The graph shows the demand curve for coal. The government imposes a tax on coal and the buyer pays the entil tax. Draw the supply curve of coal. Label it S. Draw a second supply curve that shows the effect of the tax. Label it S + tax. The more the supply of coal, OA. elastic; the larger is the amount of the tax paid by the buyer OB. elastic; the more equally is the split of the tax between the buyer. and the seller OC. inelastic; the larger is the amount of the tax paid by the buyer OD. elastic; the larger is the amount of the tax paid by the seller 60- 50- 40- 30- 20- 10- Price (dollars per ton) 0- 0 D 60 OO 20 80 100 40 Quantity (thousands of tons per year) >>> Draw only the objects specified in the question. 120 G

The graph shows the demand curve for coal. The government imposes a tax on coal and the buyer pays the entil tax. Draw the supply curve of coal. Label it S. Draw a second supply curve that shows the effect of the tax. Label it S + tax. The more the supply of coal, OA. elastic; the larger is the amount of the tax paid by the buyer OB. elastic; the more equally is the split of the tax between the buyer. and the seller OC. inelastic; the larger is the amount of the tax paid by the buyer OD. elastic; the larger is the amount of the tax paid by the seller 60- 50- 40- 30- 20- 10- Price (dollars per ton) 0- 0 D 60 OO 20 80 100 40 Quantity (thousands of tons per year) >>> Draw only the objects specified in the question. 120 G

Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781305971509

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Application: The Costs Of Taxation

Section: Chapter Questions

Problem 3CQQ

Related questions

Question

Q : 35

Please help

Transcribed Image Text:K

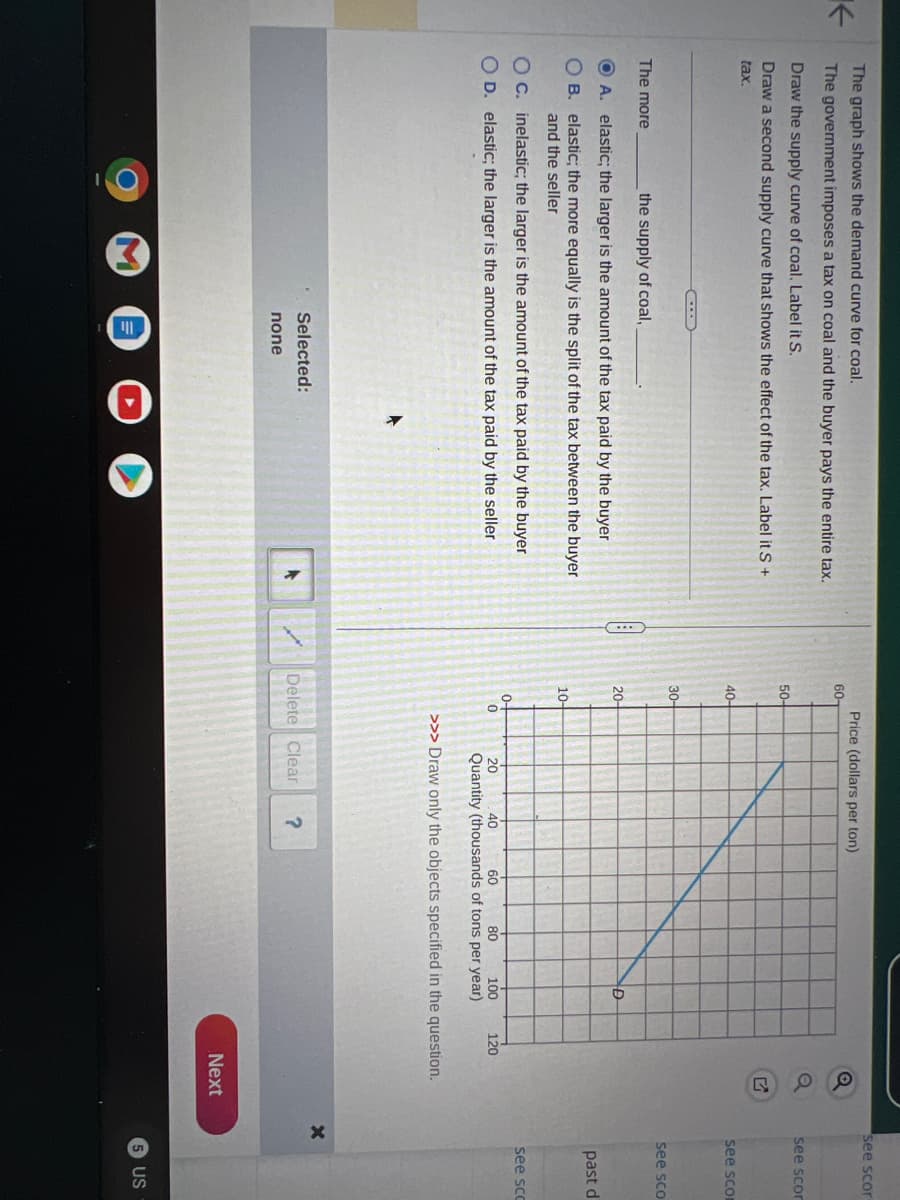

The graph shows the demand curve for coal.

The government imposes a tax on coal and the buyer pays the entire tax.

Draw the supply curve of coal. Label it S.

Draw a second supply curve that shows the effect of the tax. Label it S +

tax.

The more

the supply of coal,

OA. elastic; the larger is the amount of the tax paid by the buyer

OB. elastic; the more equally is the split of the tax between the buyer

and the seller

O c. inelastic; the larger is the amount of the tax paid by the buyer

OD. elastic; the larger is the amount of the tax paid by the seller.

Selected:

none

60-

50-

40-

30-

20-

10-

0-

Price (dollars per ton)

0

Delete Clear

40

20

60 80 100

Quantity (thousands of tons per year)

>>> Draw only the objects specified in the question.

D

?

POO

120

Next

see scor

see scor

see scor

X

see sco

past d

see scc

5 US

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax