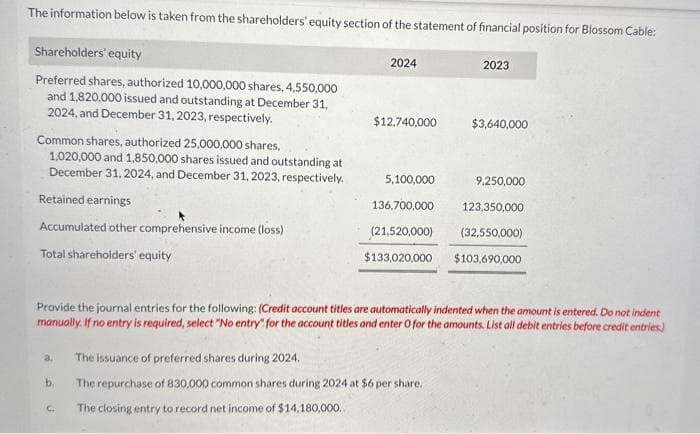

The information below is taken from the shareholders' equity section of the statement of financial position for Blossom Cable: Shareholders' equity Preferred shares, authorized 10,000,000 shares, 4,550,000 and 1,820,000 issued and outstanding at December 31, 2024, and December 31, 2023, respectively. Common shares, authorized 25,000,000 shares, 1,020,000 and 1,850,000 shares issued and outstanding at December 31, 2024, and December 31, 2023, respectively. Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity a. b. 2024 C. $12,740,000 2023 Provide the journal entries for the following: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter O for the amounts. List all debit entries before credit entries) $3,640,000 5,100,000 136,700,000 123,350,000 (21,520,000) (32,550,000) $133,020,000 $103,690,000 The issuance of preferred shares during 2024. The repurchase of 830,000 common shares during 2024 at $6 per share. The closing entry to record net income of $14,180,000. 9,250,000

The information below is taken from the shareholders' equity section of the statement of financial position for Blossom Cable: Shareholders' equity Preferred shares, authorized 10,000,000 shares, 4,550,000 and 1,820,000 issued and outstanding at December 31, 2024, and December 31, 2023, respectively. Common shares, authorized 25,000,000 shares, 1,020,000 and 1,850,000 shares issued and outstanding at December 31, 2024, and December 31, 2023, respectively. Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity a. b. 2024 C. $12,740,000 2023 Provide the journal entries for the following: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter O for the amounts. List all debit entries before credit entries) $3,640,000 5,100,000 136,700,000 123,350,000 (21,520,000) (32,550,000) $133,020,000 $103,690,000 The issuance of preferred shares during 2024. The repurchase of 830,000 common shares during 2024 at $6 per share. The closing entry to record net income of $14,180,000. 9,250,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:The information below is taken from the shareholders' equity section of the statement of financial position for Blossom Cable:

Shareholders' equity

Preferred shares, authorized 10,000,000 shares, 4,550,000

and 1,820,000 issued and outstanding at December 31,

2024, and December 31, 2023, respectively.

Common shares, authorized 25,000,000 shares,

1,020,000 and 1,850,000 shares issued and outstanding at

December 31, 2024, and December 31, 2023, respectively.

Retained earnings

Accumulated other comprehensive income (loss)

Total shareholders' equity

a.

b.

2024

C

$12,740,000

5,100,000

136,700,000

(21,520,000)

$133,020,000

2023

The issuance of preferred shares during 2024.

The repurchase of 830,000 common shares during 2024 at $6 per share.

The closing entry to record net income of $14,180,000.

$3,640,000

Provide the journal entries for the following: (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No entry for the account titles and enter O for the amounts. List all debit entries before credit entries)

9,250,000

123,350,000

(32,550,000)

$103,690,000

Transcribed Image Text:No. Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,