The information and answer is given in the images. I just need to know how they calculated imputed interest on housing loan 170. Just need to know the steps. Thanks

The information and answer is given in the images. I just need to know how they calculated imputed interest on housing loan 170. Just need to know the steps. Thanks

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 38P

Related questions

Question

100%

The information and answer is given in the images. I just need to know how they calculated imputed interest on housing loan 170.

Just need to know the steps. Thanks

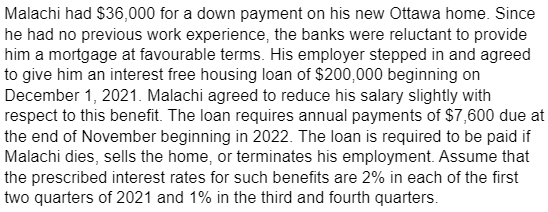

Transcribed Image Text:Malachi had $36,000 for a down payment on his new Ottawa home. Since

he had no previous work experience, the banks were reluctant to provide

him a mortgage at favourable terms. His employer stepped in and agreed

to give him an interest free housing loan of $200,000 beginning on

December 1, 2021. Malachi agreed to reduce his salary slightly with

respect to this benefit. The loan requires annual payments of $7,600 due at

the end of November beginning in 2022. The loan is required to be paid if

Malachi dies, sells the home, or terminates his employment. Assume that

the prescribed interest rates for such benefits are 2% in each of the first

two quarters of 2021 and 1% in the third and fourth quarters.

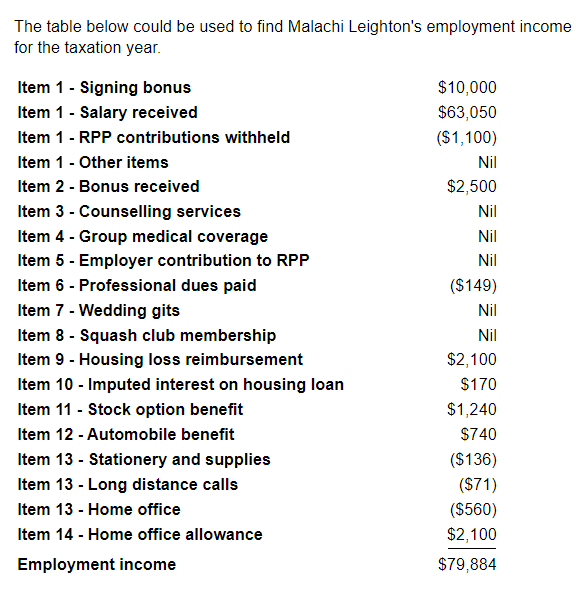

Transcribed Image Text:The table below could be used to find Malachi Leighton's employment income

for the taxation year.

Item 1 - Signing bonus

Item 1 - Salary received

Item 1 - RPP contributions withheld

Item 1 - Other items

Item 2 - Bonus received

Item 3 -

Counselling services

Item 4 - Group medical coverage

Item 5 - Employer contribution to RPP

Item 6 - Professional dues paid

Item 7 - Wedding gits

Item 8 - Squash club membership

Item 9 - Housing loss reimbursement

Item 10 - Imputed interest on housing loan

Item 11 - Stock option benefit

Item 12 - Automobile benefit

Item 13 - Stationery and supplies

Item 13 - Long distance calls

Item 13 - Home office

Item 14 - Home office allowance

Employment income

$10,000

$63,050

($1,100)

Nil

$2,500

Nil

Nil

Nil

($149)

Nil

Nil

$2,100

$170

$1,240

$740

($136)

($71)

($560)

$2,100

$79,884

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT