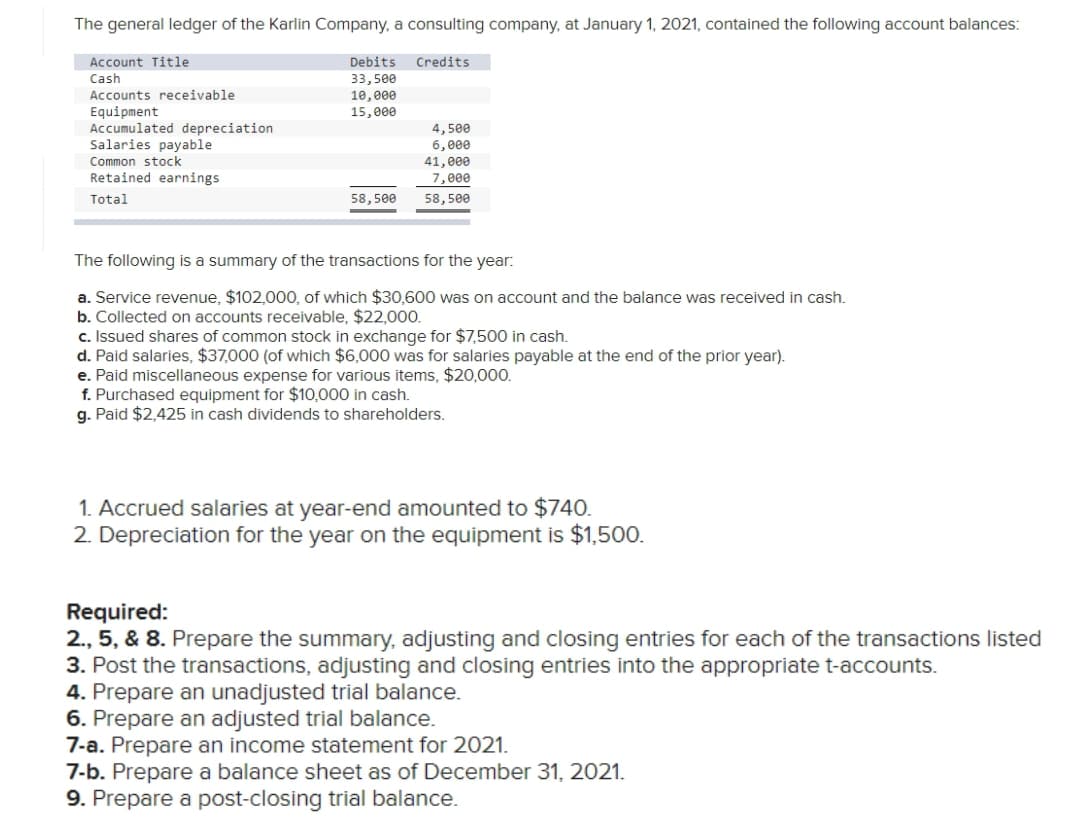

The general ledger of the Karlin Company, a consulting company, at January 1, 2021, contained the following account balances: Account Title Debits Credits Cash 33,500 Accounts receivable 10, eee 15,000 Equipment Accumulated depreciation Salaries payable 4,5e0 6,eee 41,e00 7,e00 Common stock Retained earnings Total 58,500 58, 500 The following is a summary of the transactions for the year: a. Service revenue, $102,000, of which $30,600 was on account and the balance was received in cash. b. Collected on accounts receivable, $22,000. c. Issued shares of common stock in exchange for $7,500 in cash. d. Paid salaries, $37,000 (of which $6,000 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $20,000. f. Purchased equipment for $10,000 in cash. g. Paid $2,425 in cash dividends to shareholders. 1. Accrued salaries at year-end amounted to $740. 2. Depreciation for the year on the equipment is $1,500. Required: 2., 5, & 8. Prepare the summary, adjusting and closing entries for each of the transactions listed

The general ledger of the Karlin Company, a consulting company, at January 1, 2021, contained the following account balances: Account Title Debits Credits Cash 33,500 Accounts receivable 10, eee 15,000 Equipment Accumulated depreciation Salaries payable 4,5e0 6,eee 41,e00 7,e00 Common stock Retained earnings Total 58,500 58, 500 The following is a summary of the transactions for the year: a. Service revenue, $102,000, of which $30,600 was on account and the balance was received in cash. b. Collected on accounts receivable, $22,000. c. Issued shares of common stock in exchange for $7,500 in cash. d. Paid salaries, $37,000 (of which $6,000 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $20,000. f. Purchased equipment for $10,000 in cash. g. Paid $2,425 in cash dividends to shareholders. 1. Accrued salaries at year-end amounted to $740. 2. Depreciation for the year on the equipment is $1,500. Required: 2., 5, & 8. Prepare the summary, adjusting and closing entries for each of the transactions listed

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 15P: Included in the December 31, 2018, Jacobi Company balance sheet was the following shareholders...

Related questions

Topic Video

Question

100%

Transcribed Image Text:The general ledger of the Karlin Company, a consulting company, at January 1, 2021, contained the following account balances:

Account Title

Debits

Credits

Cash

33,5eе

Accounts receivable

Equipment

Accumulated depreciation

Salaries payable

Common stock

Retained earnings

10, 000

15,000

4,50e

6,000

41, eee

7,000

Total

58, 500

58,500

The following is a summary of the transactions for the year:

a. Service revenue, $102,000, of which $30,600 was on account and the balance was received in cash.

b. Collected on accounts receivable, $22,000.

c. Issued shares of common stock in exchange for $7,500 in cash.

d. Paid salaries, $37,000 (of which $6,000 was for salaries payable at the end of the prior year).

e. Paid miscellaneous expense for various items, $20,000.

f. Purchased equipment for $10,000 in cash.

g. Paid $2,425 in cash dividends to shareholders.

1. Accrued salaries at year-end amounted to $740.

2. Depreciation for the year on the equipment is $1,500.

Required:

2., 5, & 8. Prepare the summary, adjusting and closing entries for each of the transactions listed

3. Post the transactions, adjusting and closing entries into the appropriate t-accounts.

4. Prepare an unadjusted trial balance.

6. Prepare an adjusted trial balance.

7-a. Prepare an income statement for 2021.

7-b. Prepare a balance sheet as of December 31, 2021.

9. Prepare a post-closing trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning