The company uses the perpetual inventory method and started the month of November with 500 units of inventory at a cost of $3 each. Purchases November 5, 500 units at $5 each November 18, 500 units at $6 each November 29, 500 units at $9 each Sales November 12, 400 units sold at $14 each November 25, 900 units sold at $14 each 1. Use the following format to set up this inventory costing problem, as shown in Video #2. Inventory Date Cost per Unit Units Total Cost Date Units Total Cost Beg Balance Units Cost Beginning Balance + Purchases Goods Available for Sale - Sold Ending Balance 2. Use the moving weighted average method to calculate cost of goods sold and ending inventory. 3. Calculate the company's gross margin based on using the average cost method.

The company uses the perpetual inventory method and started the month of November with 500 units of inventory at a cost of $3 each. Purchases November 5, 500 units at $5 each November 18, 500 units at $6 each November 29, 500 units at $9 each Sales November 12, 400 units sold at $14 each November 25, 900 units sold at $14 each 1. Use the following format to set up this inventory costing problem, as shown in Video #2. Inventory Date Cost per Unit Units Total Cost Date Units Total Cost Beg Balance Units Cost Beginning Balance + Purchases Goods Available for Sale - Sold Ending Balance 2. Use the moving weighted average method to calculate cost of goods sold and ending inventory. 3. Calculate the company's gross margin based on using the average cost method.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.2BPR: LIFO perpetual inventory The beginning inventory for Dunne Co. and data on purchases and sales for a...

Related questions

Topic Video

Question

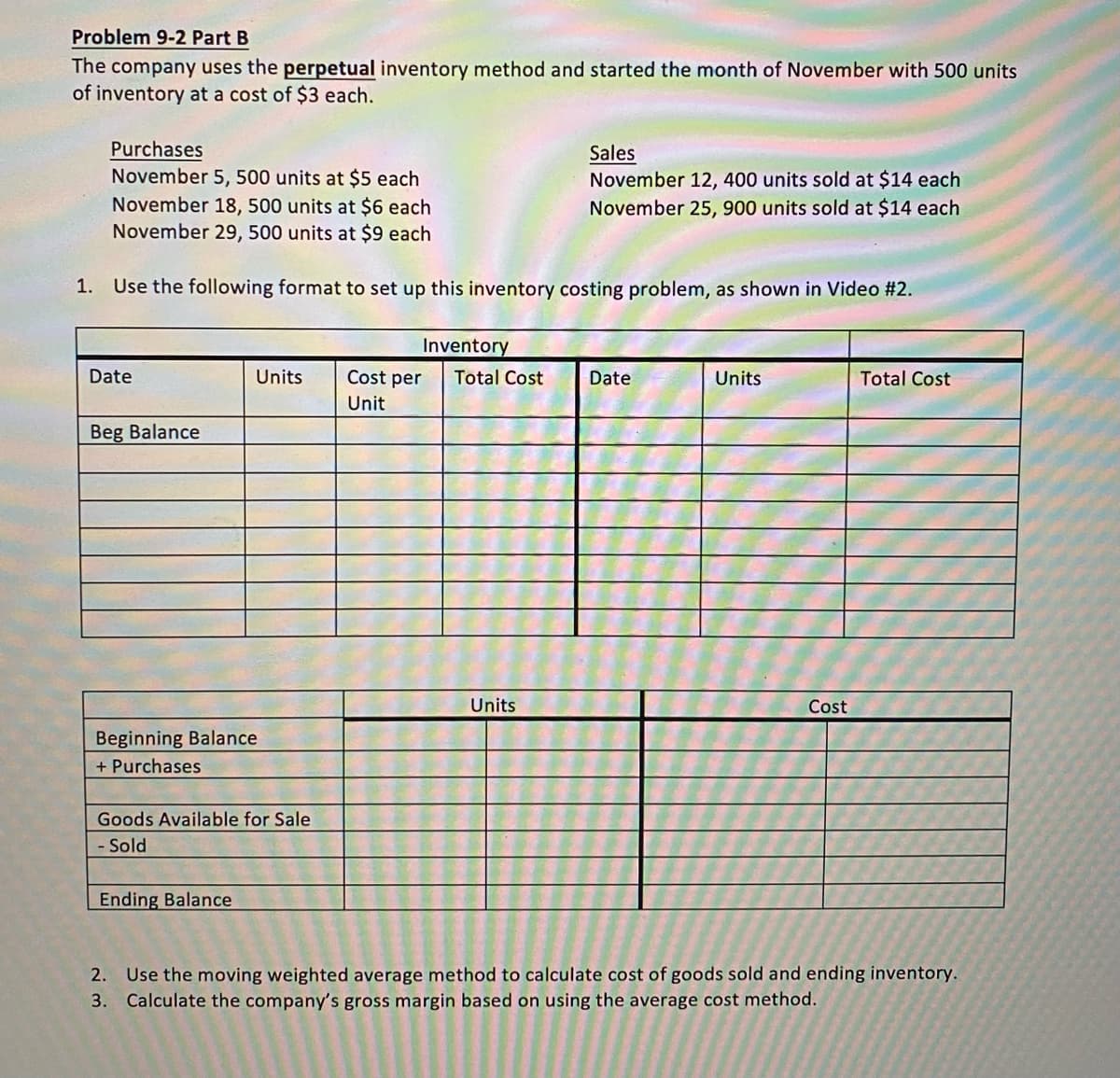

Transcribed Image Text:Problem 9-2 Part B

The company uses the perpetual inventory method and started the month of November with 500 units

of inventory at a cost of $3 each.

Purchases

November 5, 500 units at $5 each

November 18, 500 units at $6 each

November 29, 500 units at $9 each

Sales

November 12, 400 units sold at $14 each

November 25, 900 units sold at $14 each

1. Use the following format to set up this inventory costing problem, as shown in Video #2.

Inventory

Date

Únits

Cost per

Total Cost

Date

Units

Total Cost

Unit

Beg Balance

Units

Cost

Beginning Balance

+ Purchases

Goods Available for Sale

- Sold

Ending Balance

2. Use the moving weighted average method to calculate cost of goods sold and ending inventory.

3. Calculate the company's gross margin based on using the average cost method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,