The following table contains monthly returns for Cola Co. and Gas Co. for 2010 E (the returns are shown in decimal form, i.e., 0.035 is 3.5%). Using this table and the fact that Cola Co. and Gas Co. have a correlation of - 0.0969, calculate the volatility (standard deviation) of a portfolio that is 55% invested in Cola Co. stock and 45% invested in Gas Co. stock. Calculate the volatility by: a. Using the formula: Var (R,) = w sD(R,)² + w² sD (R2) + 2w, w2Corr(R,.R2) SD (R,) SD (R2) b. Calculating the monthly returns of the portfolio and computing its volatility directly. c. How do your results compare? a. Using the formula: Var (R,) = w} sD(R, )² + wž SD (R2) + 2w, wz Corr(R1.R2) SD (R,) SD (R2) The volatility (standard deviation) of the portfolio is 11 %. (Round to two decimal places.) b. Calculating the monthly returns of the portfolio and computing its volatility directly. The volatiltiy (standard deviation) of the portfolio is 1%. (Round to two decimal places.) c. How do your results compare? (Select the best choice below.) O A. The portfolio volatility calculated using the Var(Rp) formula in part (a) is much smaller than the portfolio volatility calculated used the monthly portfolio returns. O B. The portfolio volatility calculated using the Var (Rp) formula in part (a) is much larger than the portfolio volatility calculated used the monthly portfolio returns. OC. The two portfolio volatilities, calculated using the Var (Rp) formula in part (a) and using the monthly portfolio returns, are the same or almost the same. O D. This cannot be determined from the information given.

The following table contains monthly returns for Cola Co. and Gas Co. for 2010 E (the returns are shown in decimal form, i.e., 0.035 is 3.5%). Using this table and the fact that Cola Co. and Gas Co. have a correlation of - 0.0969, calculate the volatility (standard deviation) of a portfolio that is 55% invested in Cola Co. stock and 45% invested in Gas Co. stock. Calculate the volatility by: a. Using the formula: Var (R,) = w sD(R,)² + w² sD (R2) + 2w, w2Corr(R,.R2) SD (R,) SD (R2) b. Calculating the monthly returns of the portfolio and computing its volatility directly. c. How do your results compare? a. Using the formula: Var (R,) = w} sD(R, )² + wž SD (R2) + 2w, wz Corr(R1.R2) SD (R,) SD (R2) The volatility (standard deviation) of the portfolio is 11 %. (Round to two decimal places.) b. Calculating the monthly returns of the portfolio and computing its volatility directly. The volatiltiy (standard deviation) of the portfolio is 1%. (Round to two decimal places.) c. How do your results compare? (Select the best choice below.) O A. The portfolio volatility calculated using the Var(Rp) formula in part (a) is much smaller than the portfolio volatility calculated used the monthly portfolio returns. O B. The portfolio volatility calculated using the Var (Rp) formula in part (a) is much larger than the portfolio volatility calculated used the monthly portfolio returns. OC. The two portfolio volatilities, calculated using the Var (Rp) formula in part (a) and using the monthly portfolio returns, are the same or almost the same. O D. This cannot be determined from the information given.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 2MAD

Related questions

Question

Transcribed Image Text:The following table contains monthly returns for Cola Co. and Gas Co. for 2010 (the returns are shown in decimal form, i.e., 0.035 is 3.5%). Using this table and the fact that Cola Co. and Gas Co. have a correlation of – 0.0969, calculate the

volatility (standard deviation) of a portfolio that is 55% invested in Cola Co. stock and 45% invested in Gas Co. stock. Calculate the volatility by:

a. Using the formula:

Var (R,) = w SD (R,)² + w% SD (R2) + 2w, w,Corr (R, R2) SD (R,) SD (R2)

1.

b. Calculating the monthly returns of the portfolio and computing its volatility directly.

c. How do your results compare?

a. Using the formula:

Var(Rp) = w; SD(R,)² + w½ SD (R2) + 2w, w2Corr (R,.R2) SD (R,) SD (R2)

1:

The volatility (standard deviation) of the portfolio is 11 %. (Round to two decimal places.)

b. Calculating the monthly returns of the portfolio and computing its volatility directly.

The volatiltiy (standard deviation) of the portfolio is 1%. (Round to two decimal places.)

c. How do your results compare? (Select the best choice below.)

A. The portfolio volatility calculated using the Var (Rp) formula in part (a) is much smaller than the portfolio volatility calculated used the monthly portfolio returns.

B. The portfolio volatility calculated using the Var (Rp) formula in part (a) is much larger than the portfolio volatility calculated used the monthly portfolio returns.

C. The two portfolio volatilities, calculated using the Var (Rp) formula in part (a) and using the monthly portfolio returns, are the same or almost the same.

D. This cannot be determined from the information given.

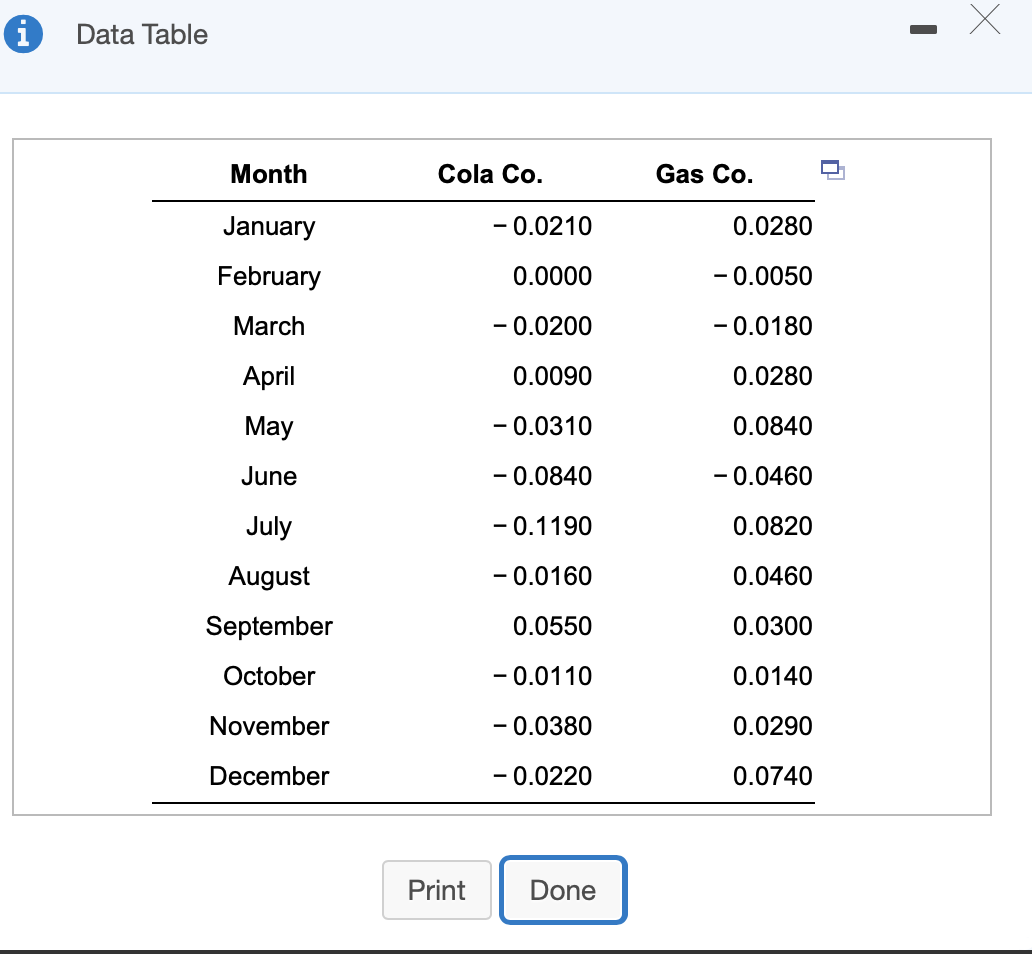

Transcribed Image Text:Data Table

Month

Cola Co.

Gas Co.

January

- 0.0210

0.0280

February

0.0000

- 0.0050

March

- 0.0200

- 0.0180

Аpril

0.0090

0.0280

May

- 0.0310

0.0840

June

- 0.0840

- 0.0460

July

- 0.1190

0.0820

August

- 0.0160

0.0460

September

0.0550

0.0300

October

- 0.0110

0.0140

November

- 0.0380

0.0290

December

- 0.0220

0.0740

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT