the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a "surf lifestyle for the home." With limited capital, they decided to focus on surf print table and floor lamps to accent people's homes. They projected unit sales of these lamps to be 10,400 in the first year, with growth of 6 percent each year for the next five years. Production of these lamps will require $53,000 in net working capital to start. Total fixed costs are $137,000 per year, variable production costs are $20 per unit, and the units are priced at $62 each. The equipment needed to begin production will cost $595,000. The equipment will be depreciated using the straight-line method over a 5-year life and is not expected to have a salvage value. The tax rate is 24 percent and the required rate of return is 19 percent. What is the NPV of this project? (Do not round intermediate calculations and round

the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a "surf lifestyle for the home." With limited capital, they decided to focus on surf print table and floor lamps to accent people's homes. They projected unit sales of these lamps to be 10,400 in the first year, with growth of 6 percent each year for the next five years. Production of these lamps will require $53,000 in net working capital to start. Total fixed costs are $137,000 per year, variable production costs are $20 per unit, and the units are priced at $62 each. The equipment needed to begin production will cost $595,000. The equipment will be depreciated using the straight-line method over a 5-year life and is not expected to have a salvage value. The tax rate is 24 percent and the required rate of return is 19 percent. What is the NPV of this project? (Do not round intermediate calculations and round

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter14: The Balanced Scorecard And Corporate Social Responsibility

Section: Chapter Questions

Problem 2PA: Strategic initiatives and CSR Get Hitched Inc. is a production company that is in the process of...

Related questions

Question

Bha

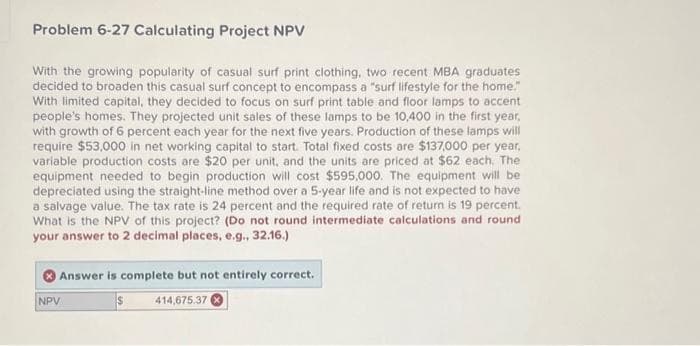

Transcribed Image Text:Problem 6-27 Calculating Project NPV

With the growing popularity of casual surf print clothing, two recent MBA graduates

decided to broaden this casual surf concept to encompass a "surf lifestyle for the home."

With limited capital, they decided to focus on surf print table and floor lamps to accent

people's homes. They projected unit sales of these lamps to be 10,400 in the first year,

with growth of 6 percent each year for the next five years. Production of these lamps will

require $53,000 in net working capital to start. Total fixed costs are $137,000 per year,

variable production costs are $20 per unit, and the units are priced at $62 each. The

equipment needed to begin production will cost $595,000. The equipment will be

depreciated using the straight-line method over a 5-year life and is not expected to have

a salvage value. The tax rate is 24 percent and the required rate of return is 19 percent.

What is the NPV of this project? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

$

414,675.37

NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning