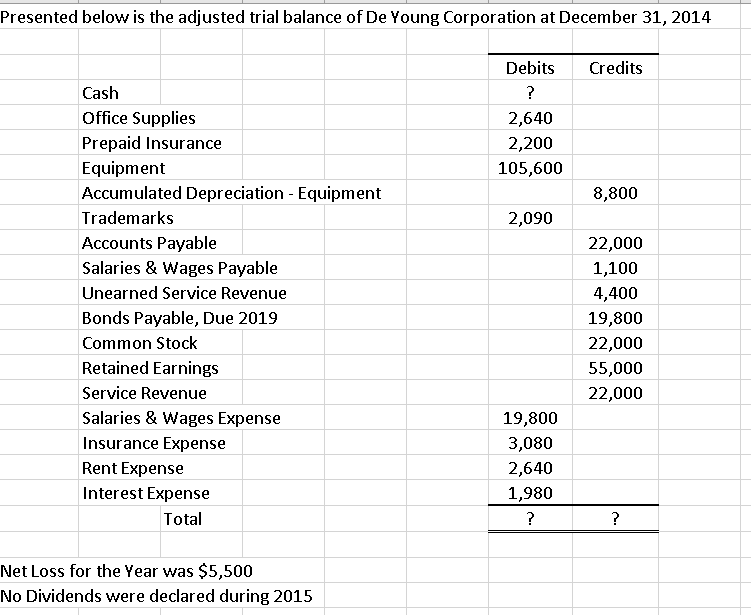

Presented below is the adjusted trial balance of De Young Corporation at December 31, 2014 Debits Credits Cash ? Office Supplies 2,640 Prepaid Insurance 2,200 Equipment 105,600 Accumulated Depreciation - Equipment 8,800 Trademarks 2,090 Accounts Payable Salaries & Wages Payable 22,000 1,100 Unearned Service Revenue 4,400 Bonds Payable, Due 2019 19,800 Common Stock 22,000 Retained Earnings 55,000 Service Revenue 22,000 Salaries & Wages Expense 19,800 Insurance Expense 3,080 Rent Expense 2,640 Interest Expense 1,980 Total ? ? Net Loss for the Year was $5,500 No Dividends were declared during 2015

Presented below is the adjusted trial balance of De Young Corporation at December 31, 2014 Debits Credits Cash ? Office Supplies 2,640 Prepaid Insurance 2,200 Equipment 105,600 Accumulated Depreciation - Equipment 8,800 Trademarks 2,090 Accounts Payable Salaries & Wages Payable 22,000 1,100 Unearned Service Revenue 4,400 Bonds Payable, Due 2019 19,800 Common Stock 22,000 Retained Earnings 55,000 Service Revenue 22,000 Salaries & Wages Expense 19,800 Insurance Expense 3,080 Rent Expense 2,640 Interest Expense 1,980 Total ? ? Net Loss for the Year was $5,500 No Dividends were declared during 2015

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 5MCQ: Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense at...

Related questions

Question

How would a classified

Transcribed Image Text:Presented below is the adjusted trial balance of De Young Corporation at December 31, 2014

Debits

Credits

Cash

?

Office Supplies

2,640

Prepaid Insurance

2,200

Equipment

Accumulated Depreciation - Equipment

105,600

8,800

Trademarks

2,090

Accounts Payable

22,000

Salaries & Wages Payable

1,100

4,400

19,800

Unearned Service Revenue

Bonds Payable, Due 2019

Common Stock

22,000

Retained Earnings

55,000

Service Revenue

22,000

Salaries & Wages Expense

19,800

Insurance Expense

3,080

Rent Expense

2,640

Interest Expense

1,980

Total

?

Net Loss for the Year was $5,500

No Dividends were declared during 2015

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning