,000 (c) 820,000 Bal. 124,000 Cost of Goods Sold (d) 874,000 The overhead applied to production during the year is distributed among the ending balances in the accounts as follows: Work in Process, ending $ 47,000 Finished Goods, ending 70,500 Cost of Goods Sold 352,500 Overhead applied $470,000

The following information is taken from the accounts of Foster Corp. The entries in the T-accounts are summaries of the transactions that affected those accounts during the year. Manufacturing Overhead (a) 428,000 (b) 470,000 42,000 Bal. Work in Progress 117,000 (c) Bal. 820,000 222,000 127,000 (b) 470,000 Bal. 116,000 Finished Goods Bal. 178,000 (d) 874,000 (c) 820,000 Bal. 124,000 Cost of Goods Sold (d) 874,000 The overhead applied to production during the year is distributed among the ending balances in the accounts as follows: Work in Process, ending $ 47,000 Finished Goods, ending 70,500 Cost of Goods Sold 352,500 Overhead applied $470,000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 62P: (Appendix 4A) Overhead Application, Journal Entries, Job Cost At the beginning of the year, Smith...

Related questions

Question

please help me to solve this problem

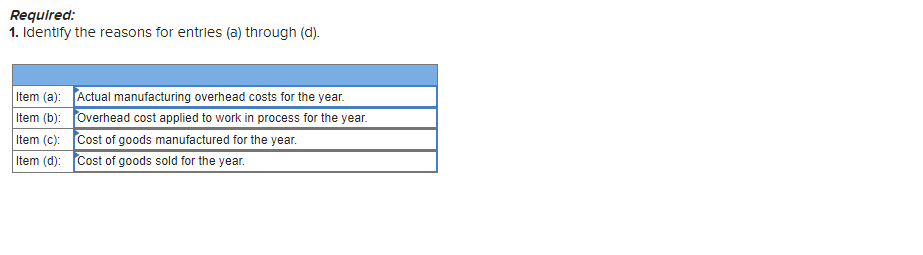

Transcribed Image Text:Required:

1. Identify the reasons for entries (a) through (d).

Item (a):

Item (b):

Item (c):

Item (d):

Actual manufacturing overhead costs for the year.

Overhead cost applied to work in process for the year.

Cost of goods manufactured for the year.

Cost of goods sold for the year.

![Problem 5-17 Applying Overhead; Journal Entries; Disposition of Underapplied or Overapplied

Overhead [LO4, LO5, LO7]

The following information is taken from the accounts of Foster Corp. The entries in the T-accounts are summaries of the transactions

that affected those accounts during the year.

Manufacturing Overhead

428,000 (b)

(a)

470,000

Bal.

42,000

Work in Progress

Bal.

117,000 (c)

820,000

222,000

127,000

(b)

470,000

Bal.

116,000

Finished Goods

Bal.

178,000 (d)

874,000

(c)

820,000

Bal.

124,000

Cost of Goods Sold

(d)

874,000

The overhead applied to production during the year is distributed among the ending balances in the accounts as follows:

Work in Process, ending

$ 47,000

70,500

Finished Goods, ending

Cost of Goods Sold

Overhead applied

352,500

$470,000](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fa5842010-91f9-42a8-8f09-43c1980060f2%2Ffe4bfb98-be9e-4b9a-9a76-8e69b670e349%2Fonkoymh_processed.png&w=3840&q=75)

Transcribed Image Text:Problem 5-17 Applying Overhead; Journal Entries; Disposition of Underapplied or Overapplied

Overhead [LO4, LO5, LO7]

The following information is taken from the accounts of Foster Corp. The entries in the T-accounts are summaries of the transactions

that affected those accounts during the year.

Manufacturing Overhead

428,000 (b)

(a)

470,000

Bal.

42,000

Work in Progress

Bal.

117,000 (c)

820,000

222,000

127,000

(b)

470,000

Bal.

116,000

Finished Goods

Bal.

178,000 (d)

874,000

(c)

820,000

Bal.

124,000

Cost of Goods Sold

(d)

874,000

The overhead applied to production during the year is distributed among the ending balances in the accounts as follows:

Work in Process, ending

$ 47,000

70,500

Finished Goods, ending

Cost of Goods Sold

Overhead applied

352,500

$470,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning