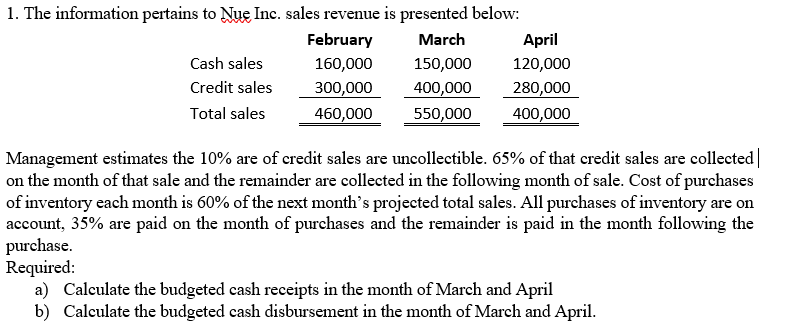

The information pertains to Nue Inc. sales revenue is presented below: February March April Cash sales 160,000 150,000 120,000 Credit sales 300,000 400,000 280,000 Total sales 460,000 550,000 400,000 anagement estimates the 10% are of credit sales are uncollectible. 65% of that credit sales are collected| the month of that sale and the remainder are collected in the following month of sale. Cost of purchases inventory each month is 60% of the next month's projected total sales. All purchases of inventory are on count, 35% are paid on the month of purchases and the remainder is paid in the month following the rchase. equired: a) Calculate the budgeted cash receipts in the month of March and April b) Calculate the budgeted cash disbursement in the month of March and April.

The information pertains to Nue Inc. sales revenue is presented below: February March April Cash sales 160,000 150,000 120,000 Credit sales 300,000 400,000 280,000 Total sales 460,000 550,000 400,000 anagement estimates the 10% are of credit sales are uncollectible. 65% of that credit sales are collected| the month of that sale and the remainder are collected in the following month of sale. Cost of purchases inventory each month is 60% of the next month's projected total sales. All purchases of inventory are on count, 35% are paid on the month of purchases and the remainder is paid in the month following the rchase. equired: a) Calculate the budgeted cash receipts in the month of March and April b) Calculate the budgeted cash disbursement in the month of March and April.

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 1P

Related questions

Question

please answer with complete solution

Transcribed Image Text:1. The information pertains to Nue Inc. sales revenue is presented below:

February

March

April

Cash sales

160,000

150,000

120,000

Credit sales

300,000

400,000

280,000

Total sales

460,000

550,000

400,000

Management estimates the 10% are of credit sales are uncollectible. 65% of that credit sales are collected

on the month of that sale and the remainder are collected in the following month of sale. Cost of purchases

of inventory each month is 60% of the next month's projected total sales. All purchases of inventory are on

account, 35% are paid on the month of purchases and the remainder is paid in the month following the

purchase.

Required:

a) Calculate the budgeted cash receipts in the month of March and April

b) Calculate the budgeted cash disbursement in the month of March and April.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning