The following transactions were selected from the records of Ocean View Company: July 12 Sold merchandise to Customer R, who charged the $3,000 purchase on his Visa credit card. Visa charges OceanView a 2 percent credit card fee. 15 Sold merchandise to Customer S at an invoice price of $9,000; terms 3/10, n/30. 20 Sold merchandise to Customer T at an invoice price of $4,000; terms 3/10, n/30. 23 Collected payment from Customer S from July 15 sale. Aug. 25 Collected payment from Customer T from July 20 sale. Required: Assuming that Sales Discounts and Credit Card Discounts are treated as contra-revenues, compute net sales for the two months ended August 31.

The following transactions were selected from the records of Ocean View Company: July 12 Sold merchandise to Customer R, who charged the $3,000 purchase on his Visa credit card. Visa charges OceanView a 2 percent credit card fee. 15 Sold merchandise to Customer S at an invoice price of $9,000; terms 3/10, n/30. 20 Sold merchandise to Customer T at an invoice price of $4,000; terms 3/10, n/30. 23 Collected payment from Customer S from July 15 sale. Aug. 25 Collected payment from Customer T from July 20 sale. Required: Assuming that Sales Discounts and Credit Card Discounts are treated as contra-revenues, compute net sales for the two months ended August 31.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter24: Recording International And Internet Sales

Section: Chapter Questions

Problem 1MP

Related questions

Question

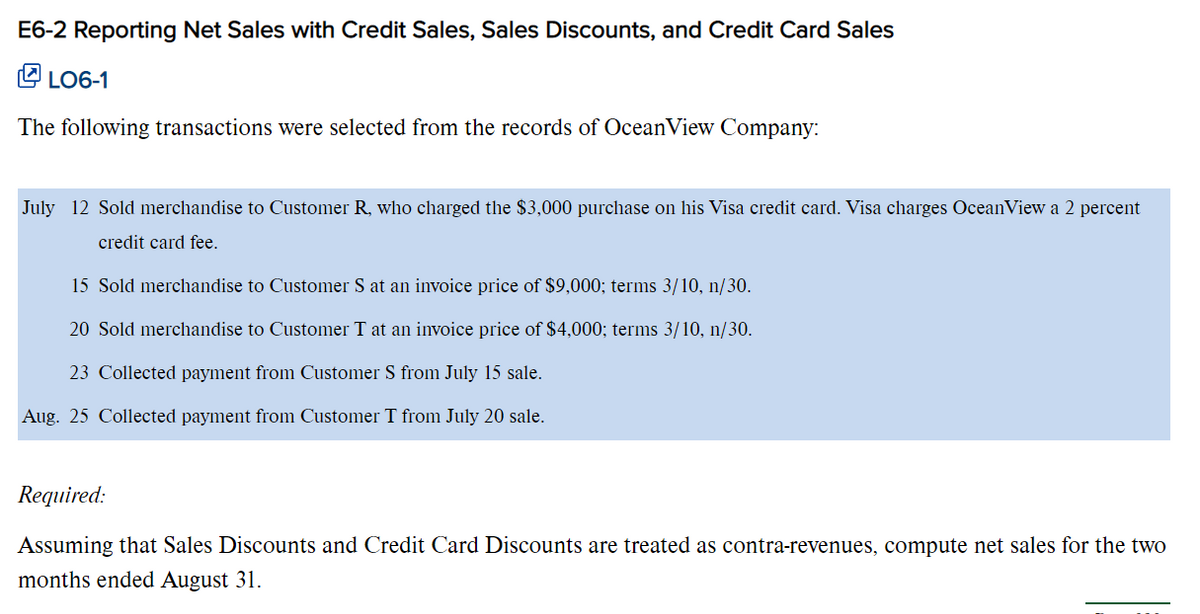

Transcribed Image Text:E6-2 Reporting Net Sales with Credit Sales, Sales Discounts, and Credit Card Sales

LO6-1

The following transactions were selected from the records of Ocean View Company:

July 12 Sold merchandise to Customer R, who charged the $3,000 purchase on his Visa credit card. Visa charges OceanView a 2 percent

credit card fee.

15 Sold merchandise to Customer S at an invoice price of $9,000; terms 3/10, n/30.

20 Sold merchandise to Customer T at an invoice price of $4,000; terms 3/10, n/30.

23 Collected payment from Customer S from July 15 sale.

Aug. 25 Collected payment from Customer T from July 20 sale.

Required:

Assuming that Sales Discounts and Credit Card Discounts are treated as contra-revenues, compute net sales for the two

months ended August 31.

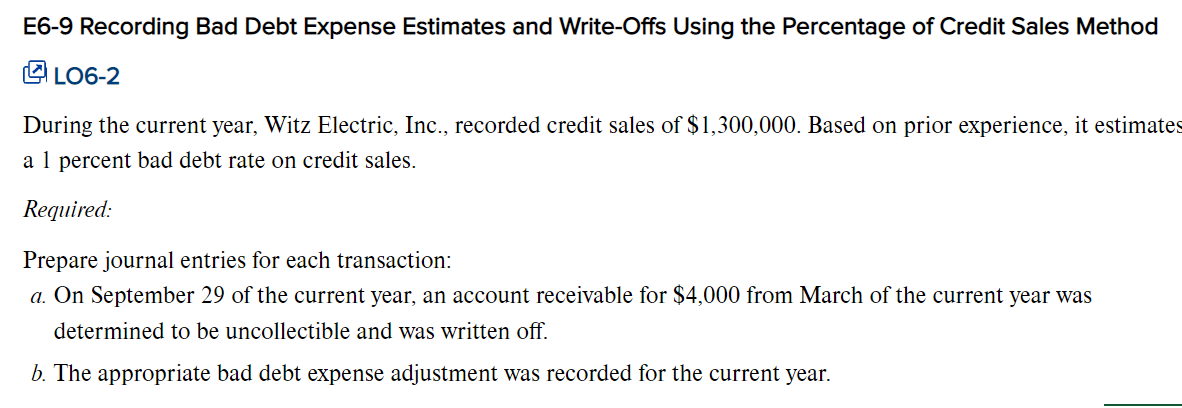

Transcribed Image Text:E6-9 Recording Bad Debt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method

LO6-2

During the current year, Witz Electric, Inc., recorded credit sales of $1,300,000. Based on prior experience, it estimates

a 1 percent bad debt rate on credit sales.

Required:

Prepare journal entries for each transaction:

a. On September 29 of the current year, an account receivable for $4,000 from March of the current year was

determined to be uncollectible and was written off.

b. The appropriate bad debt expense adjustment was recorded for the current year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,