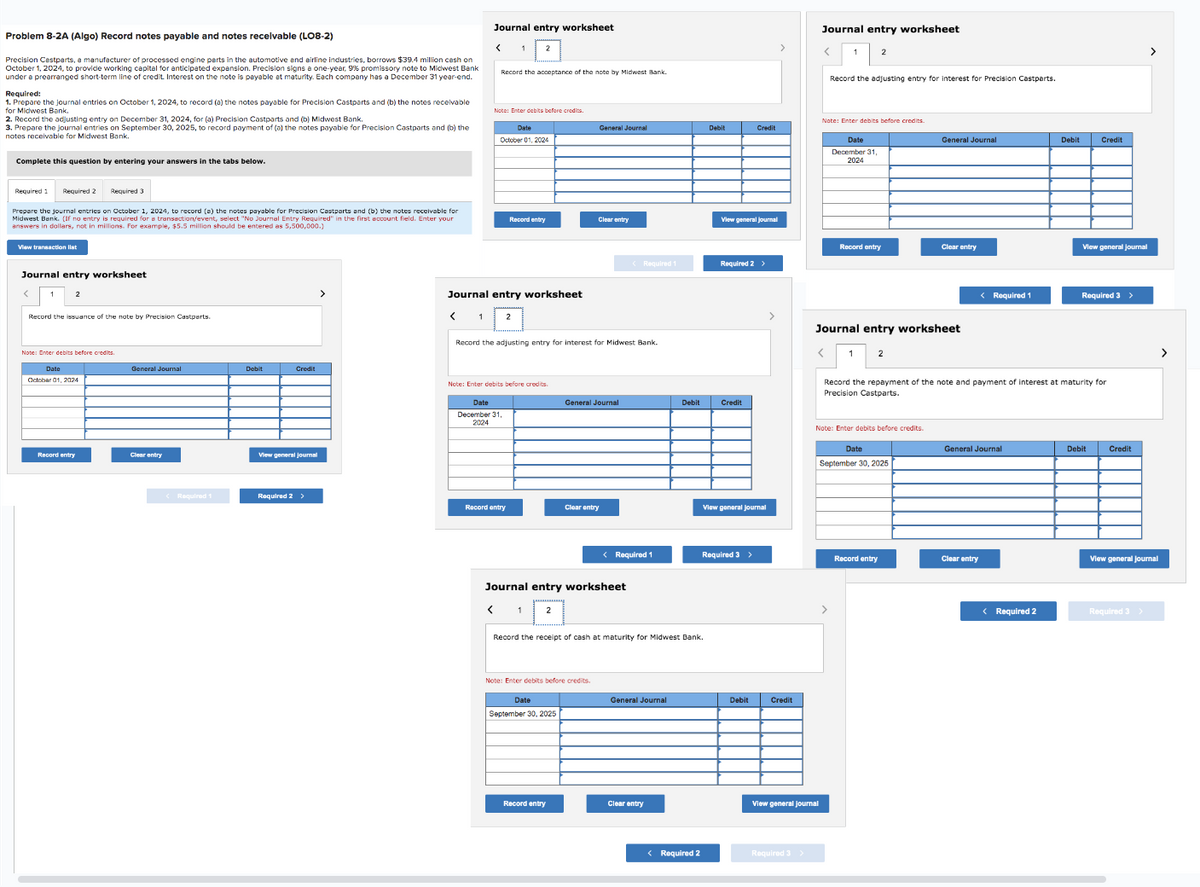

roblem 8-2A (Algo) Record notes payable and notes receivable (LO8-2) ecision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $39.4 million cash on ctober 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 9% promissory note to Midwest Bank der a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. quired: Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable Midwest Bank. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the tes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000.) View transaction list Journal entry worksheet 2 Record the issuance of the note by Precision Castparts. Journal entry worksheet < 1 2 Record the acceptance of the note by Note: Enter debits before credits Date October 01, 2024 Record entry Journal entry worksheet 1 2 Gener Clear Record the adjusting entry for interest for Mid

roblem 8-2A (Algo) Record notes payable and notes receivable (LO8-2) ecision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $39.4 million cash on ctober 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 9% promissory note to Midwest Bank der a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. quired: Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable Midwest Bank. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the tes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000.) View transaction list Journal entry worksheet 2 Record the issuance of the note by Precision Castparts. Journal entry worksheet < 1 2 Record the acceptance of the note by Note: Enter debits before credits Date October 01, 2024 Record entry Journal entry worksheet 1 2 Gener Clear Record the adjusting entry for interest for Mid

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 23PC

Related questions

Question

Transcribed Image Text:Problem 8-2A (Algo) Record notes payable and notes receivable (LO8-2)

Precision Cestparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $39.4 million cash on

October 1, 2024, to provide working capital for anticipated expension. Precision signs a one-year, 9% promissory note to Midwest Bank

under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end.

Required:

1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable

for Midwest Bank.

2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank.

3. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the

notes receivable for Midwest Bank.

Complete this question by entering your answers in the tabs below.

Required 2 Required 3

Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for

l Entry Requir

I

Midwest Bank, (1 no entry is required for a transaction/event, select "No Journal 500 ed" in the first account field. Enter you

answers in dollars, not in millions.

$5.5 million should be entered as 5

r example,

View transaction list

Required 1

Journal entry worksheet

Record the issuance of the note by Precision Castparts.

Note: Enter debits before credits.

Date

October 01, 2024

Record entry

General Journal

Clear entry

<Required 1

Debit

Credit

View general journal

Required 2 >

Journal entry worksheet

< 1

Record the acceptance of the note by Midwest Bank.

Note: Enter debits before credits.

Date

October 01, 2024

Journal entry worksheet

Note: Enter debits before credits.

Date

December 31

2024

Record entry

Record the adjusting entry for interest for Midwest Bank.

< 1

General Journal

Clear entry

Date

September 30, 2025

General Journal

Clear entry

Journal entry worksheet

Note: Enter debits before credits.

Record entry

<Required 1

< Required 1

Record the receipt of cash at maturity for Midwest Bank.

General Journal

Debit

Clear entry

< Required 2

Debit

View general journal

Required 2 >

Credit

Credit

View general Journal

Required 3 >

Debit

Credit

Required 3 >

Journal entry worksheet

View general journal

Record the adjusting entry for interest for Precision Castparts.

Note: Enter debits before credits.

<

Date

December 31,

2024

Record entry

Journal entry worksheet

Note: Enter debits before credits.

General Journal

Date

September 30, 2025

Clear entry

Record entry

< Required 1

Record the repayment of the note and payment of interest at maturity for

Precision Castparts.

General Journal

Clear entry

Debit

< Required 2

Credit

View general Journal

Required 3 >

Debit

Credit

>

View general Journal

Required 3 >

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College