The following selected information is from Princeton Company's comparative balance sheets. At December 31 Common stock, $10 par value Paid-in capital in excess of par Retained earnings The company's net income for the year ended December 31, 2017, was $62,000. 1. Complete the T-accounts to calculate the cash received from the sale of its common stock during 2017. Beg. bal. End. bal. Beg. bal. End. bal. Cash received 2017 2016 $134,000 $128,000 595,000 356,000 341,500 315,500 Common Stock, $10 Par 128,000 6,000 Issuance of common stock $ 245,000 134,000 Paid-in Capital in Excess of Par 356,000 239,000 Issuance of common stock 595,000

The following selected information is from Princeton Company's comparative balance sheets. At December 31 Common stock, $10 par value Paid-in capital in excess of par Retained earnings The company's net income for the year ended December 31, 2017, was $62,000. 1. Complete the T-accounts to calculate the cash received from the sale of its common stock during 2017. Beg. bal. End. bal. Beg. bal. End. bal. Cash received 2017 2016 $134,000 $128,000 595,000 356,000 341,500 315,500 Common Stock, $10 Par 128,000 6,000 Issuance of common stock $ 245,000 134,000 Paid-in Capital in Excess of Par 356,000 239,000 Issuance of common stock 595,000

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 15EB: Use the following excerpts from Bolognese Companys statement of cash flows and other financial...

Related questions

Question

do not give solution in image

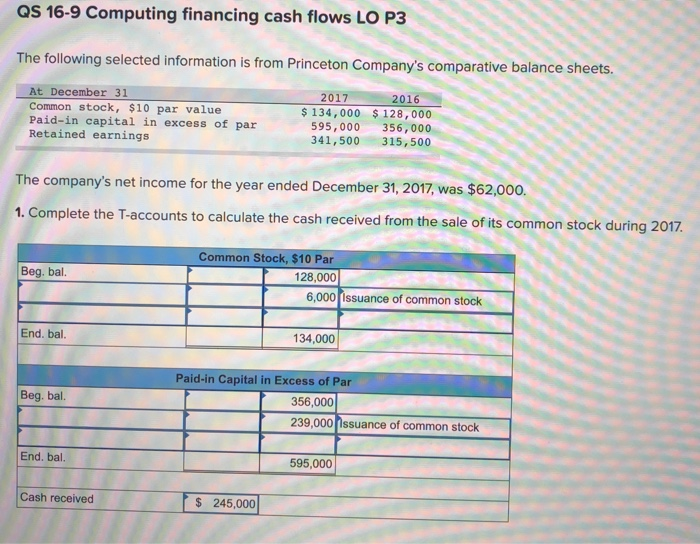

Transcribed Image Text:QS 16-9 Computing financing cash flows LO P3

The following selected information is from Princeton Company's comparative balance sheets.

At December 31

Common stock, $10 par value

Paid-in capital in excess of par

Retained earnings

Beg. bal.

The company's net income for the year ended December 31, 2017, was $62,000.

1. Complete the T-accounts to calculate the cash received from the sale of its common stock during 2017.

End. bal.

Beg. bal.

End. bal.

Cash received

2017

$ 134,000

595,000

341,500

Common Stock, $10 Par

128,000

6,000 Issuance of common stock

$ 245,000

2016

$128,000

356,000

315,500

134,000

Paid-in Capital in Excess of Par

356,000

239,000 Issuance of common stock

595,000

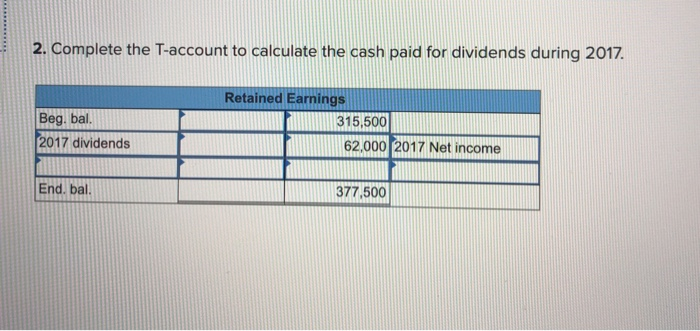

Transcribed Image Text:2. Complete the T-account to calculate the cash paid for dividends during 2017.

Beg. bal.

2017 dividends

End. bal.

Retained Earnings

315,500

62,000 2017 Net income

377,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning