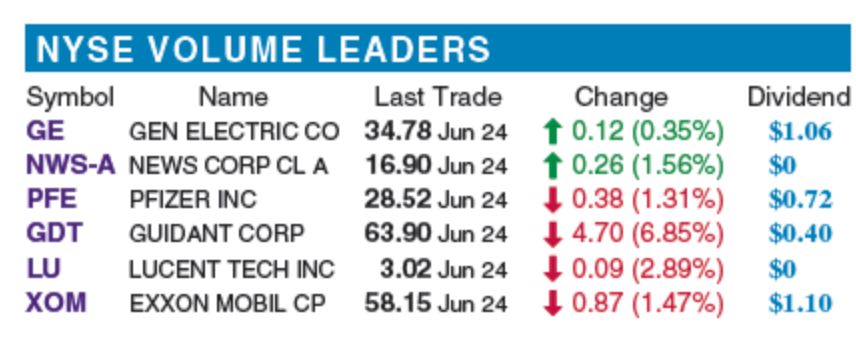

The following lists the six New York Stock Exchange volume leaders on June 24. An investor buys 100 shares of GE at the Last Trade price, pays a $100 commission on the purchase, and sells the 100 shares a year later for $37.78 per share with a 2% commission on the sale. (a) Find the total cost. $ (b) Find the total dividend. $ (c) Find the commission when selling the shares. $ (d) Find the capital gain when selling the shares.

Q: Thornton Watches, Incorporated makes watches. Its assembly department started the accounting period…

A: Formula, Cost per equivalent unit = [(Cost of beginning inventory + Transferred in cost + Material…

Q: Complete Questions 16.3-16.10 in your own words and in-detailed explanation! DON'T MISS A SINGLE…

A: Sources and Uses of Cash To comprehend how cash moves within a corporation, it is essential to know…

Q: Attribute sampling is a statistical technique used in audit procedures to examine the…

A: Whether or not official signatures appear on all checks depends on the specific control procedures…

Q: Consider the following excerpt of Butterfly Corporation's balance sheet and income statement Use…

A: Ratio analysis is quantitive method of getting inside review of an organisation. Which able to…

Q: QUESTION 2 Billy Bourne makes $97574 annually. How much does Billy pay for his E.I. premium for the…

A: The Employment Insurance (EI) premium rate for 2022 is 1.58% of insurable earnings, up to a maximum…

Q: 3. TOP Corp. has the following balance sheet. Cash Short-term investments Accounts receivable…

A: Operating capital, also known as working capital, is the cash used for daily operations in a…

Q: 20. Reznikov, Inc. provides an incentive compensation plan under. which its president receives a…

A: #Note: Requirement 20 is answered. The bonus rate is after charging bonus, thus [(income before…

Q: Classico's Pizza, a chain of pizza parlors, views each branch location as an investment center. The…

A: Solution : Sales = $3,600,000 Variable Expenses = $2,970,000 Fixed cost = $270,000

Q: phases. For some businesses, particularly Total life-cycle costing normally starts from the premise…

A: Total life cycle costing normally starts from the premise that the life cycle of a product or…

Q: Check my work In 2019, Trader Company acquired a parcel of land for a cash purchase price of…

A: We know that Land is non depreciable asset. Depreciation is not charged on land. But if the carrying…

Q: The managerial accountant at Seaside Manufacturing reported the following data: Units: Beginning WIP…

A: Finished goods inventory is the third and final classification of inventory that is used for…

Q: Tea Blending Specialists has no debt outstanding and a total market value of $349,680. Earnings…

A: Share repurchase refers to those transactions in which a company buys back its own shares. The…

Q: The adjusted trial balance of Erickson Real Estate Appraisal at June 30, 2018, follows: ERICKSON…

A: Retained earnings are an accumulation of net profits/losses earned or incurred by the company…

Q: Montoure Company uses a perpetual inventory system. It entered into the following calendar-year…

A: Ending Inventory - Ending Inventory is the inventory remain available after selling for the period.…

Q: Requirements 1. Journalize the transactions in the Johnson Pharmacies general journal. Round to the…

A: Journalisation of Mortgage loan A mortgage to a company is an example of a business deal that is…

Q: c) Peach is to introduced $20000 as capital, part of which was used on 1 January to purchase a new…

A: Question has mentioned that profit and loss are to be shared in proportion of Capital Account…

Q: Walton Company started year 1 with $330,000 in its cash and common stock accounts. During year 1,…

A: calculation of Total amount of assets and and expenses in year 1 financial statement in both case…

Q: The following information is available for two different types of businesses for the Year 1…

A: Income statement : It is prepared to know the net income (or net loss) earned by the business for a…

Q: Required information [The following information applies to the questions displayed below) Solich…

A: Amortization expense for a patent refers to the gradual expensing of the cost of acquiring or…

Q: A company's inventory on December 31, 2024, was $333,000 based on a physical count priced at cost,…

A: F.o.b. shipping means that the title to the goods passes from the owner or seller to the buyer when…

Q: CRITICS Company is a multi-product firm. Presented below is information concerning one of its…

A: Problem 1 of Inventories exercise i.e. question of Critics company is answered. Cost of goods sold =…

Q: Which statement is correct about goodwill related to investments in associates? a. It is…

A: As per the accounting concepts, when the holding company acquire a subsidiary and goodwill is the…

Q: Concord Corporation was starting a new style of jacket and was monitoring the costs of its first…

A: Total Manufacturing Costs :— It is the total cost incurred in the manufacturing of product during…

Q: On January 1, 2023, Pelicans Company sold an equipment to Hornets Company which had a carrying value…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: Ramos Corp. uses a process costing system to assign costs to its steel production. During March,…

A: FIFO stands for First in first out, which is a method of inventory valuation and this method states…

Q: C. State the account and the amount to be debited and credited using the answer sheet provided for.…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Thunder Inc. (a C corporation) has invested in the stock of several other corporations. In the…

A: Certain corporations that receive dividends from related organizations in the US are eligible for a…

Q: Elijah has $66,000 of salary and $11,500 of itemized deductions. Eriana has $99,000 and 18,100 of…

A: INTRODUCTION: Taxable income is any compensation received by an individual or corporation that is…

Q: Quinee, industrial partner, Reyna, capitalist partner, and Selena, capitalist-industrial partner,…

A: Since the partners did not agree on a loss sharing ratio, it can be assumed that they will share the…

Q: The Quadrangle Fabrication Plant suffered a fire incident at the beginning of the year, which…

A: A predetermined overhead rate forms the basis for the allocation of the actual manufacturing…

Q: Attribute sampling enables the auditor to directly assess whether a rule is operating successfully…

A: Monetary unit sampling is a statistical sampling method used in auditing to test the accuracy of…

Q: 0 inces The December 31, 2024, adjusted trial balance for Badger Corporation is presented below.…

A: Closing Entries - Closing entries are required to close the temporary accounts after making…

Q: Johny Company is a merchandising company and has the following information: Month June July August…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Rossy Investigations purchased land, paying $97,000 cash plus a $250,000 note payable. In Addition,…

A: Cost of the land include purchase price of the land, any related expenses such as closing costs,…

Q: Balance Sheet December 31, 2021 Current Assets: Cash 46,200 Accounts Receivable (net) 260,000…

A: Budgets are prepared at the beginning of the accounting period in every organization on the basis of…

Q: Eddie Company had the following data available: Direct materials purchased on account P74,000…

A: Work-in-process inventory is the inventory that is partially processed and still in the production…

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur…

A: 1. April May June Total February sales $23,000 (i.e. $230,000x10%) $23,000 March sales…

Q: During Year 1, Hardy Merchandising Company purchased $16,000 of inventory on account. Hardy sold…

A: Formula Gross margin = Sales - cost of goods sold Net income = Gross margin - operating…

Q: Comparative Balance Sheet Cash Accounts receivable (net) Prepaid insurance Land Equipment…

A: Cash Flow Statement - Under Cash Flow, there are three types of activities involved - Operating…

Q: Questions 1. state if each of the costs identified above should be provided for. Give reasons for…

A: 1. The costs identified above and whether they should be provided for are as follows: a) Cost of…

Q: Jarvis Inc. had pretax financial income of $2,000,000 and taxable income of $2,400,000

A: Tax is payable on taxable income and for timing difference between accounting profit and tax profit…

Q: Partnership Formation Max, Nat and Roberta formed a partnership to operate a dry-cleaning business.…

A: A partnership is a formal arrangement by two or more parties to manage and operate a business and…

Q: Shalom Company prepared its production plan for each quarter of 2023: Units 24,000 30,000 3 32,000 4…

A: The question is based on the concept of Cost Accounting. Total material purchases budget is the…

Q: Nuggets Company accepted a P400,000 face value, six-month, 10% note dated May 15 from a customer.…

A: To compute the gain or loss on discounting, proceeds from the sale and carrying amount of the note…

Q: Garton Company had net income of $195,000 in 2020. Depreciation expense for the year is $50,000.…

A: INTRODUCTION: Cash flow from operations is the first of three elements of the cash flow statement…

Q: 'Direct costs are treated differently under the ABC method than under the traditional full costing…

A: Costs consists of two main types – direct costs and indirect costs. Direct costs include costs…

Q: X had started business with $2,00,000 in the beginning of the year. During the year, he borrowed…

A: Note : (1) Amount borrowed from outsider is treated as liability. (2) Goods given away as charity…

Q: Complete this question by entering your answWERS Required 1 Required 2 Units to produce Prepare…

A: Formula : Materials to be purchased = Materials needed for production + Budgeted ending inventory -…

Q: Companies seek to expand their activities globally to achieve the following goals (choose the most…

A: Business expansion refers to the process by which a company increases its operations, either…

Q: Audit sampling involves applying an audit procedure to less than 100 percent of the population for…

A: Sampling risk is the possibility that the items chosen in a pattern aren't truly representative of…

The following lists the six New York Stock Exchange volume leaders on June 24.

An investor buys 100 shares of GE at the Last Trade price, pays a $100 commission on the purchase, and sells the 100 shares a year later for $37.78 per share with a 2% commission on the sale.

$

(b) Find the total dividend.

$

(c) Find the commission when selling the shares.

$

(d) Find the

$

(e) Find the total return for the year.

$

(f) Find the percent of return. (Round your answer to two decimal places.)

Step by step

Solved in 2 steps

- tion 8Income statement for the year ended 31 December, 2019 of KKMTN Ghana Ltd2018 2019ȼ ‘000 ȼ ‘000Turnover 420,000 523,600Cost of sales (330,000) (417,200)Gross profit 89,000 106,400Expenses:Administration 44,600 50,200Selling and distribution 15,400 (60,000) 19,600 (69,800)Profit before interest 29,000 36,600Debenture interest - (2,800)Net profit before tax 29,000 33,800Taxation (8,000) (10,000)Net Profit after tax 21,000 23,800Ordinary dividend paid 8,400 9,250Ordinary shares issued 12 million and trading at ȼ3 each as at yesterday onGSE.You are required to compute the following investment ratios:a). Earnings per shareb). Dividend per sharec). Payout ratiod). Price earnings ratioe). Earnings yieldHow do i create an NPV graph on excel using these data: Unit Sale NPV 1,000,000.00 - 2,952,452.00 1,500,000.00 - 2,001,492.00 2,000,000.00 - 1,050,533.00 2,500,000.00 - 384,861.00 2,789,077.17 - 3,000,000.00 280,811.00 3,500,000.00 946,482.00 4,000,000.00 1,612,154.00 4,500,000.00 2,277,826.00E23.10B (L0 1,4) (Classification of Transactions) Following are selected balance sheet accounts of BioLazer Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from 2019 to 2020. Also presented is selected income statement information for the year ended December 31, 2020, and additional information. Increase Selected balance sheet accounts 2020 2019 (Decrease)AssetsAccounts receivable $154,000 $120,000 $34,000Property, plant, and equipment 631,000 581,000 50,000Accumulated…

- Net Sales 36000 Commission received 6430 Interest received 3570 Cost of goods sold 7400 Dividends received 2220 From the above information the total income will be: a.OMR 41280 b.OMR 42820 c.OMR 48220 d.OMR 40820 Fast plz***********QWC 2016 $000 2017 $000 2018 $000 2019 $000 2020 $000 2021 $000 Current ratio 0.66 0.58 0.96 0.92 1.06 0.83 Quick ratio 0.43 0.37 0.58 0.53 0.49 0.57 Operating cash flow ratio 0.10 0.01 0.01 0.00 0.02 0.07 MMC Current ratio 2.37 2.23 2.07 1.89 2.74 2.16 Quick ratio 0.93 0.95 0.81 0.80 1.36 1.01 Operating cash flow ratio 1.02 0.72 0.96 0.47 0.32 0.52 Please interpret the ratio for both the companies. Not required to explain the theory just interpret the values for the following: 1) Current Ratio 2) Quick Ratio 3) Operating cash flow ratioHome office BranchSales P 365,000 P174,000Shipment to branch 90,000Purchases from outsiders 220,000 35,000Advertising expense 13,700 2,500Salaries and Commission 35,000 9,500Rent Expense 10,000 2,000Miscellaneous expense 3,300 500Shipment from home Office 112,500Inventories, January 1:Home Office 85,000Branch:From outsiders 9,500From home office at 2018 billed price30,000Inventories, December 31:Home Office 65,000BranchFrom outsider 6,500From Home office at 2018 billed price30,0001. The branch inventory at cost on December 31, 2021 is:a. P30,500 c. P70,000b. 31,500 d. 36,5002. The combined net income of the Home Office and the Branch on December 31, 2021 is:a. P111,000 c. P250,500b. 63,000 d. 174,000

- Microsoft HP Alaska Air Southwest Airlines Ford Motor Kellogg General Mills Volatility (standard Deviation) Correlation with 33% 37% 37% 31% 50% 20% 17% Microsoft 1.00 0.39 0.21 0.24 0.27 0.05 0.08 HP 0.39 1.00 0.28 0.35 0.27 0.11 0.06 Alaska Air 0.21 0.28 1.00 0.39 0.15 0.15 0.20 Southwest Airlines 0.24 0.35 0.39 1.00 0.30 0.15 0.22 Ford Motor 0.27 0.27 0.15 0.30 1.00 0.18 0.06 Kellogg 0.05 0.11 0.15 0.15 0.18 1.00 0.54 General Mills 0.08 0.06 0.20 0.22 0.06 0.54 1.00 Required: 1.What is the covariance between Microsoft and HP? 2. What is the covariance between General Mills and Ford? 3. What is the volatility of a portfolio with equal amounts invested in Microsoft and Hewlett-Packard stock? 4. What is the volatility of a portfolio with equal amounts invested in Microsoft and Alaska Air Stock?https://ezto-cf-media.mheducation.com/Media/Connect_Production/bne/accounting/edmonds_fmac_9e/pv_of_$1.jpg https://ezto-cf-media.mheducation.com/Media/Connect_Production/bne/accounting/edmonds_fmac_9e/pva_of_$1.jpgA2 aii Use the following information for Delta Corporation: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Account’s receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will all remain a constant…

- 7.The following data were available for ABC Corp at Dec 31, 20X2:Net purchases P345,000Inventory, Dec 31 P11,000Gross Sales, 446,250Sales returns, P10,000Gross profit is 25% of costHow much was the cost of sales during the year? 109,063 111,563 349,000 357,000ROA=10% ROE=11.2% Current ratio=1.5 Quick ratio=0.9 gross profit margin=24% Sales=1650000 Earning available for common stock =140000 How total assets turnover?44. Oman Gulf Company SAOC shows some of the financial information in their annual report. Sales: RO 50000, Cost of goods sold: RO 27500, Operating expenses: RO 15500. The net profit margin ratio of the company will be ____________. a. 14% b. 15% c. 19% d. 12%