The following information is taken from the actuarial valuation report of Daddy, Inc.'s defined benefit plan: Fair value of plan assets, Jan. 1 Present value of defined benefit obligation, Jan. 1 Past service cost from plan amendment during the year (the vesting period is 5 yrs.) u Current service cost 2,100,000 2,400,000 300,000 600,000 Benefits paid to retirees during the year Actuarial gain during the period Return on plan assets during the period Contributions to the fund during the year Discount rate based on high quality corporate bonds 450,000 15,000 270,000 0000 480,000 12% Requirements: a. Determine net defined benefit liability/asset as of Jan. 1, 20x1 and Dec. 31, 20x1, respectively. b. Compute for the defined benefit cost in 20x1, showing amoúnts recognized in P/L and OCI, respectively. c. Provide the journal entries in 20x1. d Prepare a reconciliation of the beginning and ending balances of net defined benefit liability/asset.

The following information is taken from the actuarial valuation report of Daddy, Inc.'s defined benefit plan: Fair value of plan assets, Jan. 1 Present value of defined benefit obligation, Jan. 1 Past service cost from plan amendment during the year (the vesting period is 5 yrs.) u Current service cost 2,100,000 2,400,000 300,000 600,000 Benefits paid to retirees during the year Actuarial gain during the period Return on plan assets during the period Contributions to the fund during the year Discount rate based on high quality corporate bonds 450,000 15,000 270,000 0000 480,000 12% Requirements: a. Determine net defined benefit liability/asset as of Jan. 1, 20x1 and Dec. 31, 20x1, respectively. b. Compute for the defined benefit cost in 20x1, showing amoúnts recognized in P/L and OCI, respectively. c. Provide the journal entries in 20x1. d Prepare a reconciliation of the beginning and ending balances of net defined benefit liability/asset.

Chapter21: Partnerships

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:d. Prepare a reconciliation of the beginning and ending balances

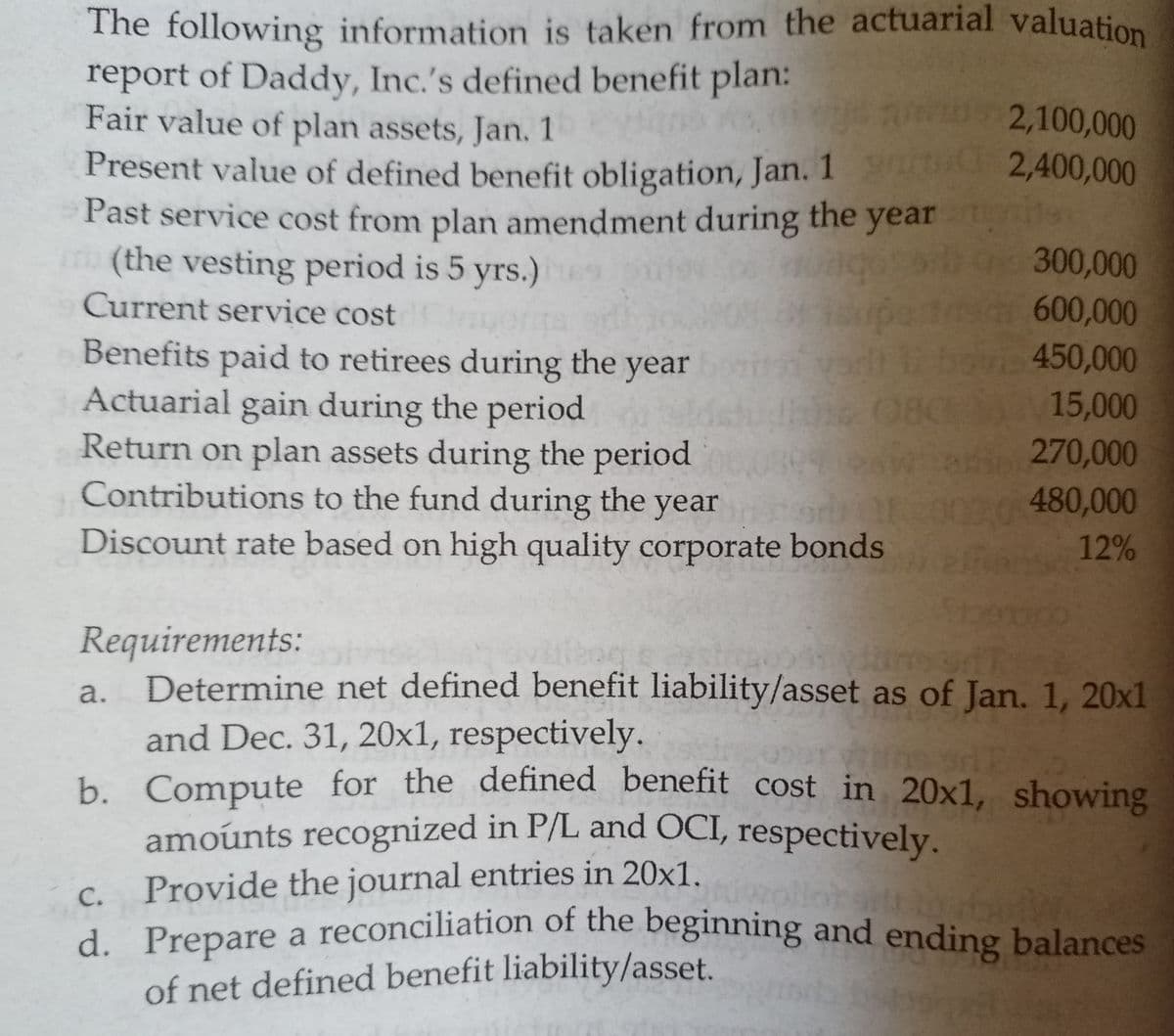

The following information is taken from the actuarial valuation

report of Daddy, Inc.'s defined benefit plan:

Fair value of plan assets, Jan. 1

Present value of defined benefit obligation, Jan. 1

Past service cost from plan amendment during the year

(the vesting period is 5 yrs.)es

2,100,000

2,400,000

300,000

Current service cost

600,000

Benefits paid to retirees during the

Actuarial gain during the period

Return on plan assets during the period

Contributions to the fund during the year

Discount rate based on high quality corporate bonds

year

450,000

15,000

270,000

480,000

12%

Requirements:

a. Determine net defined benefit liability/asset as of Jan. 1, 20x1

and Dec. 31, 20x1, respectively.

b. Compute for the defined benefit cost in 20x1, showing

amoúnts recognized in P/L and OCI, respectively.

c. Provide the journal entries in 20x1.

Prepare a reconciliation of the beginning and ending balances

с.

d.

of net defined benefit liability/asset.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you