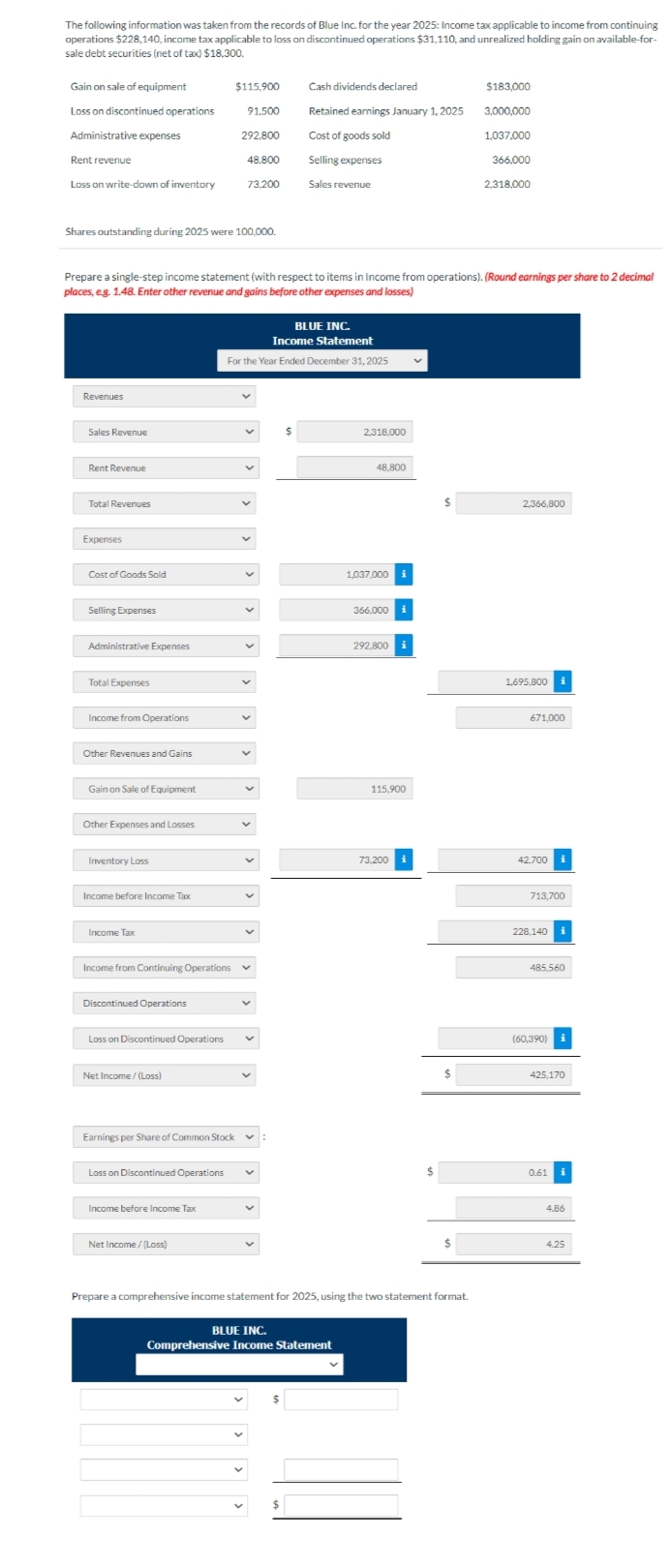

The following information was taken from the records of Blue Inc. for the year 2025: Income tax applicable to income from continuin operations $228,140, income tax applicable to loss on discontinued operations $31,110, and unrealized holding gain on available-for sale debt securities (net of tax) $18,300. Gain on sale of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write-down of inventory Revenues Shares outstanding during 2025 were 100,000. Sales Revenue Rent Revenue Total Revenues Prepare a single-step income statement (with respect to items in Income from operations). (Round earnings per share to 2 decimal places, eg. 1.48. Enter other revenue and gains before other expenses and losses) Expenses Cost of Goods Sold Selling Expenses Administrative Expenses Total Expenses Income from Operations Other Revenues and Gains Gain on Sale of Equipment Other Expenses and Losses Inventory Loss Income before Income Tax Income Tax Discontinued Operations $115,900 91.500 292,800 Net Income/(Loss) 48.800 73,200 Earnings per Share of Common Stock Income before Income Tax Net Income/(Loss) BLUE INC. Income Statement For the Year Ended December 31, 2025 V Income from Continuing Operations v V V Loss on Discontinued Operations V v v Loss on Discontinued Operations v v Cash dividends declared $183,000 Retained earnings January 1, 2025 3,000,000 Cost of goods sold 1,037,000 Selling expenses Sales revenue V $ 2,318.000 BLUE INC. Comprehensive Income Statement 48,800 1,037,000 366.000 292,800 i 115,900 73,200 i Prepare a comprehensive income statement for 2025, using the two statement format. 366.000 2,318,000 2,366,800 1.695.800 671,000 42,700 713,700 228,140 485,560 (60,390) 425,170 0.61 4.86 4.25

The following information was taken from the records of Blue Inc. for the year 2025: Income tax applicable to income from continuin operations $228,140, income tax applicable to loss on discontinued operations $31,110, and unrealized holding gain on available-for sale debt securities (net of tax) $18,300. Gain on sale of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write-down of inventory Revenues Shares outstanding during 2025 were 100,000. Sales Revenue Rent Revenue Total Revenues Prepare a single-step income statement (with respect to items in Income from operations). (Round earnings per share to 2 decimal places, eg. 1.48. Enter other revenue and gains before other expenses and losses) Expenses Cost of Goods Sold Selling Expenses Administrative Expenses Total Expenses Income from Operations Other Revenues and Gains Gain on Sale of Equipment Other Expenses and Losses Inventory Loss Income before Income Tax Income Tax Discontinued Operations $115,900 91.500 292,800 Net Income/(Loss) 48.800 73,200 Earnings per Share of Common Stock Income before Income Tax Net Income/(Loss) BLUE INC. Income Statement For the Year Ended December 31, 2025 V Income from Continuing Operations v V V Loss on Discontinued Operations V v v Loss on Discontinued Operations v v Cash dividends declared $183,000 Retained earnings January 1, 2025 3,000,000 Cost of goods sold 1,037,000 Selling expenses Sales revenue V $ 2,318.000 BLUE INC. Comprehensive Income Statement 48,800 1,037,000 366.000 292,800 i 115,900 73,200 i Prepare a comprehensive income statement for 2025, using the two statement format. 366.000 2,318,000 2,366,800 1.695.800 671,000 42,700 713,700 228,140 485,560 (60,390) 425,170 0.61 4.86 4.25

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:The following information was taken from the records of Blue Inc. for the year 2025: Income tax applicable to income from continuing

operations $228,140, income tax applicable to loss on discontinued operations $31,110, and unrealized holding gain on available-for-

sale debt securities (net of tax) $18,300.

Gain on sale of equipment

Loss on discontinued operations

Administrative expenses

Rent revenue

Loss on write-down of inventory

Revenues

Sales Revenue

Rent Revenue

Shares outstanding during 2025 were 100,000.

Total Revenues

Expenses

Cost of Goods Sold

Selling Expenses

Administrative Expenses

Prepare a single-step income statement (with respect to items in Income from operations). (Round earnings per share to 2 decimal

places, e.g. 1.48. Enter other revenue and gains before other expenses and losses)

Total Expenses

Income from Operations

Other Revenues and Gains

Gain on Sale of Equipment

Other Expenses and Losses

Inventory Loss

Income before Income Tax

Income Tax

Income from Continuing Operations

Discontinued Operations

Loss on Discontinued Operations

Net Income /(Loss)

Earnings per Share of Common Stock

Loss on Discontinued Operations

$115.900

Income before Income Tax

91.500

Net Income /(Loss)

292,800

48,800

73,200

BLUE INC.

Income Statement

For the Year Ended December 31, 2025

V

V

V

Cash dividends declared

v

Retained earnings January 1, 2025

Cost of goods sold

Selling expenses

Sales revenue

V

2.318.000

BLUE INC.

Comprehensive Income Statement

48.800

1.037.000

366,000

292,800 i

115,900

73,200

Prepare a comprehensive income statement for 2025, using the two statement format.

$183,000

3,000,000

1,037,000

366,000

2,318,000

2,366,800

1,695,800

671,000

42,700

713,700

228,140

485,560

(60,390)

425,170

0.61

4.86

4.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning