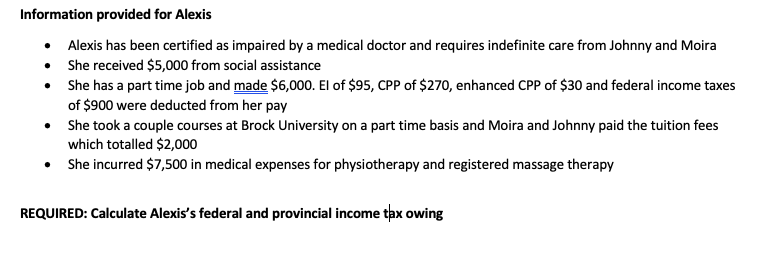

REQUIRED: Calculate Alexis's federal and provincial income tax owing

Q: Which of the following statements is true? OA. The right-of-use asset is increased by prepaid lease…

A: Right of use asset means the right of the lessee to use the asset. It could be on a property or…

Q: Cash $655,500 Marketable securities 759,000 Accounts and notes receivable (net) 310,500 Inventories…

A: Working capital is the amount of capital needed for daily operations of the business. This is…

Q: A company bought a machine for P19,500.00. It has an estimated useful life of 20 years, after which…

A: The depreciation expense is charged on fixed assets as reduction in the value of fixed assets with…

Q: Sarah moves to Germany on July 15. Of the current year, she is 35 and has lived in Canada all her…

A: The legal position of a foreign national in a country where he or she is not a citizen is referred…

Q: A Leading manufacturer of Action Figures is about to introduce four new Action Figures. The…

A:

Q: At what amount will Mills report its investment in the December 31, 2021, balance sheet?

A: Premium on Bond's :— It implies that Face Value of Bond is Less than Carrying Value Or Market Value…

Q: On January 1, DogMart Company purchased a two-year liability insurance policy for $34,320 cash. The…

A: There are several items of expenses which are paid in advance in the normal course of business…

Q: Identify why the business analyst needs to have the following skills when recruited by an…

A: INTRODUCTION: Business terminology has qualities and can be connected to one another when defining…

Q: If the cash account balance on the balance sheet is $25,000, total current assets is $150,000, and…

A: Under the vertical analysis, balance sheet items (assets) are shown as a percentage of total assets…

Q: The following information is from Dessert Dynasty. The company runs three stores and the December…

A: Store Y retail revenue: $ 26,259 Solution: (Retail Revenue=Total Revenue-Event Revenue)= $30,879…

Q: How much is the book value per preference share assuming that preference shares are non-cumulative?

A: Book value per share refers to the ratio of total value available for preference shareholder and…

Q: Fatima Alabanza is president of Sizzling Corporation, a nonpublic manufacturer of kitchen cabinets.…

A: Introduction: A code of ethics is a set of rules aimed to assist professionals to conduct business…

Q: Selected comparative financial statements of Korbin Company follow. Comparative Income Statements…

A: Under vertical analysis assets and liabilities are classified as a percentage of those of a base…

Q: Economic Profit?

A: Economic profit is different from the accounting profit earned, accounting profit is calculated at…

Q: . Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three…

A: POC % = cost incurred till date/ Total Estimated cost of completion. As per POC method, Revenue…

Q: John and Saah met at law school and decide to start a small law practice after graduation. They…

A: Disclaimer: "Since you have asked multiple questions in a single question we answered the first…

Q: Tom and Rachel are married and living together in California. Their income is as follows: Tom's…

A: INTRODUCTION: Income tax is a tax paid to the government depending on your earnings (and profit, in…

Q: Accounting for assets question. 2. a) The following information we got from Waridi mean traders for…

A: As per our guidelines, only 1 question can be answered. So here is the solution for question 2(a)…

Q: Cost items Flour Depreciation on cooking vats Cooking oil Sugar Wages of a donut cook Repair of a…

A: Costs are the amounts that are incurred for the production of goods and services. They are of…

Q: During its most recent fiscal year, Dover, Incorporated had total sales of $3,200,000. Contribution…

A: Contribution margin: The difference between the sales and the variable costs is called contribution…

Q: 1. Outline the roles and responsibilities of auditing standard setting bodies.

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Assume Ikeo Inc. sold $80,000 of gift cards during the last two weeks of December 2020. No gift…

A: Journal entries are the primary reporting of the daily transactions in the books of accounts. It is…

Q: explain how cultural influenced the accountants’ accounting values. What are the cultural dimensions…

A: In the year 1980, Hafostede published his Culture’s Consequences: International Differences in Work…

Q: During the prior year Company A had days payables outstanding of 27. As of the end of the current…

A: Accounts payable are those supplier accounts from whom business has made credit purchases and amount…

Q: $1,322,984 $1,322,984 When reviewing the end of year data, you discovered the following items are…

A: Computation of rent amount consumed during the year Rent was paid on May 1st, 2021 for twelve month…

Q: You have $500,000.00 saved for retirement. Your account earns 5% interest compounded monthly. How…

A: INTRODUCTION; Compound interest (or composite) is the interest on a loan or deposit computed using…

Q: Beginning inventory (Jan. 1) Purchase (Jan. 11) Purchase (Jan. 20) Total Quantity Unit Cost Total…

A: Introduction: LIFO: LIFO stands for Last in First Out. Which means last received inventory to be…

Q: On December 31, ABC had 40,000 weighted average outstanding ordinary shares. During the year, ABC…

A: Basic earnings per ordinary share is amount that is left of ordinary shares after all the expenses…

Q: Lunox Corporation is composed of two major subunits: Wholesale and Retail. In December, Retail…

A: Segment Reporting: Reporting on a company's business segments dis-aggregates the company's financial…

Q: Required: i) Lara Sdn . Bhd . has a variable cost ratio of 0.56 . The fixed cost is RM103,840 and…

A: Break-even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: After receiving the two million pesos as graduation gift, you decided to invest the whole two…

A:

Q: assigned allowance for doubtful accounts. II – Assets and liabilities of a disposal group classified…

A: Accounting refers to the process of compiling and documenting all the transactions of a company into…

Q: Units 100 50 80 Beginning inventory Purchase (April 3) Sale (April 10) Purchase (April 18) Purchase…

A: LIFO is last in first out inventory valuation method which says that inventory which is purchased…

Q: Analyze the truth of these statements: Assume a corporation issued $2,000,000 of common stock in…

A: If cash is paid in exchange for fixed assets then it will be shown under cash flow under investing…

Q: Tango Company produces joint products M, N, and T from a joint process. This information concerns a…

A: Joint cost means the cost which is incurred jointly on all the products and can't be determined…

Q: 9 6 7 8 5 4 3 Question # 1 2 For each item above, indicate whether the cost is MAINLY fixed or…

A: The cost can be classified based on nature like fixed costs or variable costs. The cost is variable…

Q: You can afford a $500.00 per month car payment. You can get a loan at 8% interest for 4 years. A.…

A: Loan: When money is lent to another party in return for regular repayment of the loan principal…

Q: You want to buy a $15,000.00 car. You can make a 10% down payment, and will finance the balance with…

A: The Equal Montly installment is calculated with the help of following formula EMI = P × r(1 + r)n…

Q: Balance sheet. Liu Zhang operates Lawson Consulting, which began operations on June 1. The Retained…

A: The balance sheet is a financial statement that depicts the financial position of a business at a…

Q: XYZ Inc issued 445 convertible bonds - each at a price of 101.95% of the $1,000 face value. At…

A: A bond may be regarded of as an I.O.U. between the debtor and creditor including the loan…

Q: A $1000 face value, 8% bond (interest payable semiannually) has 20 years remaining until maturity…

A: Lets understand the basics. When market interest rate is more than the bond interest rate then value…

Q: Via Gelato is a popular neighborhood gelato shop. The company has provided the following cost…

A: The revenue and spending variance is the difference between actual results and flexible budget data…

Q: two (2) reasons why ROI, RI and EVA may be inappropriate measures of performance.

A: ROI ( Return on Investment)- This measure is used to measure the return on any investment. This is a…

Q: PA8-3 (Algo) Recording Notes Receivable Transactions [LO 8-3] C&S Marketing (CSM) recently hired a…

A: A record is often kept in the accounting records, but it can also be kept in a single account,…

Q: I – Non-adjusting event falling after date of authorization of FS issuance may or may not be…

A: Correct option is (d) Only statement II is true. It is recommended by the Standard that at most,…

Q: O’Brien Company manufactures and sells one product. The following information pertains to each of…

A: Inventory refers to the stock that the company hasn't sold yet or is kept to be sold in a near…

Q: (a) Bara Enterprise manufactures product Alpha. The following information is for the year 2021:…

A: Production budget is the statement which is prepared to know the estimated production needed for a…

Q: An equipment was bought in the beginning of January 2014 with the Original Cost of $48.000. The…

A: As per our guidelines we are supposed to answer only 3 sub parts

Q: ABC prepares statements on the cash basis. The balance sheet as of December 31, 2021 and income…

A: Accrual basis: Under accrual basis accounting, revenue and expenses are recognized when they are…

Q: Following are five separate cases involving internal control issues. Required: 1. For each case,…

A: Receiving payments and posting the same in the accounts violate the principle of segregation of…

Step by step

Solved in 2 steps

- Kim was seriously injured at her job. As a result of her injury, she received the following payments: 5,000 reimbursement from employer-provided health insurance for medical expenses paid by Kim. The premiums this year paid by Kims employer totaled 6,000. 15,000 disability pay. Kim has disability insurance provided by her employer as a nontaxable fringe benefit. Kims employer paid 6,000 in disability premiums this year on behalf of Kim. 10,000 received for damages for personal physical injury. 200,000 for punitive damages. What amount is taxable to Kim? a. 215,000 b. 225,000 c. 236,000 d. 0Addison Parker (Social Security number 123-45-6785), single and age 32, lives at 3218 Columbia Drive, Spokane, WA 99210. She is employed as regional sales manager by VITA Corporation, a manufacturer and distributor of vitamins and food supplements. Addison is paid an annual salary of 83,000 and a separate travel allowance of 28,000. In order to access the travel allowance, VITA requires adequate accounting by Addison. Addison participates in VITAs contributor) health and 401(k) plans. During 2019, she paid 4,500 for her share of the medical insurance and contributed 11,000 to the 401(k) retirement plan. Addison uses her automobile 70% for business and 30% for personal. The automobile, a Toyota Avalon, was purchased new on June 30, 2017, for 37,000 (no trade-in was involved). Depreciation has been claimed using the MACRS 200% declining-balance method, and no 179 election was made in the year of purchase. (For depreciation information, see the IRS Instructions for Form 4562, Part V.) During 2019, Addison drove 15,000 miles and incurred and paid the following expenses relating to the automobile: Because VITA does not have an office in Spokane, the company expects Addison to maintain one in her home. Out of 1.500 square feet of living space in her apartment, Addison has set aside 300 square feet as an office. Expenses for 2019 relating to the office are listed below. Addisons employment-related expenses (except for the trip to Korea) for 2019 are summarized below. Most of Addisons business trips involve visits to retail outlets in her region. Store managers and their key employees, as well as some suppliers, were the parties entertained. The business gifts were boxes of candy costing 30 (25 each plus 5 for wrapping and shipping) sent to 18 store managers at Christmas. The continuing education was a noncredit course dealing with improving management skills that Addison took online. In July 2019, Addison traveled to Korea to investigate a new process that is being developed to convert fish parts to a solid consumable tablet form. She spent one week checking out the process and then took a one-week vacation tour of the country. The round-trip airfare was 3,600, and her expenses relating to business were 2,100 for lodging (300 each night), 1,470 for meals, and 350 for transportation. Upon returning to the United States, Addison sent her findings about the process to her employer. VITA was so pleased with her report that it gave her an employee achievement award of 10,000. The award was sent to Addison in January 2020. Besides the items already mentioned, Addison had the following receipts in 2019: Regarding the city lot (located in Vancouver), Addison purchased the property in 2004 for 16,000 and held it as an investment. Unfortunately, the neighborhood where the lot was located deteriorated, and property values declined. In 2019, Addison decided to cut her losses and sold the property for 13,000. The sailboat was used for pleasure and was purchased in 2015 for 16,500. Addison sold the boat because she purchased a new and larger model (see below). While at the Spokane airport, Addison found an unmarked envelope containing 55,000 in 50 bills. Because no mention of any lost funds was noted in the media, Addison kept the money. Addisons expenditures for 2019 (not previously noted) are summarized below. Addison keeps careful records regarding sales taxes. In 2019, the sales tax total was unusually high due to the purchase of a new sailboat. In 2019, Addison decided to pay her church pledge for both 2019 and 2020. The insurance premium was on a policy covering her fathers life. (Addison is the designated beneficiary under the policy.) Addisons employer withheld 8,600 for Federal income tax purposes, and she applied her 800 overpayment for 2018 toward the 2019 tax liability. Compute Addisons Federal income tax payable (or refund) for 2019. In making the calculation, use the Fax Rate Schedule and disregard the application of the alternative minimum tax (AMI), which is not discussed until Chapter 12.