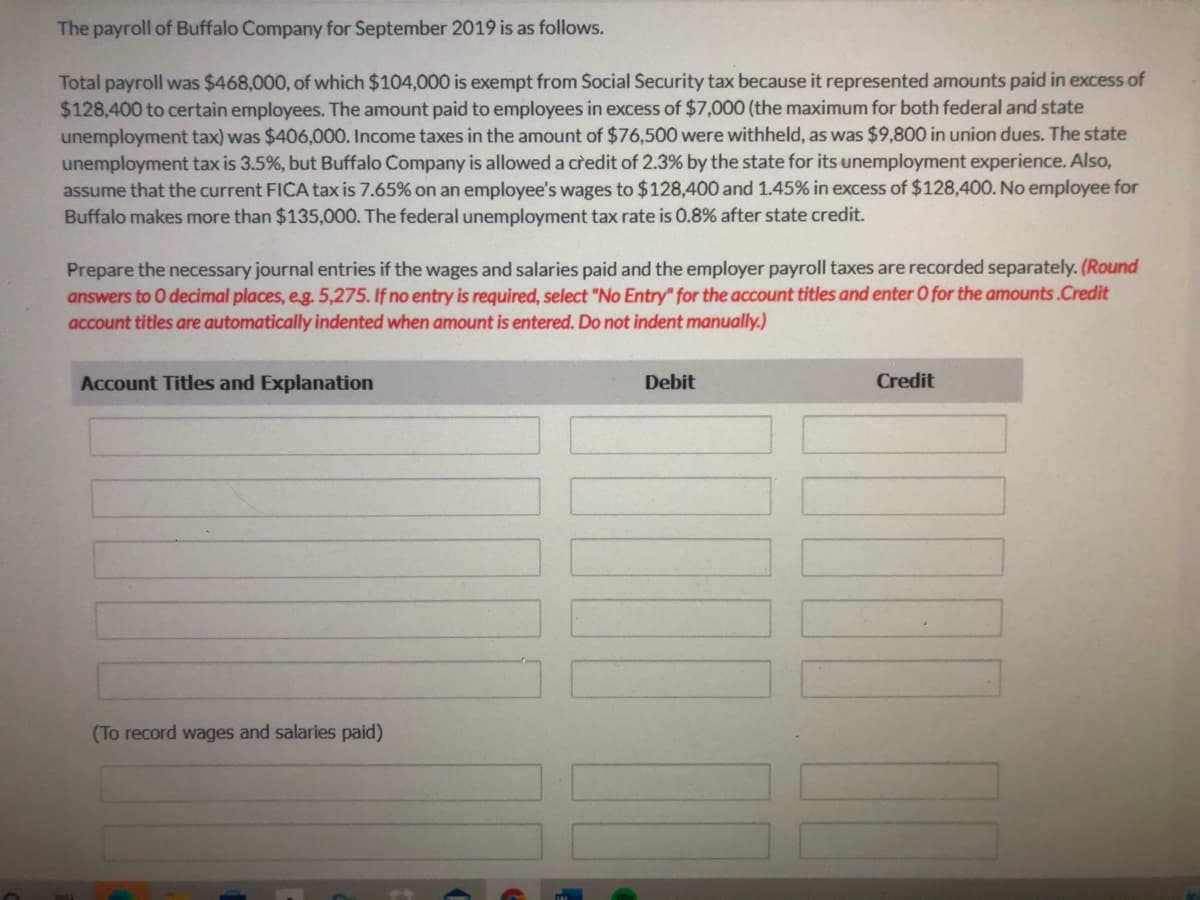

The payroll of Buffalo Company for September 2019 is as follows. Total payroll was $468,000, of which $104,000 is exempt from Social Security tax because it represented amounts paid in excess of $128,400 to certain employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state unemployment tax) was $406,000. Income taxes in the amount of $76,500 were withheld, as was $9,800 in union dues. The state unemployment taxis 3.5%, but Buffalo Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $128,400 and 1.45% in excess of $128,400. No employee for Buffalo makes more than $135,000. The federal unemployment tax rate is 0.8% after state credit. Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately. (Round answers to 0 decimal places, eg. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.Credit account titles are automatically indented when amount is entered. Do not indent manually.)

The payroll of Buffalo Company for September 2019 is as follows. Total payroll was $468,000, of which $104,000 is exempt from Social Security tax because it represented amounts paid in excess of $128,400 to certain employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state unemployment tax) was $406,000. Income taxes in the amount of $76,500 were withheld, as was $9,800 in union dues. The state unemployment taxis 3.5%, but Buffalo Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $128,400 and 1.45% in excess of $128,400. No employee for Buffalo makes more than $135,000. The federal unemployment tax rate is 0.8% after state credit. Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately. (Round answers to 0 decimal places, eg. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.Credit account titles are automatically indented when amount is entered. Do not indent manually.)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 6E: On January 21, the column totals of the payroll register for Great Products Company showed that its...

Related questions

Question

Transcribed Image Text:The payroll of Buffalo Company for September 2019 is as follows.

Total payroll was $468,000, of which $104,000 is exempt from Social Security tax because it represented amounts paid in excess of

$128,400 to certain employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state

unemployment tax) was $406,000. Income taxes in the amount of $76,500 were withheld, as was $9,800 in union dues. The state

unemployment tax is 3.5%, but Buffalo Company is allowed a credit of 2.3% by the state for its unemployment experience. Also,

assume that the current FICA tax is 7.65% on an employee's wages to $128,400 and 1.45% in excess of $128,400. No employee for

Buffalo makes more than $135,000. The federal unemployment tax rate is 0.8% after state credit.

Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately. (Round

answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.Credit

account titles are automatically indented when amount is entered. Do not indent manually.)

Account Titles and Explanation

Debit

Credit

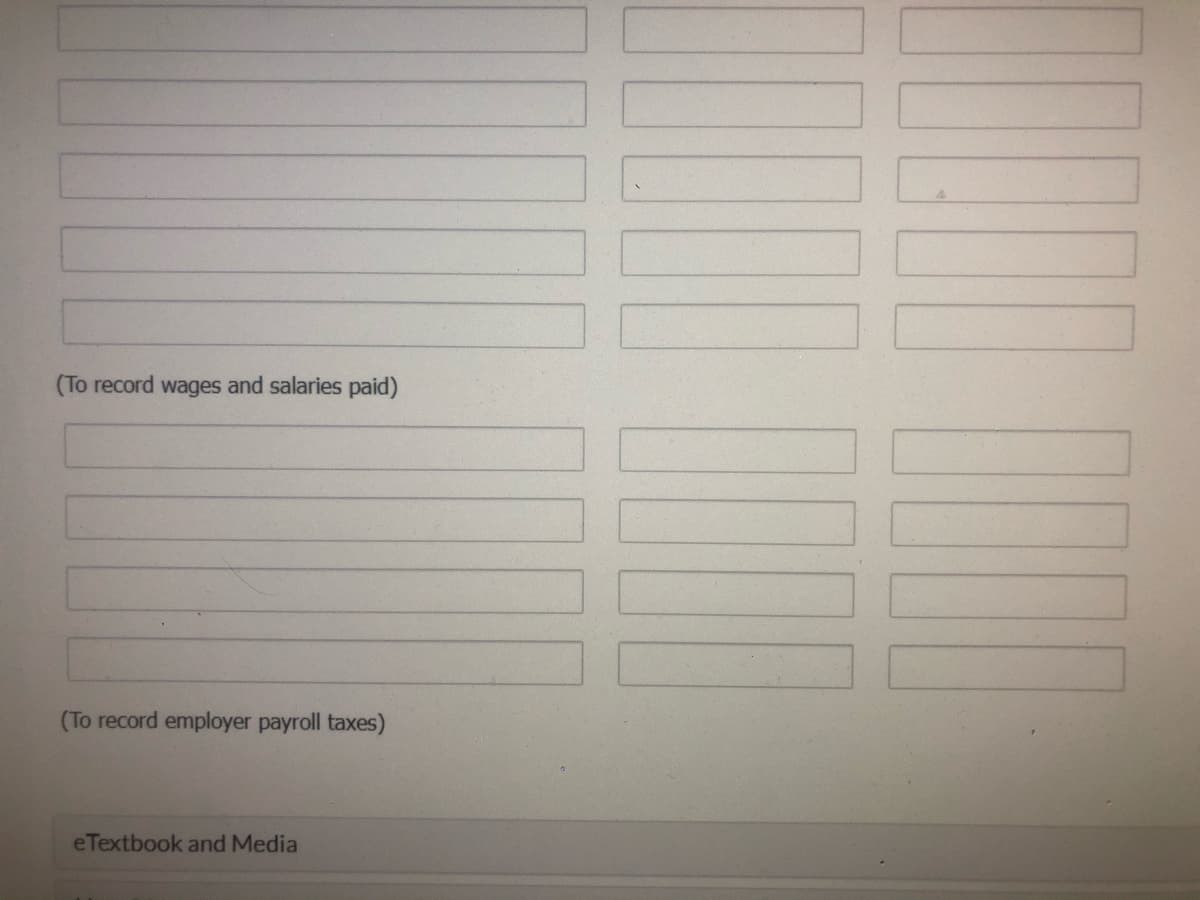

(To record wages and salaries paid)

Transcribed Image Text:(To record wages and salaries paid)

(To record employer payroll taxes)

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage