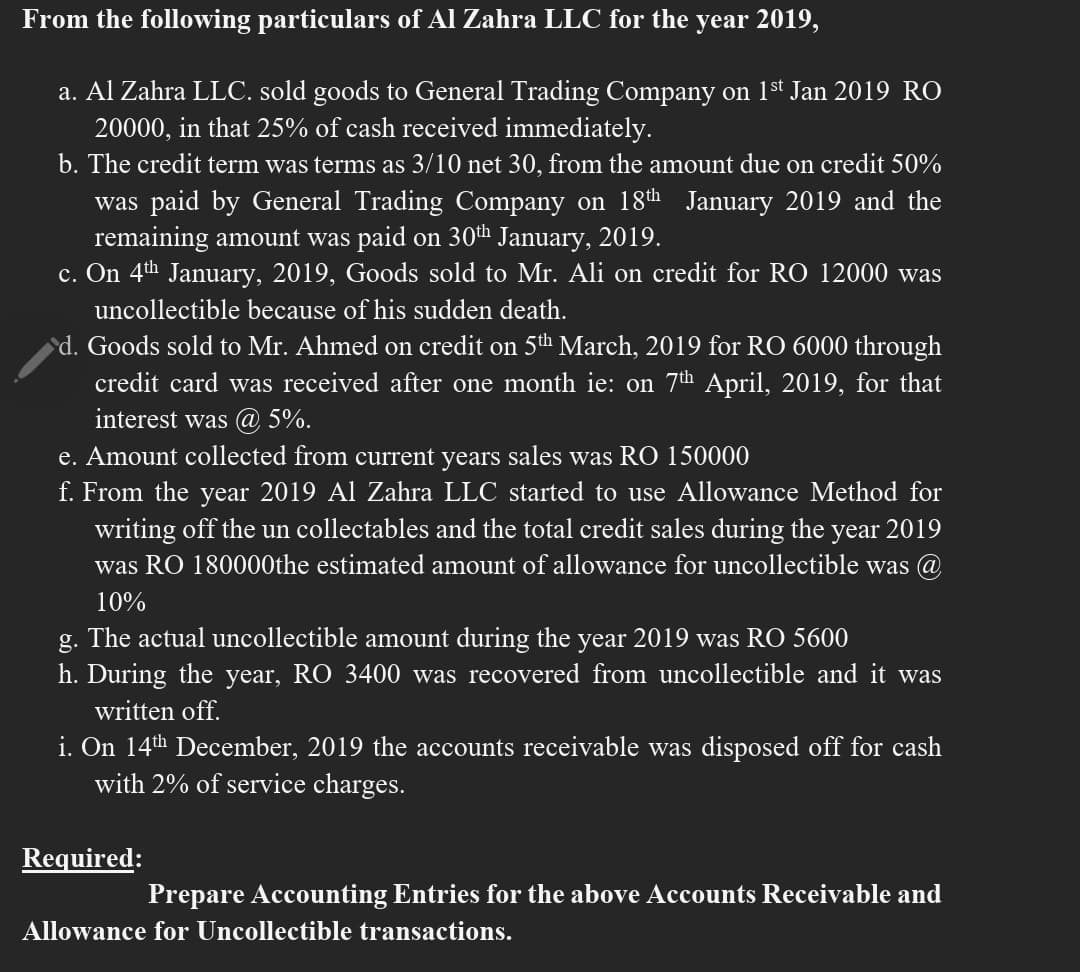

From the following particulars of Al Zahra LLC for the year 2019, a. Al Zahra LLC. sold goods to General Trading Company on 1st Jan 2019 RO 20000, in that 25% of cash received immediately. b. The credit term was terms as 3/10 net 30, from the amount due on credit 50% was paid by General Trading Company on 18th January 2019 and the remaining amount was paid on 30th January, 2019. c. On 4th January, 2019, Goods sold to Mr. Ali on credit for RO 12000 was uncollectible because of his sudden death. d. Goods sold to Mr. Ahmed on credit on 5th March, 2019 for RO 6000 through credit card was received after one month ie: on 7th April, 2019, for that interest was @ 5%. e. Amount collected from current years sales was RO 150000 f. From the year 2019 Al Zahra LLC started to use Allowance Method for writing off the un collectables and the total credit sales during the year 2019 was RO 180000the estimated amount of allowance for uncollectible was @ 10% g. The actual uncollectible amount during the year 2019 was RO 5600 h. During the year, RO 3400 was recovered from uncollectible and it was written off. i. On 14th December, 2019 the accounts receivable was disposed off for cash with 2% of service charges. Required: Prepare Accounting Entries for the above Accounts Receivable and Allowance for Uncollectible transactions.

From the following particulars of Al Zahra LLC for the year 2019, a. Al Zahra LLC. sold goods to General Trading Company on 1st Jan 2019 RO 20000, in that 25% of cash received immediately. b. The credit term was terms as 3/10 net 30, from the amount due on credit 50% was paid by General Trading Company on 18th January 2019 and the remaining amount was paid on 30th January, 2019. c. On 4th January, 2019, Goods sold to Mr. Ali on credit for RO 12000 was uncollectible because of his sudden death. d. Goods sold to Mr. Ahmed on credit on 5th March, 2019 for RO 6000 through credit card was received after one month ie: on 7th April, 2019, for that interest was @ 5%. e. Amount collected from current years sales was RO 150000 f. From the year 2019 Al Zahra LLC started to use Allowance Method for writing off the un collectables and the total credit sales during the year 2019 was RO 180000the estimated amount of allowance for uncollectible was @ 10% g. The actual uncollectible amount during the year 2019 was RO 5600 h. During the year, RO 3400 was recovered from uncollectible and it was written off. i. On 14th December, 2019 the accounts receivable was disposed off for cash with 2% of service charges. Required: Prepare Accounting Entries for the above Accounts Receivable and Allowance for Uncollectible transactions.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Transcribed Image Text:From the following particulars of Al Zahra LLC for the year 2019,

a. Al Zahra LLC. sold goods to General Trading Company on 1st Jan 2019 RO

20000, in that 25% of cash received immediately.

b. The credit term was terms as 3/10 net 30, from the amount due on credit 50%

was paid by General Trading Company on 18th January 2019 and the

remaining amount was paid on 30h January, 2019.

c. On 4th January, 2019, Goods sold to Mr. Ali on credit for RO 12000 was

uncollectible because of his sudden death.

d. Goods sold to Mr. Ahmed on credit on 5th March, 2019 for RO 6000 through

credit card was received after one month ie: on 7th April, 2019, for that

interest was @ 5%.

e. Amount collected from current years sales was RO 150000

f. From the year 2019 Al Zahra LLC started to use Allowance Method for

writing off the un collectables and the total credit sales during the year 2019

was RO 180000the estimated amount of allowance for uncollectible was @

10%

g. The actual uncollectible amount during the year 2019 was RO 5600

h. During the year, RO 3400 was recovered from uncollectible and it was

written off.

i. On 14th December, 2019 the accounts receivable was disposed off for cash

with 2% of service charges.

Required:

Prepare Accounting Entries for the above Accounts Receivable and

Allowance for Uncollectible transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College