[The folowng information applies to the questions displayed below The foilowing summary data for the payroll period ended December 27, 2018, are available for Cayman Coating Co. Grass 2 YICA t vithheldings Inene tithalding Greup hespitaliati on insme Enploye contrilutine to gensin pl Total debitions Sat pay 3, 000 16. 20 L.0 29. 149 Additionel Information: . For employees, FICA tax rates for 2018 were 765% on the first St18.500 of each employee's annual earmings However, no employees had accumulated earnings for the year in excess of the $118.500 imit • For employers, FICA tax rates for 2018 were also 765% on the first $118,500 of each employee's annual earnings • The federal and state unemployment compensation tax rates are 06% and 54%, respectively. These rates are levied against the employer for the first $7,000 of each employee's annual earmings Only $15,400 of ine gross pay amount for the December 27, 2018, pay period was owed to employees who were still under the annual imit. quired: . Assuming that Cayman Coating Co's payrol for the last week of the year is to be paid on January 3, 2019, use the horzontai pdel to record the effects of the December 27, 2018, entries for Accrued payron Indicate the financial statement effect (Enter creases with a minus sign to Indicate a negetive finencial statement effect.) Balance Sheet Liabilites Stockholders'Equity Net ncome Assets

[The folowng information applies to the questions displayed below The foilowing summary data for the payroll period ended December 27, 2018, are available for Cayman Coating Co. Grass 2 YICA t vithheldings Inene tithalding Greup hespitaliati on insme Enploye contrilutine to gensin pl Total debitions Sat pay 3, 000 16. 20 L.0 29. 149 Additionel Information: . For employees, FICA tax rates for 2018 were 765% on the first St18.500 of each employee's annual earmings However, no employees had accumulated earnings for the year in excess of the $118.500 imit • For employers, FICA tax rates for 2018 were also 765% on the first $118,500 of each employee's annual earnings • The federal and state unemployment compensation tax rates are 06% and 54%, respectively. These rates are levied against the employer for the first $7,000 of each employee's annual earmings Only $15,400 of ine gross pay amount for the December 27, 2018, pay period was owed to employees who were still under the annual imit. quired: . Assuming that Cayman Coating Co's payrol for the last week of the year is to be paid on January 3, 2019, use the horzontai pdel to record the effects of the December 27, 2018, entries for Accrued payron Indicate the financial statement effect (Enter creases with a minus sign to Indicate a negetive finencial statement effect.) Balance Sheet Liabilites Stockholders'Equity Net ncome Assets

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section: Chapter Questions

Problem 2AP

Related questions

Question

Please Solve In 15mins I will Thumbs-up promise

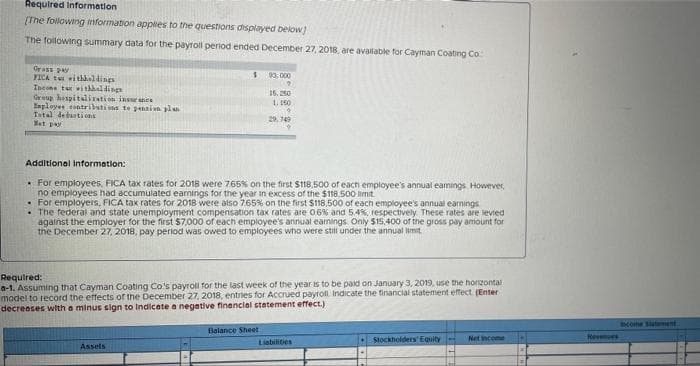

Transcribed Image Text:Required Information

(The folilowing mformation apples to the questions displayed below)

The foilowing summary data for the payroll period ended December 27, 2018, are available for Cayman Coating Co

Gross pay

YICA t itl1dings

Ineone ta withhaldingn

Greup hespitaliration insr nce

Enployes contributions te pensi vn plan

Tstal dedarti ons

Set p

93. 000

16. 260

1. 150

29. 749

Additional Information:

• For employees, FICA tax rates for 2018 were 765% on the first S118,500 of each employee's annual eamings However,

no employees had accumulated earnings for the year in excess of the $18.500 limit.

• For employers, FICA tax rates for 2018 were also 765% on the first $118.500 of each employee's annual earnings

• The federal and state unempioyment compensation tax rates are 0.6% and 5.4%, respectively These rates are levied

against the employer for the first $7,000 of each employee's annual eanings. Only S15.400 of the gross pay amount for

the December 27, 2018, pay period was owed to employees who were still under the annual imit.

Required:

a-1. Assuming that Cayman Coating Co's payroll for the last week of the year is to be paid on January 3, 2019, use the horzontai

model to record the effects or the December 27, 2018, entries for Accrued payroll Indicate the financial statement effect (Enter

decreases with a minus sign to Indicate a negative finencial statement effect.)

come tent

Balance Sheet

Stockholders'Equity

Net ncome

Revemes

Liebilites

Assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning