I'll upvote if complete and correct. Thank you

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section22.1: Preparing Adjusting Entries

Problem 1OYO

Related questions

Question

100%

I'll upvote if complete and correct. Thank you

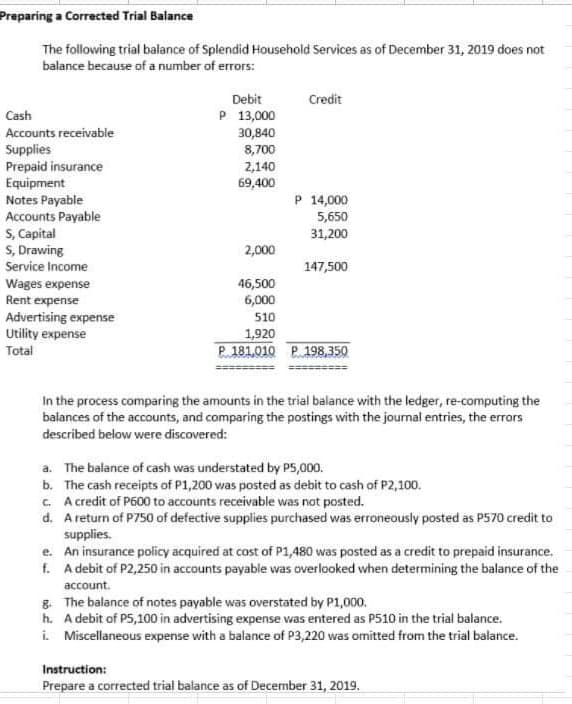

Transcribed Image Text:Preparing a Corrected Trial Balance

The following trial balance of Splendid Household Services as of December 31, 2019 does not

balance because of a number of errors:

Debit

P 13,000

30,840

8,700

Credit

Cash

Accounts receivable

Supplies

Prepaid insurance

Equipment

Notes Payable

Accounts Payable

S, Capital

S, Drawing

Service Income

2,140

69,400

P 14,000

5,650

31,200

2,000

147,500

Wages expense

Rent expense

Advertising expense

Utility expense

Total

46,500

6,000

510

1,920

P. 181,010 P. 198,350

In the process comparing the amounts in the trial balance with the ledger, re-computing the

balances of the accounts, and comparing the postings with the journal entries, the errars

described below were discovered:

a. The balance of cash was understated by P5,000.

b. The cash receipts of P1,200 was posted as debit to cash of P2,100.

c. A credit of P600 to accounts receivable was not posted.

d. Areturn of P750 of defective supplies purchased was erroneously posted as P570 credit to

supplies.

e. An insurance policy acquired at cost of P1,480 was posted as a credit to prepaid insurance.

f. A debit of P2,250 in accounts payable was overlooked when determining the balance of the

account.

g. The balance of notes payable was overstated by P1,000.

h. A debit of P5,100 in advertising expense was entered as P510 in the trial balance.

i. Miscellaneous expense with a balance of P3,220 was omitted from the trial balance.

Instruction:

Prepare a corrected trial balance as of December 31, 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning