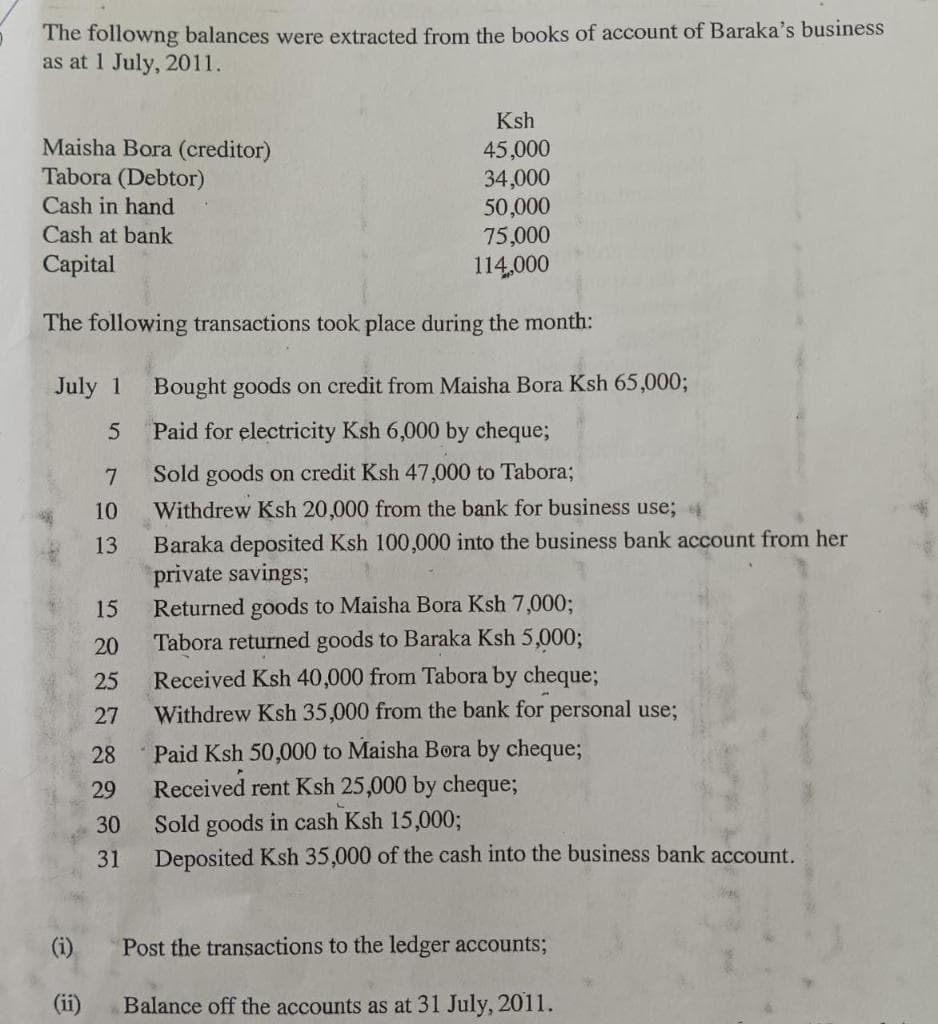

The followng balances were extracted from the books of account of Baraka's business as at 1 July, 2011. Ksh Maisha Bora (creditor) 45,000 Tabora (Debtor) 34,000 Cash in hand 50,000 Cash at bank 75,000 Capital 114,000 The following transactions took place during the month: July 1 5 7 10 13 (i) 15 20 25 27 28 29 30 31 Bought goods on credit from Maisha Bora Ksh 65,000; Paid for electricity Ksh 6,000 by cheque; Sold goods on credit Ksh 47,000 to Tabora; Withdrew Ksh 20,000 from the bank for business use; Baraka deposited Ksh 100,000 into the business bank account from her private savings; Returned goods to Maisha Bora Ksh 7,000; Tabora returned goods to Baraka Ksh 5,000; Received Ksh 40,000 from Tabora by cheque; Withdrew Ksh 35,000 from the bank for personal use; Paid Ksh 50,000 to Maisha Bora by cheque; Received rent Ksh 25,000 by cheque; Sold goods in cash Ksh 15,000; Deposited Ksh 35,000 of the cash into the business bank account. Post the transactions to the ledger accounts; Balance off the accounts as at 31 July, 2011.

The followng balances were extracted from the books of account of Baraka's business as at 1 July, 2011. Ksh Maisha Bora (creditor) 45,000 Tabora (Debtor) 34,000 Cash in hand 50,000 Cash at bank 75,000 Capital 114,000 The following transactions took place during the month: July 1 5 7 10 13 (i) 15 20 25 27 28 29 30 31 Bought goods on credit from Maisha Bora Ksh 65,000; Paid for electricity Ksh 6,000 by cheque; Sold goods on credit Ksh 47,000 to Tabora; Withdrew Ksh 20,000 from the bank for business use; Baraka deposited Ksh 100,000 into the business bank account from her private savings; Returned goods to Maisha Bora Ksh 7,000; Tabora returned goods to Baraka Ksh 5,000; Received Ksh 40,000 from Tabora by cheque; Withdrew Ksh 35,000 from the bank for personal use; Paid Ksh 50,000 to Maisha Bora by cheque; Received rent Ksh 25,000 by cheque; Sold goods in cash Ksh 15,000; Deposited Ksh 35,000 of the cash into the business bank account. Post the transactions to the ledger accounts; Balance off the accounts as at 31 July, 2011.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 12PB: Prepare journal entries to record the following transactions that occurred in March: A. on first day...

Related questions

Question

Please help me

Transcribed Image Text:The followng balances were extracted from the books of account of Baraka's business

as at 1 July, 2011.

Ksh

Maisha Bora (creditor)

45,000

Tabora (Debtor)

34,000

Cash in hand

50,000

Cash at bank

75,000

Capital

114,000

The following transactions took place during the month:

July 1

5

(i)

(ii)

7

10

13

15

20

25

27

28

29

30

31

Bought goods on credit from Maisha Bora Ksh 65,000;

Paid for electricity Ksh 6,000 by cheque;

Sold goods on credit Ksh 47,000 to Tabora;

Withdrew Ksh 20,000 from the bank for business use;

Baraka deposited Ksh 100,000 into the business bank account from her

private savings;

Returned goods to Maisha Bora Ksh 7,000;

Tabora returned goods to Baraka Ksh 5,000;

Received Ksh 40,000 from Tabora by cheque;

Withdrew Ksh 35,000 from the bank for personal use;

Paid Ksh 50,000 to Maisha Bora by cheque;

Received rent Ksh 25,000 by cheque;

Sold goods in cash Ksh 15,000;

Deposited Ksh 35,000 of the cash into the business bank account.

Post the transactions to the ledger accounts;

Balance off the accounts as at 31 July, 2011.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning