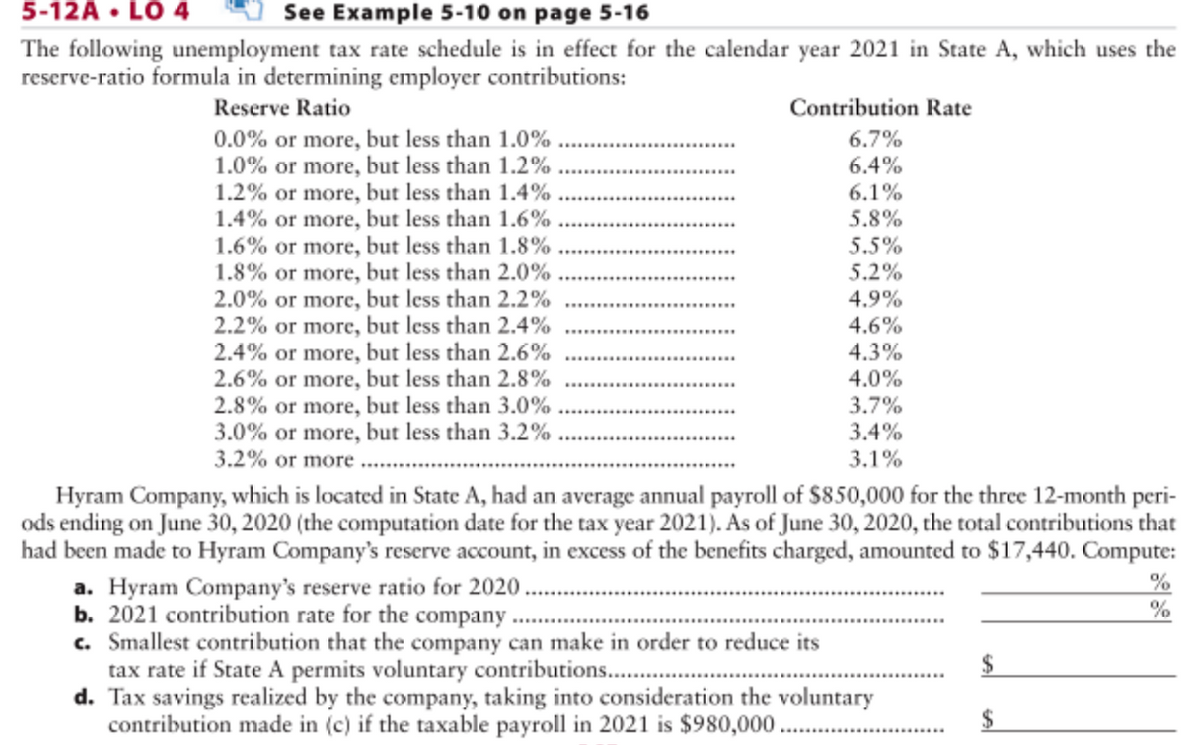

The following unemployment tax rate schedule is in effect for the calendar year 2021 in State A, which uses the reserve-ratio formula in determining employer contributions: Reserve Ratio Contribution Rate 0.0% or more, but less than 1.0% 1.0% or more, but less than 1.2% 1.2% or more, but less than 1.4% 1.4% or more, but less than 1.6% 1.6% or more, but less than 1.8% 1.8% or more, but less than 2.0% 2.0% or more, but less than 2.2% 2.2% or more, but less than 2.4% 2.4% or more, but less than 2.6% 2.6% or more, but less than 2.8% 2.8% or more, but less than 3.0% 3.0% or more, but less than 3.2% 3.2% or more 6.7% 6.4% 6.1% 5.8% 5.5% 5.2% 4.9% 4.6% 4.3% 4.0% 3.7% 3.4% 3.1% Hyram Company, which is located in State A, had an average annual payroll of $850,000 for the three 12-month peri- ods ending on June 30, 2020 (the computation date for the tax year 2021). As of June 30, 2020, the total contributions that had been made to Hyram Company's reserve account, in excess of the benefits charged, amounted to $17,440. Compute: a. Hyram Company's reserve ratio for 2020 b. 2021 contribution rate for the company c. Smallest contribution that the company can make in order to reduce its tax rate if State A permits voluntary contributions... d. Tax savings realized by the company, taking into consideration the voluntary contribution made in (c) if the taxable payroll in 2021 is $980,000. 70 70 2$

The following unemployment tax rate schedule is in effect for the calendar year 2021 in State A, which uses the reserve-ratio formula in determining employer contributions: Reserve Ratio Contribution Rate 0.0% or more, but less than 1.0% 1.0% or more, but less than 1.2% 1.2% or more, but less than 1.4% 1.4% or more, but less than 1.6% 1.6% or more, but less than 1.8% 1.8% or more, but less than 2.0% 2.0% or more, but less than 2.2% 2.2% or more, but less than 2.4% 2.4% or more, but less than 2.6% 2.6% or more, but less than 2.8% 2.8% or more, but less than 3.0% 3.0% or more, but less than 3.2% 3.2% or more 6.7% 6.4% 6.1% 5.8% 5.5% 5.2% 4.9% 4.6% 4.3% 4.0% 3.7% 3.4% 3.1% Hyram Company, which is located in State A, had an average annual payroll of $850,000 for the three 12-month peri- ods ending on June 30, 2020 (the computation date for the tax year 2021). As of June 30, 2020, the total contributions that had been made to Hyram Company's reserve account, in excess of the benefits charged, amounted to $17,440. Compute: a. Hyram Company's reserve ratio for 2020 b. 2021 contribution rate for the company c. Smallest contribution that the company can make in order to reduce its tax rate if State A permits voluntary contributions... d. Tax savings realized by the company, taking into consideration the voluntary contribution made in (c) if the taxable payroll in 2021 is $980,000. 70 70 2$

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.8EX: Calculate payroll An employee earns 44 per hour and 1.5 times that rate for all hours in excess of...

Related questions

Question

Transcribed Image Text:5-12A • LO 4

The following unemployment tax rate schedule is in effect for the calendar year 2021 in State A, which uses the

reserve-ratio formula in determining employer contributions:

See Example 5-10 on page 5-16

Reserve Ratio

Contribution Rate

0.0% or more, but less than 1.0% .

1.0% or more, but less than 1.2%

1.2% or more, but less than 1.4%

1.4% or more, but less than 1.6%

1.6% or more, but less than 1.8%

1.8% or more, but less than 2.0%

2.0% or more, but less than 2.2%

2.2% or more, but less than 2.4%

2.4% or more, but less than 2.6%

2.6% or more, but less than 2.8%

2.8% or more, but less than 3.0%

3.0% or more, but less than 3.2%

3.2% or more

6.7%

6.4%

6.1%

5.8%

5.5%

5.2%

4.9%

4.6%

4.3%

4.0%

3.7%

3.4%

3.1%

.......

Hyram Company, which is located in State A, had an average annual payroll of $850,000 for the thrce 12-month peri-

ods ending on June 30, 2020 (the computation date for the tax year 2021). As of June 30, 2020, the total contributions that

had been made to Hyram Company's reserve account, in excess of the benefits charged, amounted to $17,440. Compute:

%

a. Hyram Company's reserve ratio for 2020.

b. 2021 contribution rate for the company.

c. Smallest contribution that the company can make in order to reduce its

tax rate if State A permits voluntary contributions..

d. Tax savings realized by the company, taking into consideration the voluntary

contribution made in (c) if the taxable payroll in 2021 is $980,000.

$

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning