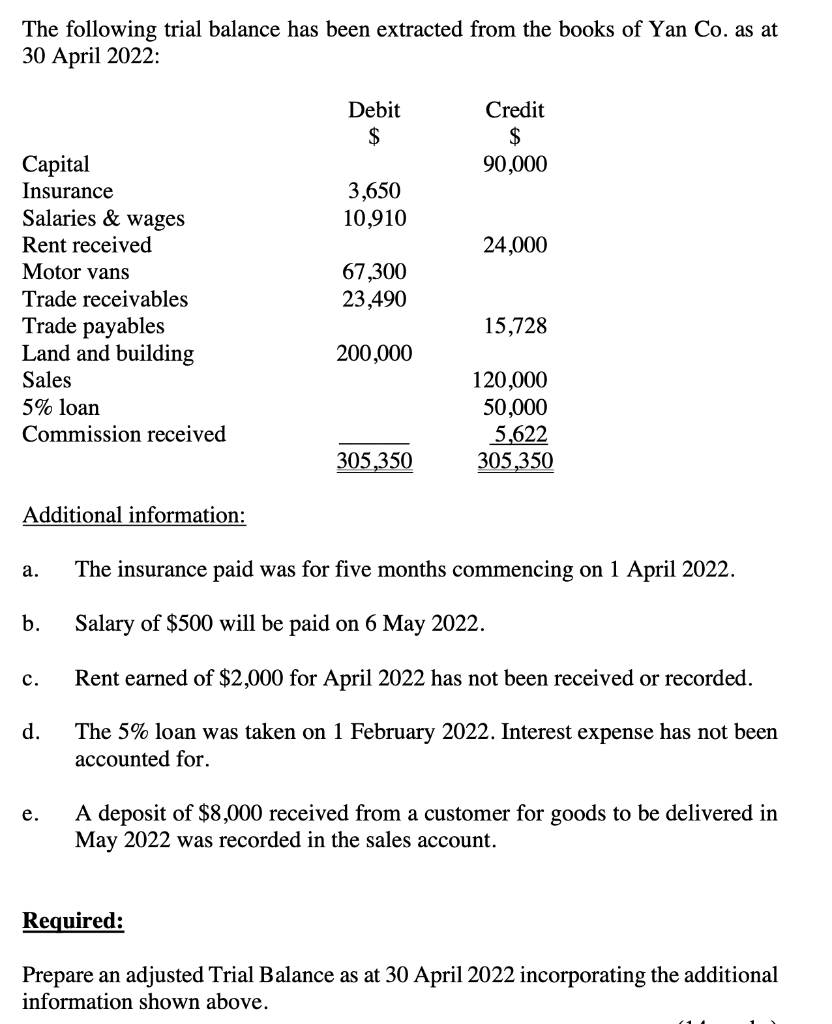

The following trial balance has been extracted from the books of Yan Co. as at 30 April 2022: Capital Insurance Salaries & wages Rent received Motor vans Trade receivables Trade payables Land and building Sales 5% loan Commission received Additional information: a. b. C. d. e. Debit $ 3,650 10,910 67,300 23,490 200,000 305,350 Credit $ 90,000 24,000 15,728 120,000 50,000 5,622 305,350 The insurance paid was for five months commencing on 1 April 2022. Salary of $500 will be paid on 6 May 2022. Rent earned of $2,000 for April 2022 has not been received or recorded. The 5% loan was taken on 1 February 2022. Interest expense has not been accounted for. A deposit of $8,000 received from a customer for goods to be delivered in May 2022 was recorded in the sales account. Required: Prepare an adjusted Trial Balance as at 30 April 2022 incorporating the additional information shown above.

The following trial balance has been extracted from the books of Yan Co. as at 30 April 2022: Capital Insurance Salaries & wages Rent received Motor vans Trade receivables Trade payables Land and building Sales 5% loan Commission received Additional information: a. b. C. d. e. Debit $ 3,650 10,910 67,300 23,490 200,000 305,350 Credit $ 90,000 24,000 15,728 120,000 50,000 5,622 305,350 The insurance paid was for five months commencing on 1 April 2022. Salary of $500 will be paid on 6 May 2022. Rent earned of $2,000 for April 2022 has not been received or recorded. The 5% loan was taken on 1 February 2022. Interest expense has not been accounted for. A deposit of $8,000 received from a customer for goods to be delivered in May 2022 was recorded in the sales account. Required: Prepare an adjusted Trial Balance as at 30 April 2022 incorporating the additional information shown above.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Transcribed Image Text:The following trial balance has been extracted from the books of Yan Co. as at

30 April 2022:

Capital

Insurance

Salaries & wages

Rent received

Motor vans

Trade receivables

Trade payables

Land and building

Sales

5% loan

Commission received

Additional information:

a.

b.

C.

d.

e.

Debit

$

3,650

10,910

67,300

23,490

200,000

305,350

Credit

$

90,000

24,000

15,728

120,000

50,000

5,622

305,350

The insurance paid was for five months commencing on 1 April 2022.

Salary of $500 will be paid on 6 May 2022.

Rent earned of $2,000 for April 2022 has not been received or recorded.

The 5% loan was taken on 1 February 2022. Interest expense has not been

accounted for.

A deposit of $8,000 received from a customer for goods to be delivered in

May 2022 was recorded in the sales account.

Required:

Prepare an adjusted Trial Balance as at 30 April 2022 incorporating the additional

information shown above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage