The following selected transactions pertain to L. Lewis Corporation: Jan. 3 Issued 100,000 shares, $10 par value, common stock for $25 per share. Issued 6,000 shares, $10 par value, common stock in exchange for special purpose equipment. L. Lewis Corporation's common stock has been actively traded on the stock exchange at $30 Feb. 10 per share. Instructions Journalize the transactions.

The following selected transactions pertain to L. Lewis Corporation: Jan. 3 Issued 100,000 shares, $10 par value, common stock for $25 per share. Issued 6,000 shares, $10 par value, common stock in exchange for special purpose equipment. L. Lewis Corporation's common stock has been actively traded on the stock exchange at $30 Feb. 10 per share. Instructions Journalize the transactions.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 4SEA: STOCK DIVIDENDS Kaufman Company currently has 200,000 shares of 1 par common stock outstanding. On...

Related questions

Question

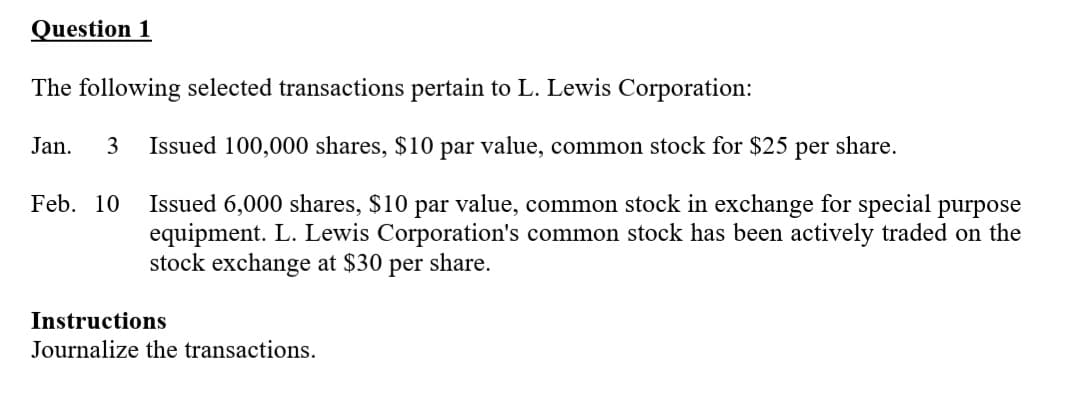

Transcribed Image Text:Question 1

The following selected transactions pertain to L. Lewis Corporation:

Jan.

3

Issued 100,000 shares, $10 par value, common stock for $25

per

share.

Issued 6,000 shares, $10 par value, common stock in exchange for special purpose

equipment. L. Lewis Corporation's common stock has been actively traded on the

stock exchange at $30

Feb. 10

per

share.

Instructions

Journalize the transactions.

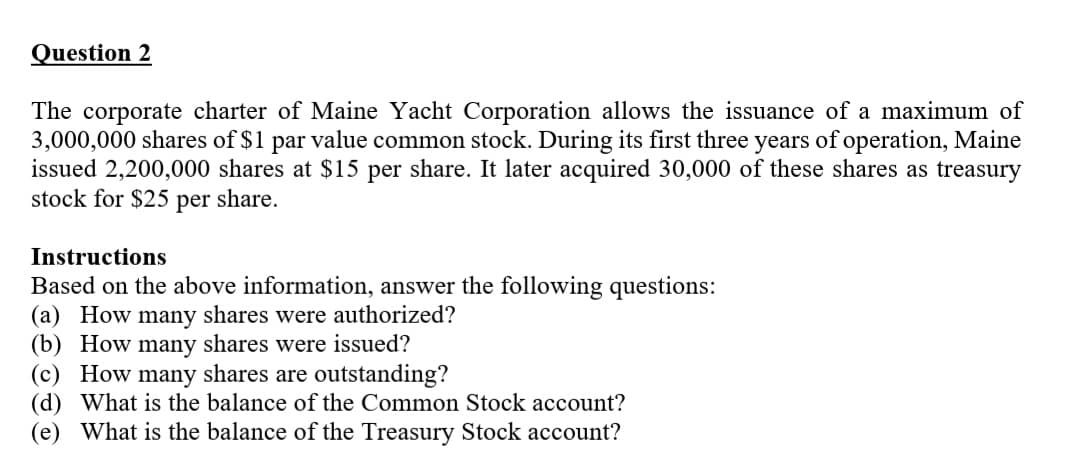

Transcribed Image Text:Question 2

The corporate charter of Maine Yacht Corporation allows the issuance of a maximum of

3,000,000 shares of $1 par value common stock. During its first three years of operation, Maine

issued 2,200,000 shares at $15 per share. It later acquired 30,000 of these shares as treasury

stock for $25 per share.

Instructions

Based on the above information, answer the following questions:

(a) How many shares were authorized?

(b) How many shares were issued?

(c) How many shares are outstanding?

(d) What is the balance of the Common Stock account?

(e) What is the balance of the Treasury Stock account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning