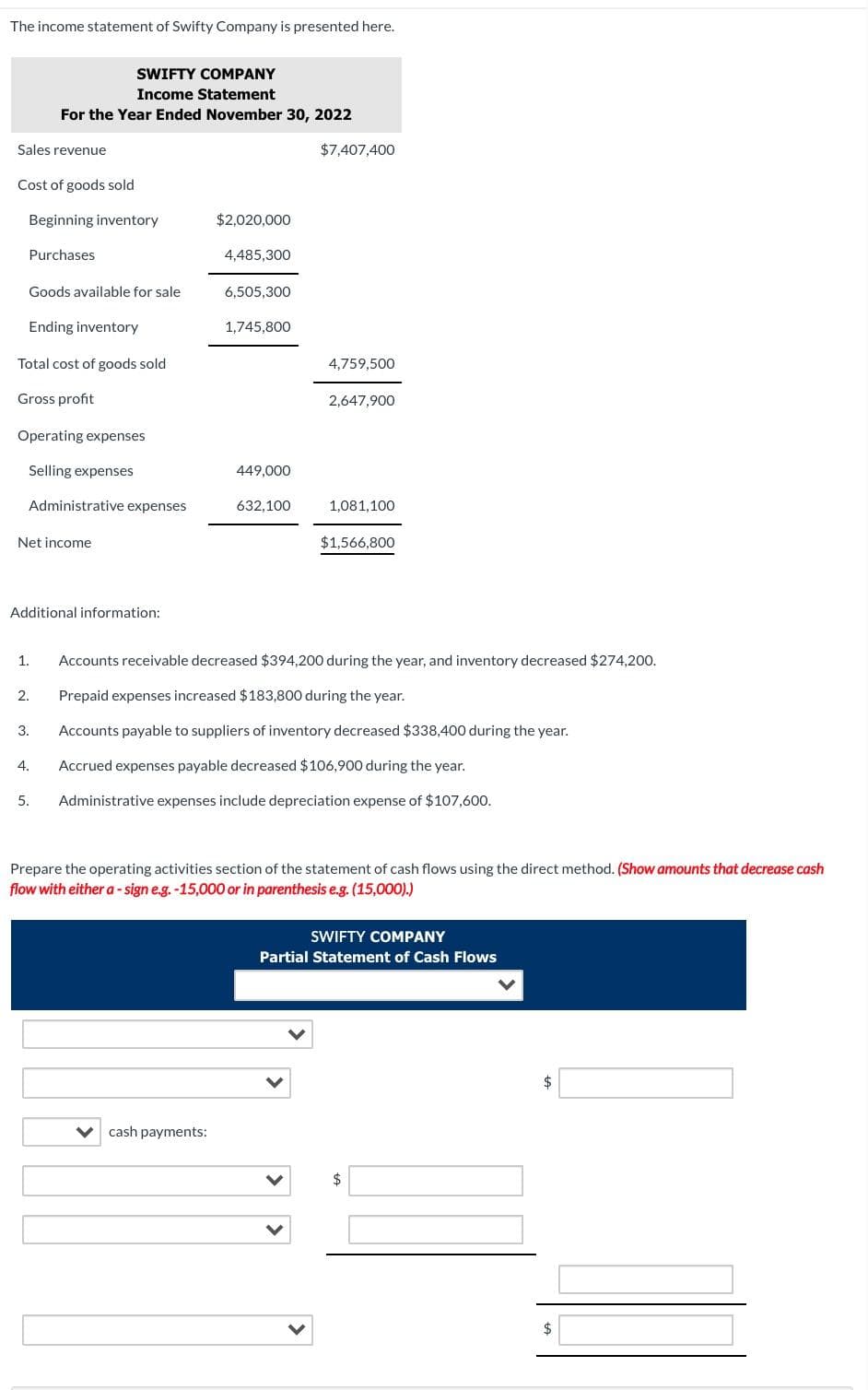

The income statement of Swifty Company is presented here. SWIFTY COMPANY Income Statement For the Year Ended November 30, 2022 Sales revenue $7,407,400 Cost of goods sold Beginning inventory $2,020,000 Purchases 4,485,300 Goods available for sale 6,505,300 Ending inventory 1,745,800 Total cost of goods sold 4,759,500 Gross profit 2,647,900 Operating expenses Selling expenses 449,000 Administrative expenses 632,100 1,081,100 Net income $1,566,800 Additional information: 1. Accounts receivable decreased $394,200 during the year, and inventory decreased $274,200. 2. Prepaid expenses increased $183,800 during the year. 3. Accounts payable to suppliers of inventory decreased $338,400 during the year. 4. Accrued expenses payable decreased $106,900 during the year. 5. Administrative expenses include depreciation expense of $107,600. Prepare the operating activities section of the statement of cash flows using the direct method. (Show amounts that decrease cas flow with either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).) SWIFTY COMPANY Partial Statement of Cash Flows

The income statement of Swifty Company is presented here. SWIFTY COMPANY Income Statement For the Year Ended November 30, 2022 Sales revenue $7,407,400 Cost of goods sold Beginning inventory $2,020,000 Purchases 4,485,300 Goods available for sale 6,505,300 Ending inventory 1,745,800 Total cost of goods sold 4,759,500 Gross profit 2,647,900 Operating expenses Selling expenses 449,000 Administrative expenses 632,100 1,081,100 Net income $1,566,800 Additional information: 1. Accounts receivable decreased $394,200 during the year, and inventory decreased $274,200. 2. Prepaid expenses increased $183,800 during the year. 3. Accounts payable to suppliers of inventory decreased $338,400 during the year. 4. Accrued expenses payable decreased $106,900 during the year. 5. Administrative expenses include depreciation expense of $107,600. Prepare the operating activities section of the statement of cash flows using the direct method. (Show amounts that decrease cas flow with either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).) SWIFTY COMPANY Partial Statement of Cash Flows

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.13MCP

Related questions

Question

Please answer it competely

Transcribed Image Text:The income statement of Swifty Company is presented here.

SWIFTY COMPANY

Income Statement

For the Year Ended November 30, 2022

Sales revenue

$7,407,400

Cost of goods sold

Beginning inventory

$2,020,000

Purchases

4,485,300

Goods available for sale

6,505,300

Ending inventory

1,745,800

Total cost of goods sold

4,759,500

Gross profit

2,647,900

Operating expenses

Selling expenses

449,000

Administrative expenses

632,100

1,081,100

Net income

$1,566,800

Additional information:

1.

Accounts receivable decreased $394,200 during the year, and inventory decreased $274,200.

2.

Prepaid expenses increased $183,800 during the year.

3.

Accounts payable to suppliers of inventory decreased $338,400 during the year.

4.

Accrued expenses payable decreased $106,900 during the year.

5.

Administrative expenses include depreciation expense of $107,600.

Prepare the operating activities section of the statement of cash flows using the direct method. (Show amounts that decrease cash

flow with either a- sign e.g. -15,000 or in parenthesis e.g. (15,000).)

SWIFTY COMPANY

Partial Statement of Cash Flows

$

V cash payments:

2$

$4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,