B. G, and C put up a partnership on April 1, 2017. The following capital balances were taken from the books on December 31, 2017. before closing net income: B, Capital P84,000 G, Capital 114,000 C, Capital 92,000 During the year, B permanently withdrew P10,000 cash while C invested a property with a fair value of P22,000. The partners agreed to distribute profits for the first year as follows: . Annual salary of P30,000 to G and P25,000 to C. Allow a 5% interest to each partner on their capital at the inception of the partnership. . Allow a 20% bonus to B based on net income after salaries, interests, and bonus. Any remaining undistributed profit or loss will be distributed in the following manner: . In the ratio 2:3:5, if under-allocated • Equally, if over-allocated Case 1: The net income of the partnership is P100,000 during the year 2017. How much is the bonus given to B? 0 7,979 O8.054 O 7.375 07475

B. G, and C put up a partnership on April 1, 2017. The following capital balances were taken from the books on December 31, 2017. before closing net income: B, Capital P84,000 G, Capital 114,000 C, Capital 92,000 During the year, B permanently withdrew P10,000 cash while C invested a property with a fair value of P22,000. The partners agreed to distribute profits for the first year as follows: . Annual salary of P30,000 to G and P25,000 to C. Allow a 5% interest to each partner on their capital at the inception of the partnership. . Allow a 20% bonus to B based on net income after salaries, interests, and bonus. Any remaining undistributed profit or loss will be distributed in the following manner: . In the ratio 2:3:5, if under-allocated • Equally, if over-allocated Case 1: The net income of the partnership is P100,000 during the year 2017. How much is the bonus given to B? 0 7,979 O8.054 O 7.375 07475

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 20P

Related questions

Question

help

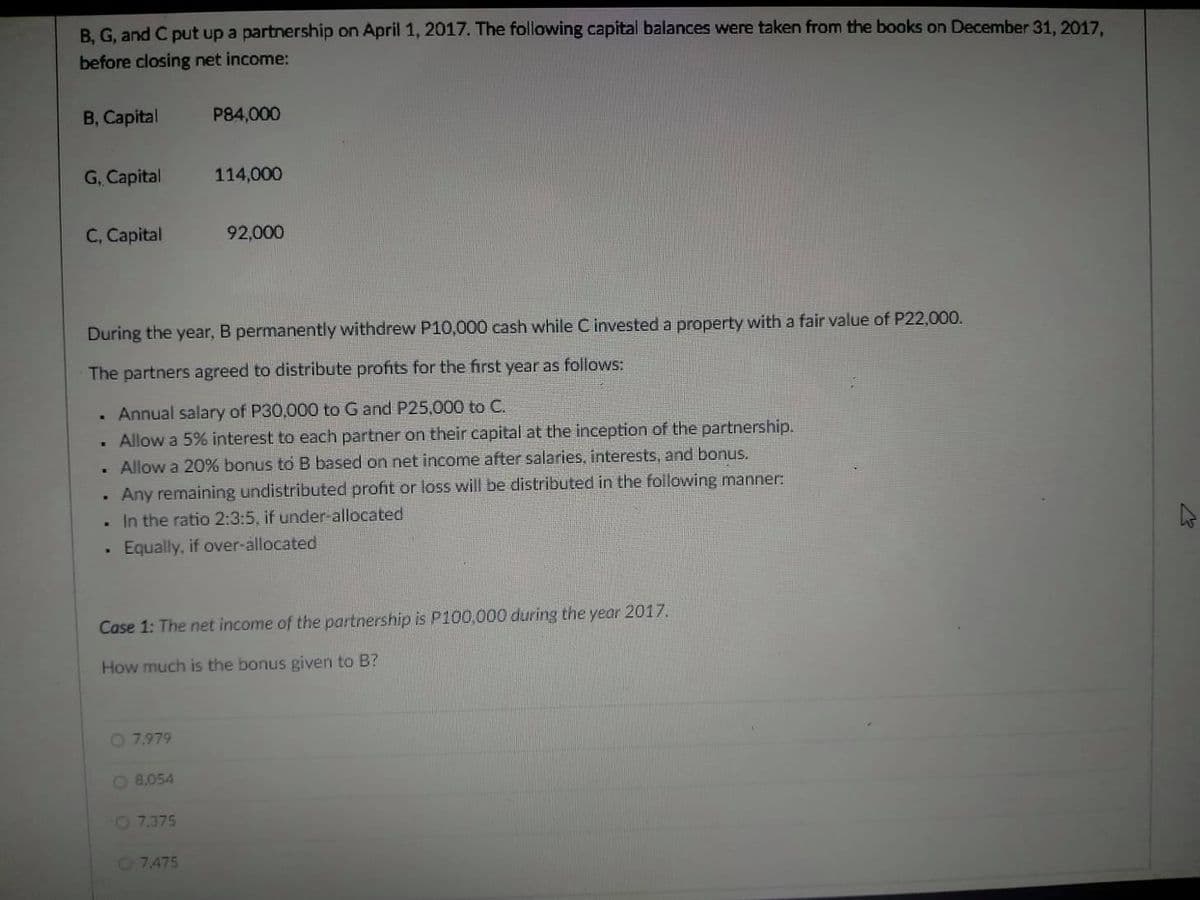

Transcribed Image Text:B, G, and C put up a partnership on April 1, 2017. The following capital balances were taken from the books on December 31, 2017.

before closing net income:

B, Capital

P84,000

G, Capital

114,000

C, Capital

92,000

During the year, B permanently withdrew P10,000 cash while C invested a property with a fair value of P22,000.

The partners agreed to distribute profits for the first year as follows:

Annual salary of P30,000 to G and P25,000 to C.

Allow a 5% interest to each partner on their capital at the inception of the partnership.

Allow a 20% bonus to B based on net income after salaries, interests, and bonus.

Any remaining undistributed profit or loss will be distributed in the following manner:

. In the ratio 2:3:5, if under-allocated

Equally, if over-allocated

Case 1: The net income of the partnership is P100,000 during the year 2017.

How much is the bonus given to B?

0 7.979

O 8,054

O 7.375

07475

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,