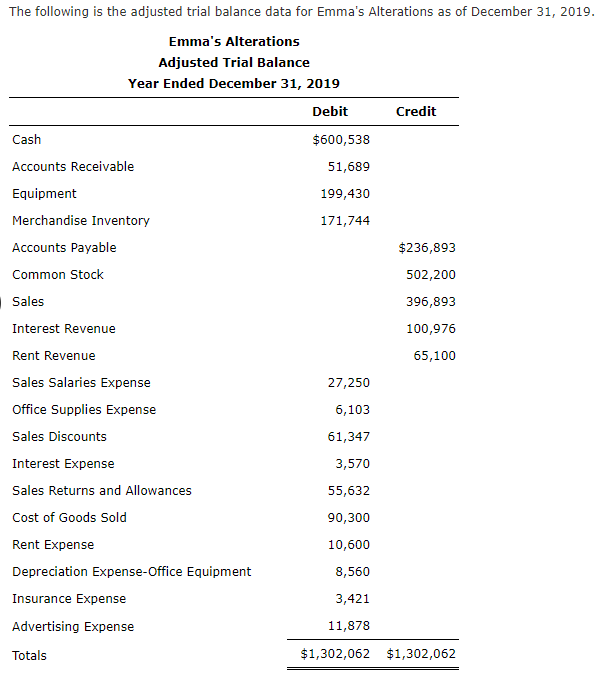

The following is the adjusted trial balance data for Emma's Alterations as of December 31, 20 Emma's Alterations Adjusted Trial Balance Year Ended December 31, 2019 Debit Credit Cash $600,538 Accounts Receivable 51,689 Equipment 199,430 Merchandise Inventory 171,744 Accounts Payable $236,893 Common Stock 502,200 Sales 396,893 Interest Revenue 100,976 Rent Revenue 65,100 Sales Salaries Expense 27,250 Office Supplies Expense 6,103 Sales Discounts 61,347 Interest Expense 3,570 Sales Returns and Allowances 55,632 Cost of Goods Sold 90,300 Rent Expense 10,600 Depreciation Expense-Office Equipment 8,560 Insurance Expense 3,421 Advertising Expense 11,878 Totals $1,302,062 $1,302,062

The following is the adjusted trial balance data for Emma's Alterations as of December 31, 20 Emma's Alterations Adjusted Trial Balance Year Ended December 31, 2019 Debit Credit Cash $600,538 Accounts Receivable 51,689 Equipment 199,430 Merchandise Inventory 171,744 Accounts Payable $236,893 Common Stock 502,200 Sales 396,893 Interest Revenue 100,976 Rent Revenue 65,100 Sales Salaries Expense 27,250 Office Supplies Expense 6,103 Sales Discounts 61,347 Interest Expense 3,570 Sales Returns and Allowances 55,632 Cost of Goods Sold 90,300 Rent Expense 10,600 Depreciation Expense-Office Equipment 8,560 Insurance Expense 3,421 Advertising Expense 11,878 Totals $1,302,062 $1,302,062

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 11PA: The following is the adjusted trial balance data for Emmas Alterations as of December 31, 2019. A....

Related questions

Question

a,b, and c please

Transcribed Image Text:The following is the adjusted trial balance data for Emma's Alterations as of December 31, 2019.

Emma's Alterations

Adjusted Trial Balance

Year Ended December 31, 2019

Debit

Credit

Cash

$600,538

Accounts Receivable

51,689

Equipment

199,430

Merchandise Inventory

171,744

Accounts Payable

$236,893

Common Stock

502,200

Sales

396,893

Interest Revenue

100,976

Rent Revenue

65,100

Sales Salaries Expense

27,250

Office Supplies Expense

6,103

Sales Discounts

61,347

Interest Expense

3,570

Sales Returns and Allowances

55,632

Cost of Goods Sold

90,300

Rent Expense

10,600

Depreciation Expense-Office Equipment

8,560

Insurance Expense

3,421

Advertising Expense

11,878

Totals

$1,302,062 $1,302,062

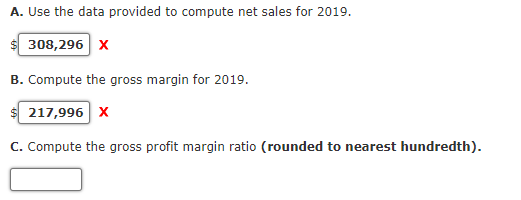

Transcribed Image Text:A. Use the data provided to compute net sales for 2019.

308,296 x

B. Compute the gross margin for 2019.

217,996 x

C. Compute the gross profit margin ratio (rounded to nearest hundredth).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning