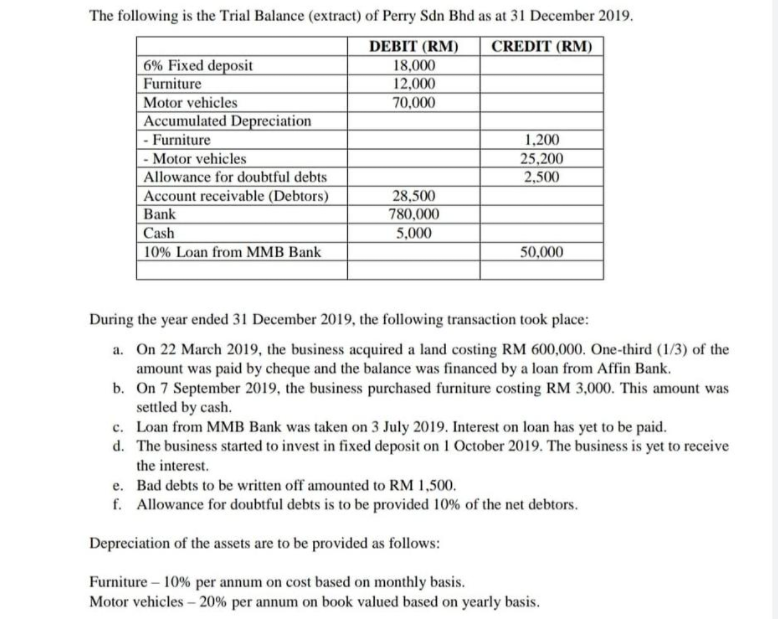

The following is the Trial Balance (extract) of Perry Sdn Bhd as at 31 December 2019. DEBIT (RM) CREDIT (RM) 6% Fixed deposit 18,000 12,000 70,000 Furniture Motor vehicles Accumulated Depreciation - Furniture - Motor vehicles Allowance for doubtful debts Account receivable (Debtors) Bank 1,200 25,200 2,500 28,500 780,000 5,000 Cash 10% Loan from MMB Bank 50,000 During the year ended 31 December 2019, the following transaction took place: a. On 22 March 2019, the business acquired a land costing RM 600,000. One-third (1/3) of the amount was paid by cheque and the balance was financed by a loan from Affin Bank. b. On 7 September 2019, the business purchased furniture costing RM 3,000. This amount was settled by cash. c. Loan from MMB Bank was taken on 3 July 2019. Interest on loan has yet to be paid. d. The business started to invest in fixed deposit on 1 October 2019. The business is yet to receive the interest. e. Bad debts to be written off amounted to RM 1,500, f. Allowance for doubtful debts is to be provided 10% of the net debtors. Depreciation of the assets are to be provided as follows: Furniture – 10% per annum on cost based on monthly basis. Motor vehicles - 20% per annum on book valued based on yearly basis.

The following is the Trial Balance (extract) of Perry Sdn Bhd as at 31 December 2019. DEBIT (RM) CREDIT (RM) 6% Fixed deposit 18,000 12,000 70,000 Furniture Motor vehicles Accumulated Depreciation - Furniture - Motor vehicles Allowance for doubtful debts Account receivable (Debtors) Bank 1,200 25,200 2,500 28,500 780,000 5,000 Cash 10% Loan from MMB Bank 50,000 During the year ended 31 December 2019, the following transaction took place: a. On 22 March 2019, the business acquired a land costing RM 600,000. One-third (1/3) of the amount was paid by cheque and the balance was financed by a loan from Affin Bank. b. On 7 September 2019, the business purchased furniture costing RM 3,000. This amount was settled by cash. c. Loan from MMB Bank was taken on 3 July 2019. Interest on loan has yet to be paid. d. The business started to invest in fixed deposit on 1 October 2019. The business is yet to receive the interest. e. Bad debts to be written off amounted to RM 1,500, f. Allowance for doubtful debts is to be provided 10% of the net debtors. Depreciation of the assets are to be provided as follows: Furniture – 10% per annum on cost based on monthly basis. Motor vehicles - 20% per annum on book valued based on yearly basis.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 17E: Interest-Bearing and Non-Interest-Bearing Notes On December 11, 2019, Hooper Inc. made a credit sale...

Related questions

Question

prepare statment of profit or loss(extract) for the year ended 31 december 2019

Transcribed Image Text:The following is the Trial Balance (extract) of Perry Sdn Bhd as at 31 December 2019.

DEBIT (RM)

18,000

12,000

70,000

CREDIT (RM)

6% Fixed deposit

Furniture

Motor vehicles

Accumulated Depreciation

- Furniture

- Motor vehicles

Allowance for doubtful debts

Account receivable (Debtors)

Bank

1,200

25,200

2,500

28,500

780,000

Cash

5,000

10% Loan from MMB Bank

50,000

During the year ended 31 December 2019, the following transaction took place:

a. On 22 March 2019, the business acquired a land costing RM 600,000. One-third (1/3) of the

amount was paid by cheque and the balance was financed by a loan from Affin Bank.

b. On 7 September 2019, the business purchased furniture costing RM 3,000. This amount was

settled by cash.

c. Loan from MMB Bank was taken on 3 July 2019. Interest on loan has yet to be paid.

d. The business started to invest in fixed deposit on 1 October 2019. The business is yet to receive

the interest.

e. Bad debts to be written off amounted to RM 1,500.

f. Allowance for doubtful debts is to be provided 10% of the net debtors.

Depreciation of the assets are to be provided as follows:

Furniture – 10% per annum on cost based on monthly basis.

Motor vehicles – 20% per annum on book valued based on yearly basis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning