The general journal of Kevin Berry Industries included the following entries relating to various expenditures during 20X5. Review this information and prepare corresponding entries to record any necessary straight-line amortization or other impairment for the year ending December 31. GENERAL JOURNAL Date Accounts Debit Credit 01-Jan Patent 30,000 Cash 30,000 Acquired a patent from an inventor. The patent has a 15-year remaining legal life, but it is expected that Berry will utilize the patent for only 5 years. 15-May Research Expense 12,000 Cash 12,000 Incurred costs in research and development activity. It is possible these costs will result in new product with a 48-month life. 01-Sep Inventory 25,000 Building 75,000 Goodwill 50,000 Cash 150,000 To record purchase of business, expected to be operated successfully for an indefinite number of future years. 20-Dec Copyright 10,000 Cash 10,000 Purchased copyright to a video production, but concluded that it was worthiess by year's end.

The general journal of Kevin Berry Industries included the following entries relating to various expenditures during 20X5. Review this information and prepare corresponding entries to record any necessary straight-line amortization or other impairment for the year ending December 31. GENERAL JOURNAL Date Accounts Debit Credit 01-Jan Patent 30,000 Cash 30,000 Acquired a patent from an inventor. The patent has a 15-year remaining legal life, but it is expected that Berry will utilize the patent for only 5 years. 15-May Research Expense 12,000 Cash 12,000 Incurred costs in research and development activity. It is possible these costs will result in new product with a 48-month life. 01-Sep Inventory 25,000 Building 75,000 Goodwill 50,000 Cash 150,000 To record purchase of business, expected to be operated successfully for an indefinite number of future years. 20-Dec Copyright 10,000 Cash 10,000 Purchased copyright to a video production, but concluded that it was worthiess by year's end.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

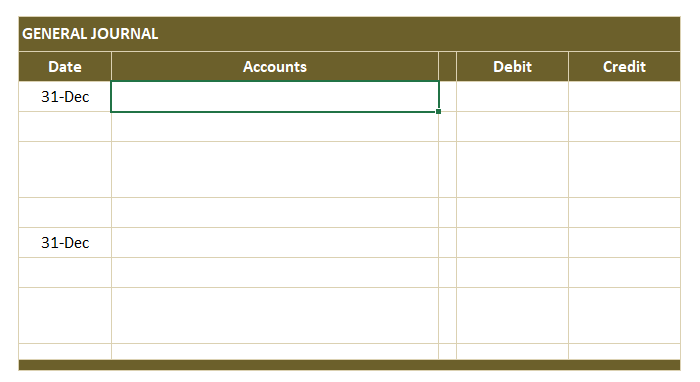

Transcribed Image Text:GENERAL JOURNAL

Date

Accounts

Debit

Credit

31-Dec

31-Dec

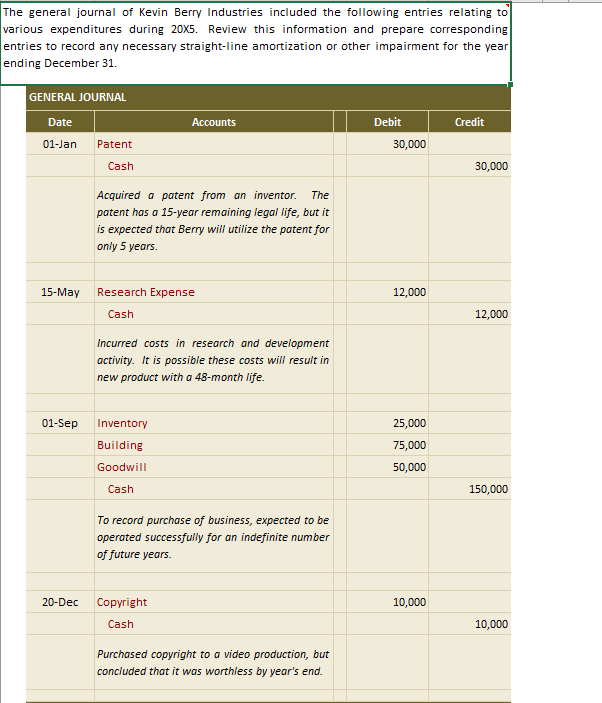

Transcribed Image Text:The general journal of Kevin Berry Industries included the following entries relating to

various expenditures during 20X5. Review this information and prepare corresponding

entries to record any necessary straight-line amortization or other impairment for the year

ending December 31.

GENERAL JOURNAL

Date

Accounts

Debit

Credit

01-Jan

Patent

30,000

Cash

30,000

Acquired a patent from an inventor.

The

patent has a 15-year remaining legal life, but it

is expected that Berry will utilize the patent for

only 5 years.

15-May

Research Expense

12,000

Cash

12,000

Incurred costs in research and development

activity. It is possible these costs will result in

new product with a 48-month life.

01-Sep

Inventory

25,000

Building

75,000

Goodwill

50,000

Cash

150,000

To record purchase of business, expected to be

operated successfully for an indefinite number

of future years.

20-Dec

Copyright

10,000

Cash

10,000

Purchased copyright to a video production, but

concluded that it was worthless by year's end.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education