Capital, 1 February 2019 Drawings Fixtures and fittings Equipment Accumulated depreciation of fixtures and fittings Accumulated depreciation of equipment Cash in Hand Hairdressing Fees Interest expense Wages and salaries Insurance expense Cash at bank (Cr) Rent income $ 16 000 1 900 30 000 25 200 6 000 1 320 750 38 100 500 23 900 3 850 910 12 300

Capital, 1 February 2019 Drawings Fixtures and fittings Equipment Accumulated depreciation of fixtures and fittings Accumulated depreciation of equipment Cash in Hand Hairdressing Fees Interest expense Wages and salaries Insurance expense Cash at bank (Cr) Rent income $ 16 000 1 900 30 000 25 200 6 000 1 320 750 38 100 500 23 900 3 850 910 12 300

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 10E: Spreadsheet The following 2019 information is available for Payne Company: Partial additional...

Related questions

Question

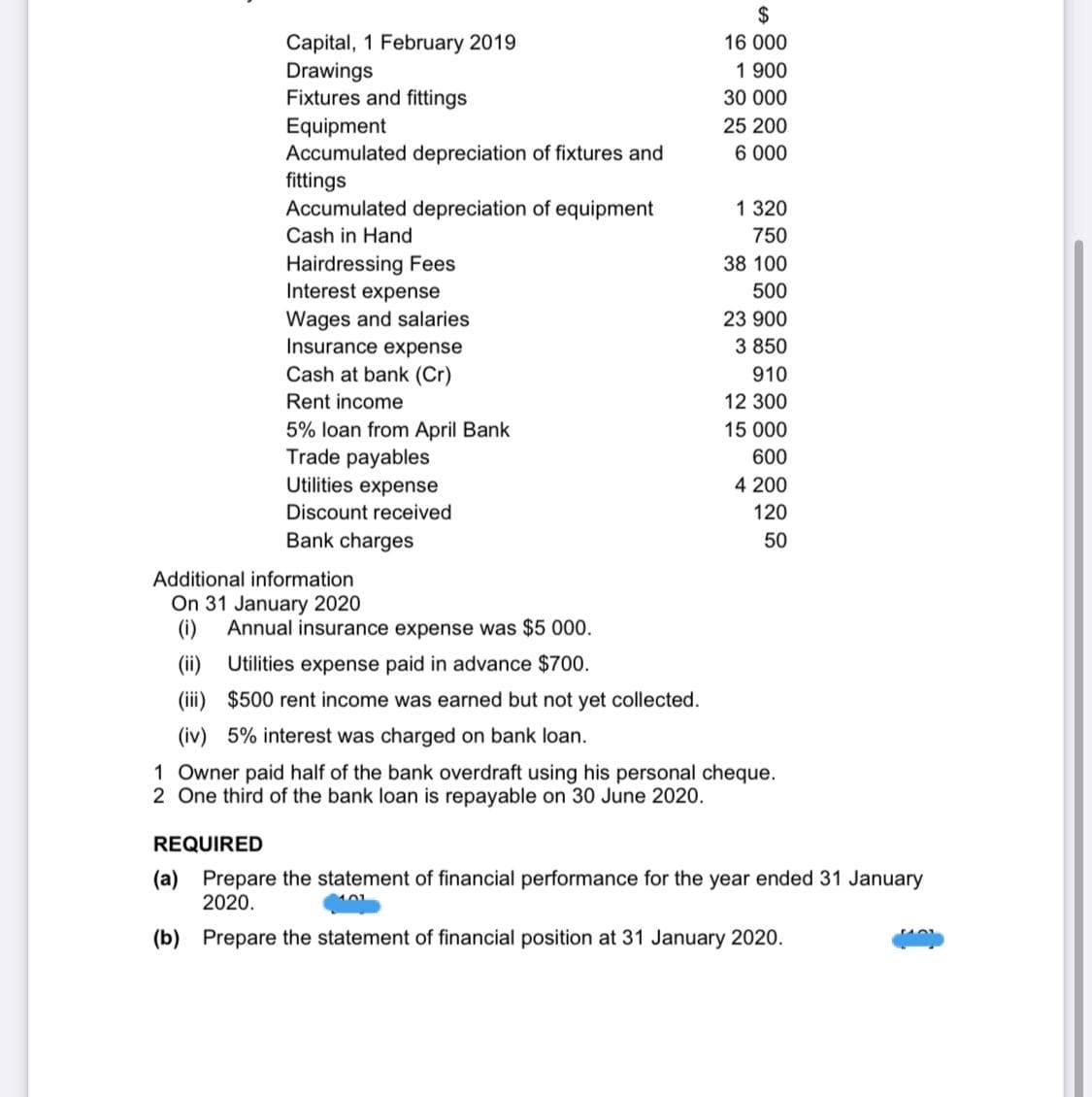

Transcribed Image Text:Capital, 1 February 2019

Drawings

Fixtures and fittings

Equipment

Accumulated depreciation of fixtures and

fittings

Accumulated depreciation of equipment

Cash in Hand

Hairdressing Fees

Interest expense

Wages and salaries

Insurance expense

Cash at bank (Cr)

Rent income

5% loan from April Bank

Trade payables

Utilities expense

Discount received

Bank charges

$

16 000

1 900

30 000

25 200

6 000

1 320

750

38 100

500

23 900

3 850

910

12 300

15 000

600

4 200

120

50

Additional information

On 31 January 2020

(i) Annual insurance expense was $5 000.

(ii) Utilities expense paid in advance $700.

(iii) $500 rent income was earned but not yet collected.

(iv) 5% interest was charged on bank loan.

1 Owner paid half of the bank overdraft using his personal cheque.

2 One third of the bank loan is repayable on 30 June 2020.

REQUIRED

(a) Prepare the statement of financial performance for the year ended 31 January

2020.

(b) Prepare the statement of financial position at 31 January 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning