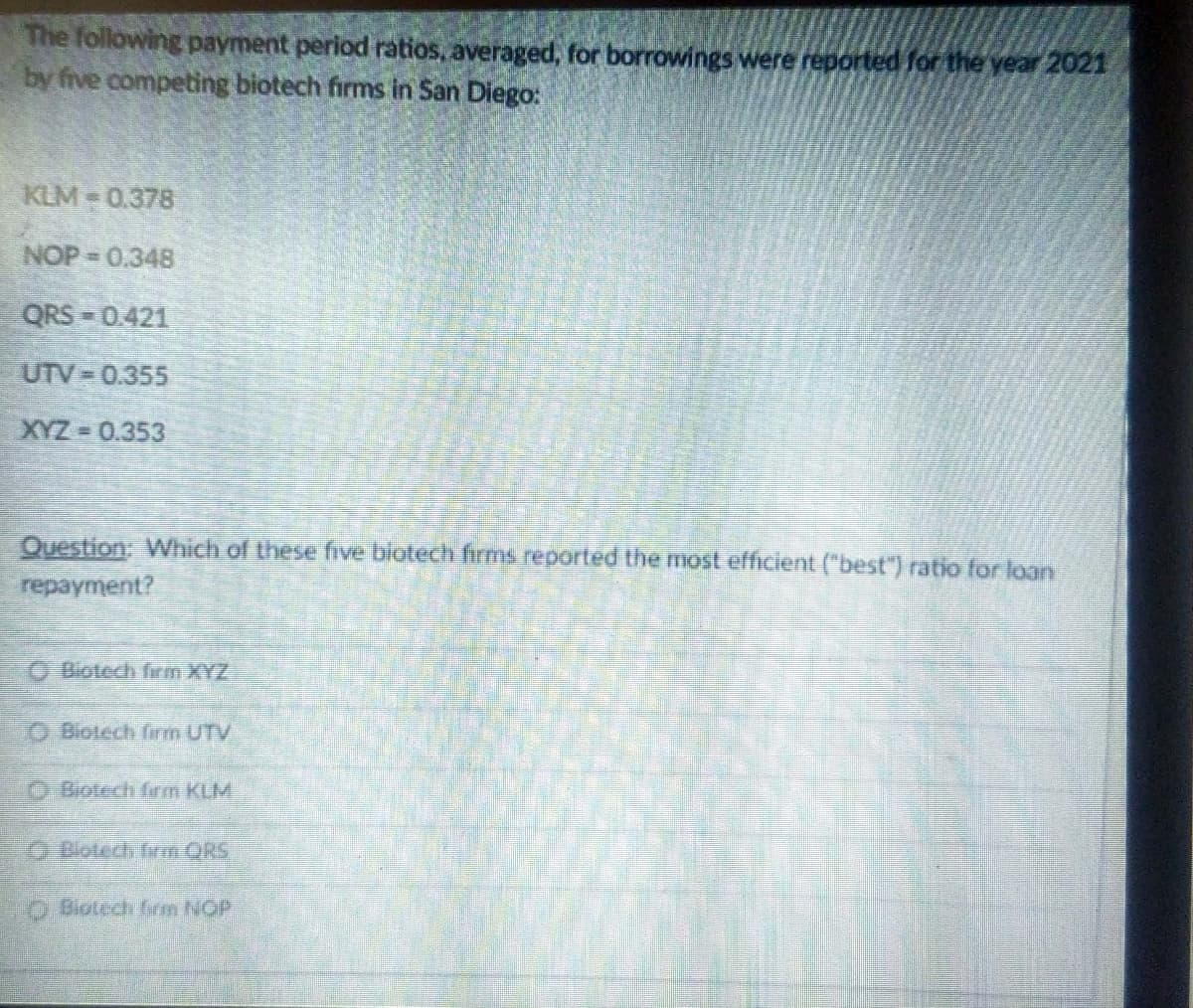

The following payment period ratios, averaged, for borrowings were reported for the year 2021 y five competing biotech firms in San Diego: KLM = 0.378 %23 HOP = 0.348 QRS - 0.421 UTV 0.355 EYZ = 0.353 Question: Which of these five biotech firms reported the most efficient ("best") ratio for loan epayment? Biotech firm XYZ O Biotech firm UTV D Biotech firm KLM Blotech firm QRS OBiotech Grm NOP

Q: How does Perception affect employees at the Workplace? Discuss the key aspects of the Perception…

A: A person's perspective is their thoughts, attitudes, and actions. Perception grows as a result of…

Q: Why is it more difficult to implement an agile development approach in a company that has a…

A: Under Traditional Project Management, all tasks related to the proect are done in a defined…

Q: Mr. ASHOK like to do business, but confused between PRODUCTS OR SERVCIES. So explain how both areas…

A: Product-based industry: While selling an item, organizations will need to feature explicit elements…

Q: Define and briefly discuss the concept of labour relations. In 10 bullet points

A: Labor relations refers to the process through which employers and employees, management, and unions…

Q: In what ways might working on a unique project inside one's company improve one's career? Risks…

A: Working on any project comes with some inherent risks. There is always the chance that the project…

Q: Can you tell me the advantages and disadvantages of alliances of international carriers to…

A: In this question, I would describe the advantages and disadvantages of alliances of international…

Q: What factors contribute to a project's success or failure during implementation? In your opinion,…

A: Project implementation refers to the process in which a project is launched or starts its working on…

Q: Write down the constrained optimization problem as a function of the Objective Function. Then, on a…

A: Linear programming is a mathematical technique that is also used in operations management…

Q: Why was W. Edwards Deming important to the quality movement?

A: Quality is the important aspect of the firm as in today's world all firms focuses upon increasing…

Q: Differentiate between speculative and event risks.

A: Risk management can be stated as the approach of recognizing, evaluating, and handling or…

Q: Discuss the meaning of the term downstream effect in risk management.

A: Risk management is the recognition, assessment, & prioritization of risks trailed by coordinated…

Q: s, assess the operations management practices within a restaurant

A: There is seldom a moment at a restaurant when there is nothing that requires attention. Perhaps it…

Q: A project has the following activities, with specified precedents and expected durations (in hours).…

A: A network diagram is a diagram that shows the visual form of the project activities and their…

Q: Uberya Towing Services repair vehicles that break down at an average 7.5 vehicles per day. The…

A: GIVEN: ARRIVAL RATE 7.5 SERVICE RATE 10

Q: Crash the project until no more crash can be performed How much it would cost The new critical…

A: Proect crashing is one of the techniques used in the calculation of the duration of the critical…

Q: Lori Cook has developed the following forecasting model: y = 45.0 + 4.50x, where y = demand for Kool…

A: Given equation for the forecasting model, y=45+4.50×x y= Demand for Kol air conditioners x=the…

Q: What is the duration of the project? Identify the critical path. How many days can ACTIVITY C be…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: It costs $2 to move 1 workpiece 1 foot. What is the cost?

A: Production is the process of converting inputs into outputs. During production, there are various…

Q: Describe how an organization can use a social media site such as LinkedIn to hire the best people

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: When R promises B that R will deliver to B P100,000.00 in exchange of B’s 10,000 worth of paintings.…

A: ANSWER : Assignment means the work or job to do some work Barter means exchange of goods without…

Q: nce of effective time management to successful study? Explain your answers and reasoning.

A: Effective time productively permits understudies to finish more significantly quicker, on the…

Q: tuation 1. Mr. Patty Fat is the human resource supervisor of Cornee Corporation, producer of a…

A: Situation1: As a supervisor, how will you decide on this situation? What considerations are needed…

Q: Below are the production demands for the first four months of the year. What is the 4 month moving…

A: Forecasting is the process of estimation in which future demand is predicted based on previous or…

Q: List and describe five (5) ways in which a project manager may seek to motivate their team.

A: Organizations are dependent on their employees. Businesses must rely on qualified project managers…

Q: Quantity per Year Choice less than units Seattle between and units more than units en's…

A: Break-even analysis is one of the methods that are commonly and widely used in manufacturing…

Q: Explain TWO (2) example of poor material management and solution to solve of the problem.

A: Materials management is a basic element of supply chain management that involves the design and…

Q: A young mechanical engineer devised two different approaches to completing a production task. Both…

A: Method Method A Method B Cost of one worker 30 per hour 35 per hour Number of workers 3 2 Cost…

Q: Is there any use for dynamic programming in the "real world"?

A: Dynamic programming is a technique used to efficiently solve the problems having overlapping…

Q: "In conclusion, I congratulate the country upon the fraternal spirit of the people and the…

A: The question is related meaning of Manifestation

Q: • Q1: Determine the critical path, the critical activities and the project completion time.…

A: A project network diagram is the visual representation of the project activities and their durations…

Q: What is the importtance of forecasting room availability and room revenue for Front Office Managers.

A: Forecasting is the technique to estimate/predicting future values using different approaches. In…

Q: Security rules has 2 kinds of implementation specifications, one of them is Required specifications,…

A: The Health Insurance Probability and Accountability Act often called the HIPAA security rule set up…

Q: alifornia. The assembly area is ava lach 10 for 200 minutes per day. (T making other products.) The…

A: Given: Time availability to produce Mach 10 is 200mins Required output rate r=60 units/day Time…

Q: Discuss the benefits as well the obstacles of value chain management to institutions, providing an…

A: Value chain management refers to the overall management till a product is planned and sold in the…

Q: A. The Naive Approach B. Three month moving average C.A weighted moving average using 0.60 for the…

A: Forecasting techniques are used to predict future events. Forecasting is the process of estimating…

Q: Think about the benefits and drawbacks of a manual task. response program (in which the customer…

A: Manual tasks are activities performed by an individual using their own body to do any work..…

Q: 5. List and explain at least five efficiency evaluation metrics for collection management

A: Collection management can be extremely challenging, with any number of competing goals and…

Q: Q2: The activities involved in the construction of a certain project are given in the table below.…

A: A network diagram is a visual representation of a project which helps to identify the activity…

Q: Please give two examples of each of the following sources of errors. a. Instrumental…

A: Errors refers to the mistakes which are caused either due to negligence or due to intentionally.

Q: Provide a justified evaluation of how different factors influence hotel decision-making and buying…

A: Decision-making and buying behavior are significantly influenced by a variety of factors, some of…

Q: What are the many tools that are used for scheduling, such as Gantt charts and PERT/CPM charts?

A: A project schedule is described as a mechanism through which task status can be known and the way…

Q: d) What is the efficiency of your answer to (b)?

A: A project schedule network diagram shows the sequence of the task that are performed to complete a…

Q: What are the standard devices for sample quality assessment?

A: There are a number of different devices that can be used for assessing the quality of a sample.…

Q: demonstrate the benefit of using the Work Breakdown Structure (WBS) concept?

A: A graphical, hierarchical, and deliverable representation of the breakdown of a project is called a…

Q: LahLa Mub Delivery a logistics operator process the packages for shipment. The items arrive at the…

A: Service rate is the rate at which the customers are being served by the workers in an organisation.

Q: Please explain the fundamental shift in quality attention in manufacturing from the Industrial…

A: The Industrial Revolution was a period of dramatic change in manufacturing that occurred in the late…

Q: What is Direct Mapping, and how does it work?

A: Direct mapping is a procedure in a memory management system in which we are able to add a new memory…

Q: Which of the following is a true statement regarding project lifecycles? Iterative-phasing of a…

A: The project life cycle consists of four phases, Initiation: Includes developing project proposals…

Q: Discuss the traditional, Western management approach to quality as compared to the quality…

A: Quality Management Philosophy: Traditional Western Quality Management Approach: The product must…

Q: Explain: Peak load pricing, Preprocessing strategy, Arrival process, Unstable queue

A: These terms are important to understand when learning about queuing theory and how to manage queues…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Seas Beginning sells clothing by mail order. An important question is when to strike a customer from the companys mailing list. At present, the company strikes a customer from its mailing list if a customer fails to order from six consecutive catalogs. The company wants to know whether striking a customer from its list after a customer fails to order from four consecutive catalogs results in a higher profit per customer. The following data are available: If a customer placed an order the last time she received a catalog, then there is a 20% chance she will order from the next catalog. If a customer last placed an order one catalog ago, there is a 16% chance she will order from the next catalog she receives. If a customer last placed an order two catalogs ago, there is a 12% chance she will order from the next catalog she receives. If a customer last placed an order three catalogs ago, there is an 8% chance she will order from the next catalog she receives. If a customer last placed an order four catalogs ago, there is a 4% chance she will order from the next catalog she receives. If a customer last placed an order five catalogs ago, there is a 2% chance she will order from the next catalog she receives. It costs 2 to send a catalog, and the average profit per order is 30. Assume a customer has just placed an order. To maximize expected profit per customer, would Seas Beginning make more money canceling such a customer after six nonorders or four nonorders?Lemingtons is trying to determine how many Jean Hudson dresses to order for the spring season. Demand for the dresses is assumed to follow a normal distribution with mean 400 and standard deviation 100. The contract between Jean Hudson and Lemingtons works as follows. At the beginning of the season, Lemingtons reserves x units of capacity. Lemingtons must take delivery for at least 0.8x dresses and can, if desired, take delivery on up to x dresses. Each dress sells for 160 and Hudson charges 50 per dress. If Lemingtons does not take delivery on all x dresses, it owes Hudson a 5 penalty for each unit of reserved capacity that is unused. For example, if Lemingtons orders 450 dresses and demand is for 400 dresses, Lemingtons will receive 400 dresses and owe Jean 400(50) + 50(5). How many units of capacity should Lemingtons reserve to maximize its expected profit?Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.

- The Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. Can you guess the results of a sensitivity analysis on the initial inventory in the Pigskin model? See if your guess is correct by using SolverTable and allowing the initial inventory to vary from 0 to 10,000 in increments of 1000. Keep track of the values in the decision variable cells and the objective cell.The Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. As indicated by the algebraic formulation of the Pigskin model, there is no real need to calculate inventory on hand after production and constrain it to be greater than or equal to demand. An alternative is to calculate ending inventory directly and constrain it to be nonnegative. Modify the current spreadsheet model to do this. (Delete rows 16 and 17, and calculate ending inventory appropriately. Then add an explicit non-negativity constraint on ending inventory.)The Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. Modify the Pigskin model so that there are eight months in the planning horizon. You can make up reasonable values for any extra required data. Dont forget to modify range names. Then modify the model again so that there are only four months in the planning horizon. Do either of these modifications change the optima] production quantity in month 1?

- The Tinkan Company produces one-pound cans for the Canadian salmon industry. Each year the salmon spawn during a 24-hour period and must be canned immediately. Tinkan has the following agreement with the salmon industry. The company can deliver as many cans as it chooses. Then the salmon are caught. For each can by which Tinkan falls short of the salmon industrys needs, the company pays the industry a 2 penalty. Cans cost Tinkan 1 to produce and are sold by Tinkan for 2 per can. If any cans are left over, they are returned to Tinkan and the company reimburses the industry 2 for each extra can. These extra cans are put in storage for next year. Each year a can is held in storage, a carrying cost equal to 20% of the cans production cost is incurred. It is well known that the number of salmon harvested during a year is strongly related to the number of salmon harvested the previous year. In fact, using past data, Tinkan estimates that the harvest size in year t, Ht (measured in the number of cans required), is related to the harvest size in the previous year, Ht1, by the equation Ht = Ht1et where et is normally distributed with mean 1.02 and standard deviation 0.10. Tinkan plans to use the following production strategy. For some value of x, it produces enough cans at the beginning of year t to bring its inventory up to x+Ht, where Ht is the predicted harvest size in year t. Then it delivers these cans to the salmon industry. For example, if it uses x = 100,000, the predicted harvest size is 500,000 cans, and 80,000 cans are already in inventory, then Tinkan produces and delivers 520,000 cans. Given that the harvest size for the previous year was 550,000 cans, use simulation to help Tinkan develop a production strategy that maximizes its expected profit over the next 20 years. Assume that the company begins year 1 with an initial inventory of 300,000 cans.Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A, 300 of B, and 1000 of C. The current share prices are 42.76, 81.33, and, 58.22, respectively. You plan to hold this portfolio for at least a year. During the coming year, economists have predicted that the national economy will be awful, stable, or great with probabilities 0.2, 0.5, and 0.3. Given the state of the economy, the returns (one-year percentage changes) of the three stocks are independent and normally distributed. However, the means and standard deviations of these returns depend on the state of the economy, as indicated in the file P11_23.xlsx. a. Use @RISK to simulate the value of the portfolio and the portfolio return in the next year. How likely is it that you will have a negative return? How likely is it that you will have a return of at least 25%? b. Suppose you had a crystal ball where you could predict the state of the economy with certainty. The stock returns would still be uncertain, but you would know whether your means and standard deviations come from row 6, 7, or 8 of the P11_23.xlsx file. If you learn, with certainty, that the economy is going to be great in the next year, run the appropriate simulation to answer the same questions as in part a. Repeat this if you learn that the economy is going to be awful. How do these results compare with those in part a?If a monopolist produces q units, she can charge 400 4q dollars per unit. The variable cost is 60 per unit. a. How can the monopolist maximize her profit? b. If the monopolist must pay a sales tax of 5% of the selling price per unit, will she increase or decrease production (relative to the situation with no sales tax)? c. Continuing part b, use SolverTable to see how a change in the sales tax affects the optimal solution. Let the sales tax vary from 0% to 8% in increments of 0.5%.