The information below is from the books of the Seminole Corporation on June 30: Balance per bank 11,164 statement Receipts recorded but not yet deposited in 1340 the bank Bank charges no 16 recorded

The information below is from the books of the Seminole Corporation on June 30: Balance per bank 11,164 statement Receipts recorded but not yet deposited in 1340 the bank Bank charges no 16 recorded

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 2AP

Related questions

Question

See photo.

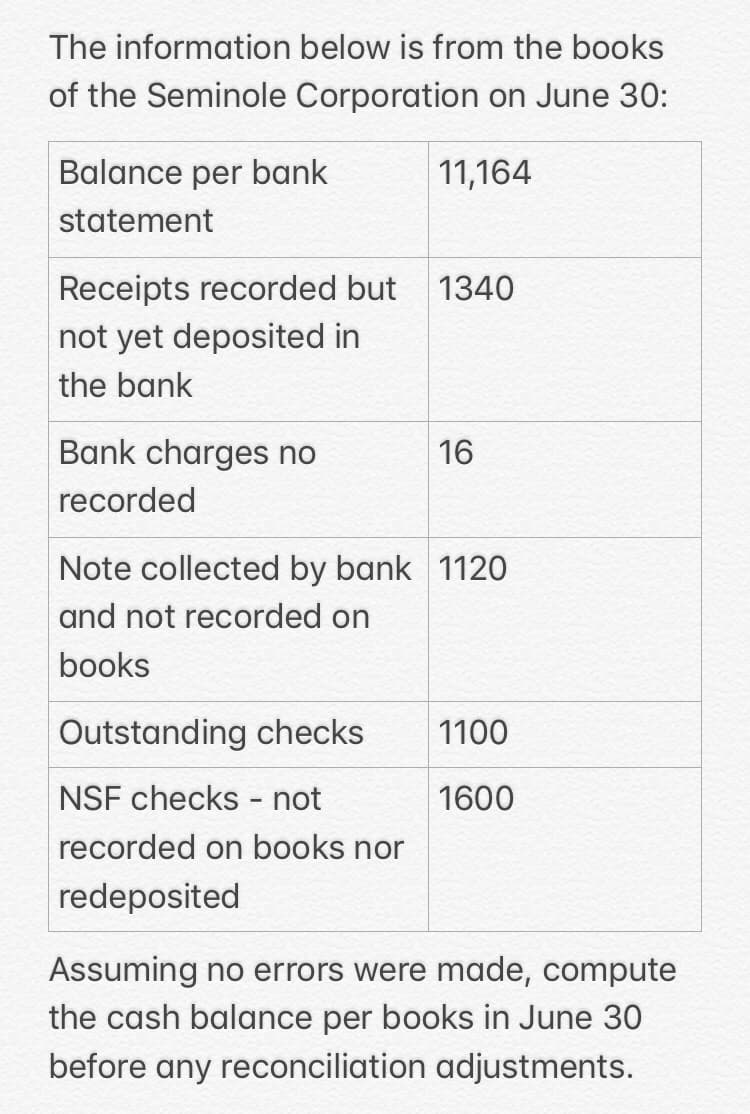

Transcribed Image Text:The information below is from the books

of the Seminole Corporation on June 30:

Balance per bank

11,164

statement

Receipts recorded but

1340

not yet deposited in

the bank

Bank charges no

16

recorded

Note collected by bank 1120

and not recorded on

books

Outstanding checks

1100

NSF checks - not

1600

recorded on books nor

redeposited

Assuming no errors were made, compute

the cash balance per books in June 30

before any reconciliation adjustments.

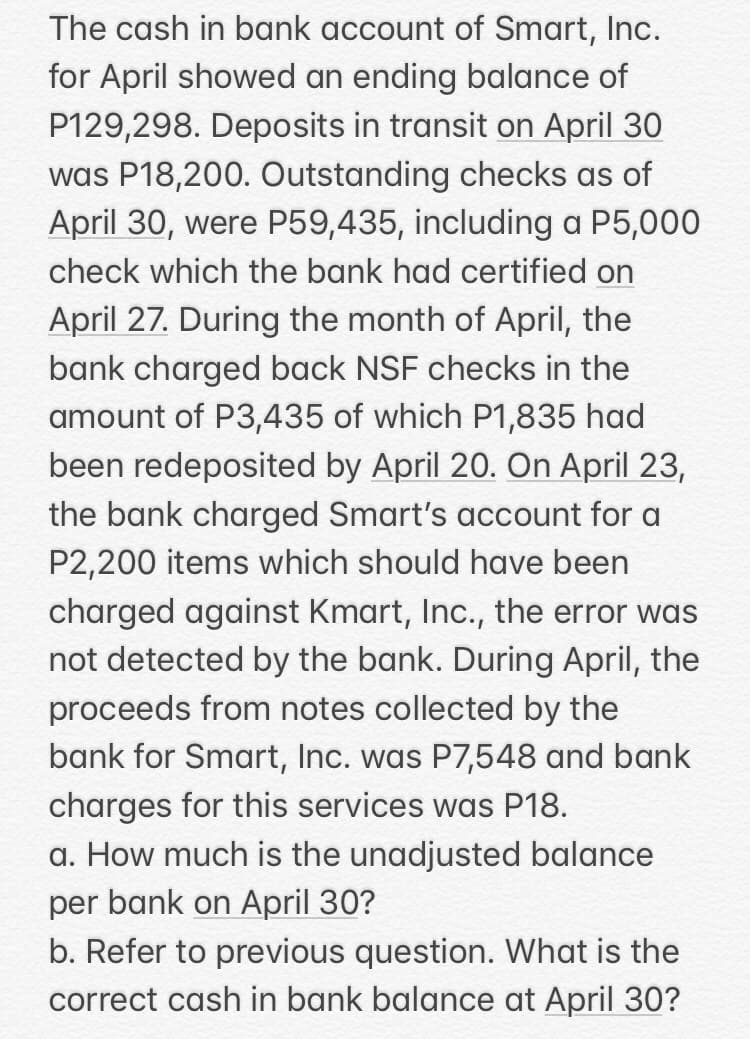

Transcribed Image Text:The cash in bank account of Smart, Inc.

for April showed an ending balance of

P129,298. Deposits in transit on April 30

was P18,200. Outstanding checks as of

April 30, were P59,435, including a P5,000

check which the bank had certified on

April 27. During the month of April, the

bank charged back NSF checks in the

amount of P3,435 of which P1,835 had

been redeposited by April 20. On April 23,

the bank charged Smart's account for a

P2,200 items which should have been

charged against Kmart, Inc., the error was

not detected by the bank. During April, the

proceeds from notes collected by the

bank for Smart, Inc. was P7,548 and bank

charges for this services was P18.

a. How much is the unadjusted balance

per bank on April 30?

b. Refer to previous question. What is the

correct cash in bank balance at April 30?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub