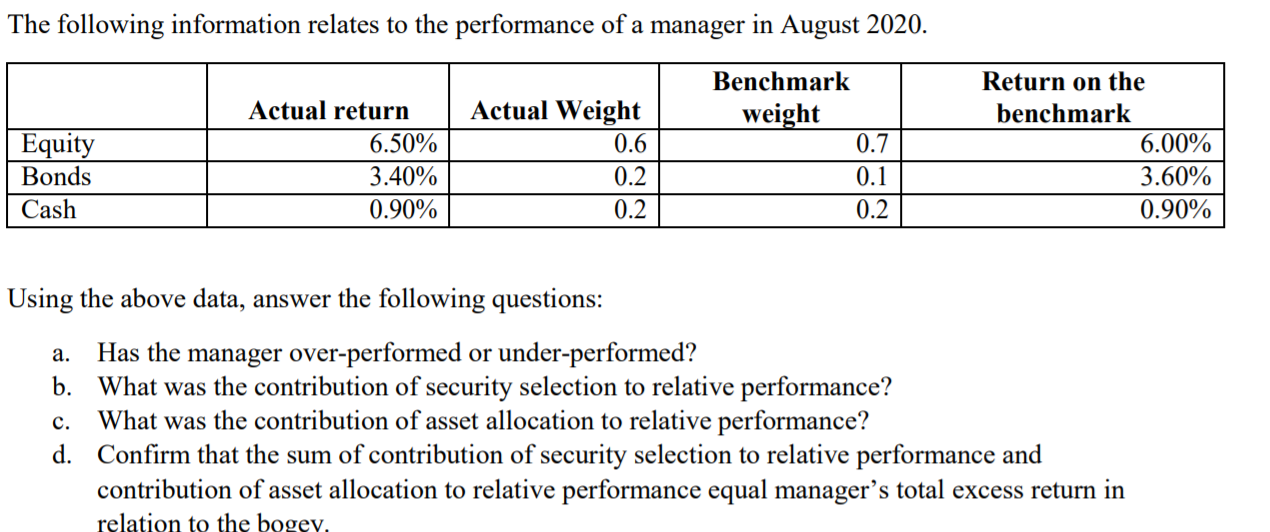

The following information relates to the performance of a manager in August 2020. Benchmark Return on the Actual return Actual Weight weight 0.7 benchmark 6.00% Equity Bonds 6.50% 0.6 3.40% 0.2 0.1 3.60% Cash 0.90% 0.2 0.2 0.90% Using the above data, answer the following questions: Has the manager over-performed or under-performed? b. What was the contribution of security selection to relative performance? What was the contribution of asset allocation to relative performance? d. Confirm that the sum of contribution of security selection to relative performance and contribution of asset allocation to relative performance equal manager's total excess return in а. с. relation to the bogev,

The following information relates to the performance of a manager in August 2020. Benchmark Return on the Actual return Actual Weight weight 0.7 benchmark 6.00% Equity Bonds 6.50% 0.6 3.40% 0.2 0.1 3.60% Cash 0.90% 0.2 0.2 0.90% Using the above data, answer the following questions: Has the manager over-performed or under-performed? b. What was the contribution of security selection to relative performance? What was the contribution of asset allocation to relative performance? d. Confirm that the sum of contribution of security selection to relative performance and contribution of asset allocation to relative performance equal manager's total excess return in а. с. relation to the bogev,

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter14: The Balanced Scorecard And Corporate Social Responsibility

Section: Chapter Questions

Problem 1BE: 72 Inc. has developed a balanced scorecard with the following performance metrics: Total sales...

Related questions

Question

Transcribed Image Text:The following information relates to the performance of a manager in August 2020.

Benchmark

Return on the

Actual return

Actual Weight

weight

0.7

benchmark

6.00%

Equity

Bonds

6.50%

0.6

3.40%

0.2

0.1

3.60%

Cash

0.90%

0.2

0.2

0.90%

Using the above data, answer the following questions:

Has the manager over-performed or under-performed?

b. What was the contribution of security selection to relative performance?

What was the contribution of asset allocation to relative performance?

d. Confirm that the sum of contribution of security selection to relative performance and

contribution of asset allocation to relative performance equal manager's total excess return in

а.

с.

relation to the bogev,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning