The following transactions you gathered from the not so organized records of Mr. Ave Tor:

The following transactions you gathered from the not so organized records of Mr. Ave Tor:

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter6: Work Sheet And Adjusting Entries For A Service Business

Section: Chapter Questions

Problem 1CP

Related questions

Question

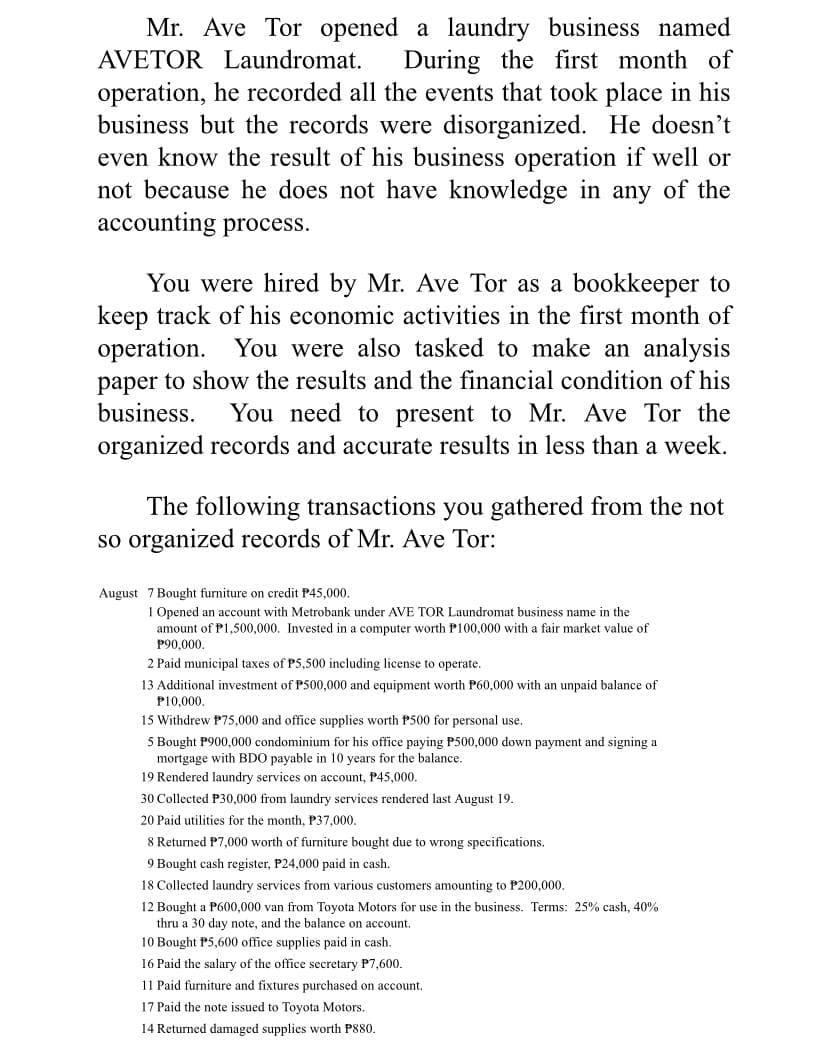

Transcribed Image Text:Mr. Ave Tor opened a laundry business named

AVETOR Laundromat.

During the first month of

operation, he recorded all the events that took place in his

business but the records were disorganized. He doesn't

even know the result of his business operation if well or

not because he does not have knowledge in any of the

accounting process.

You were hired by Mr. Ave Tor as a bookkeeper to

keep track of his economic activities in the first month of

operation. You were also tasked to make an analysis

paper to show the results and the financial condition of his

You need to present to Mr. Ave Tor the

organized records and accurate results in less than a week.

business.

The following transactions you gathered from the not

so organized records of Mr. Ave Tor:

August 7 Bought furniture on credit P45,000.

1 Opened an account with Metrobank under AVE TOR Laundromat business name in the

amount of P1,500,000. Invested in a computer worth P100,000 with a fair market value of

P90,000,

2 Paid municipal taxes of P5,500 including license to operate.

13 Additional investment of P500,000 and equipment worth P60,000 with an unpaid balance of

P10,000,

15 Withdrew P75,000 and office supplies worth P500 for personal use.

5 Bought P900,000 condominium for his office paying P500,000 down payment and signing a

mortgage with BDO payable in 10 years for the balance.

19 Rendered laundry services on account, P45,000.

30 Collected P30,000 from laundry services rendered last August 19.

20 Paid utilities for the month, P37,000.

8 Returned P7,000 worth of furniture bought due to wrong specifications.

9 Bought cash register, P24,000 paid in cash.

18 Collected laundry services from various customers amounting to P200,000.

12 Bought a P600,000 van from Toyota Motors for use in the business. Terms: 25% cash, 40%

thru a 30 day note, and the balance on account.

10 Bought P5,600 office supplies paid in cash.

16 Paid the salary of the office secretary P7,600.

11 Paid furniture and fixtures purchased on account.

17 Paid the note issued to Toyota Motors.

14 Returned damaged supplies worth P880.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub