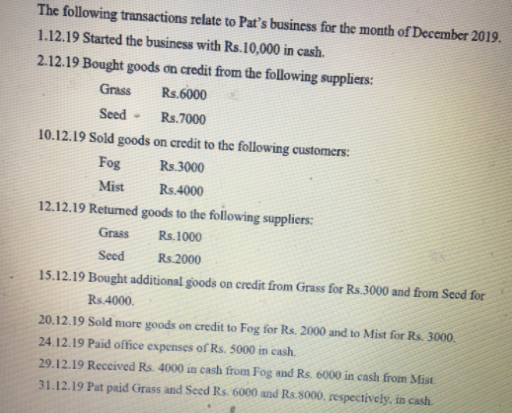

The following transactions relate to Pat's business for the month of December 2019. 1.12.19 Started the business with Rs.10,000 in cash. 2.12.19 Bought goods on credit from the following suppliers: Grass Rs.6000 Seed - Rs.7000 10.12.19 Sold goods on credit to the following customers: Fog Rs.3000 Mist Rs.4000 12.12.19 Returned goods to the following suppliers: Grass Rs.1000 Seed Rs.2000 15.12.19 Bought additional goods on credit from Grass for Rs.3000 and from Seod for Rs.4000. 20.12.19 Sold niore goods on credit to Fog for Rs. 2000 and to Mist for Rs. 3000. 24.12.19 Paid office expenses of Rs. 5000 in cash. 29.12.19 Received Rs. 4000 in cash from Fog and Rs. 6000 in cash from Mist. 31.12.19 Pat paid Grass and Seed Rs. 6000 and Rs.8000, respectively, in cash.

The following transactions relate to Pat's business for the month of December 2019. 1.12.19 Started the business with Rs.10,000 in cash. 2.12.19 Bought goods on credit from the following suppliers: Grass Rs.6000 Seed - Rs.7000 10.12.19 Sold goods on credit to the following customers: Fog Rs.3000 Mist Rs.4000 12.12.19 Returned goods to the following suppliers: Grass Rs.1000 Seed Rs.2000 15.12.19 Bought additional goods on credit from Grass for Rs.3000 and from Seod for Rs.4000. 20.12.19 Sold niore goods on credit to Fog for Rs. 2000 and to Mist for Rs. 3000. 24.12.19 Paid office expenses of Rs. 5000 in cash. 29.12.19 Received Rs. 4000 in cash from Fog and Rs. 6000 in cash from Mist. 31.12.19 Pat paid Grass and Seed Rs. 6000 and Rs.8000, respectively, in cash.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5EB: Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On...

Related questions

Question

Record them in the Pats journal and ledger accounts and compile a trail balance.

Transcribed Image Text:The following transactions relate to Pat's business for the month of December 2019.

1.12.19 Started the business with Rs.10,000 in cash.

2.12.19 Bought goods on credit from the following suppliers:

Grass

Rs.6000

Seed -

Rs.7000

10.12.19 Sold goods on credit to the following customers:

Fog

Rs.3000

Mist

Rs.4000

12.12.19 Returned goods to the following suppliers:

Grass

Rs.1000

Seed

Rs.2000

15.12.19 Bought additional goods on credit from Grass for Rs.3000 and from Seod for

Rs.4000.

20.12.19 Sold niore goods on credit to Fog for Rs. 2000 and to Mist for Rs. 3000.

24.12.19 Paid office expenses of Rs. 5000 in cash.

29.12.19 Received Rs. 4000 in cash from Fog and Rs. 6000 in cash from Mist.

31.12.19 Pat paid Grass and Seed Rs. 6000 and Rs.8000, respectively, in cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT