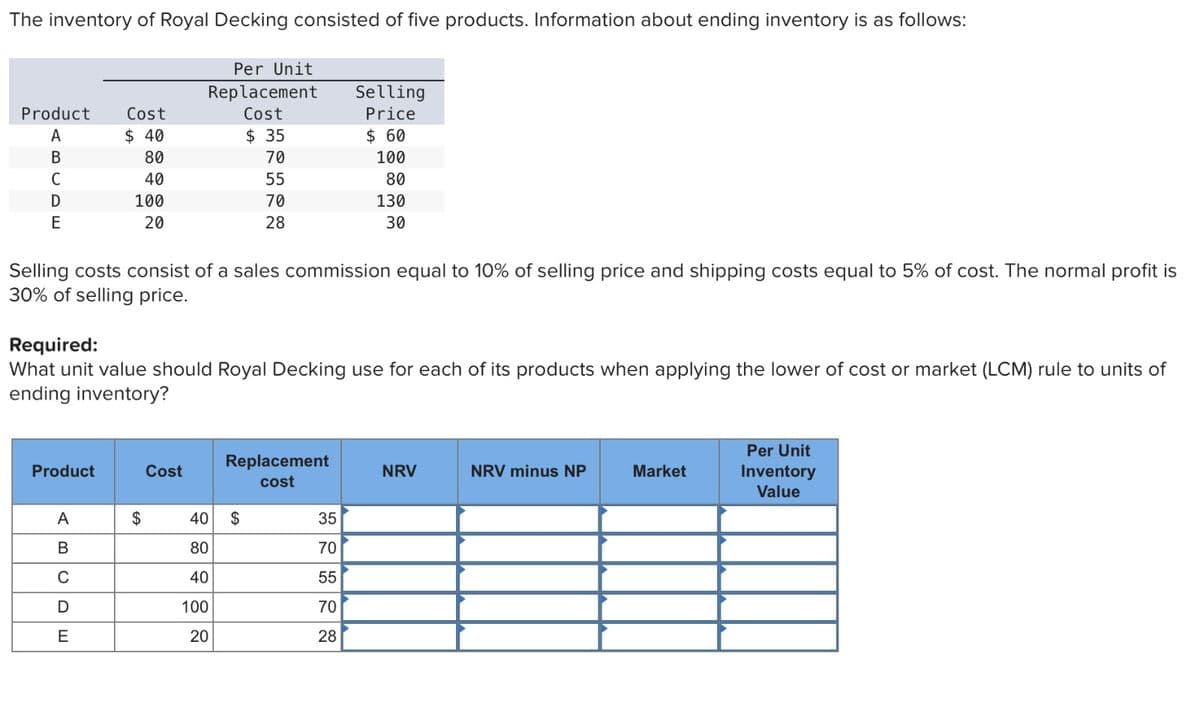

The inventory of Royal Decking consisted of five products. Information about ending inventory is as follows: Per Unit Replacement Product Cost Cost Selling Price A $ 40 $ 35 $ 60 B 80 70 100 C 40 55 80 D 100 E 20 70 28 130 30 Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal profit is 30% of selling price. Required: What unit value should Royal Decking use for each of its products when applying the lower of cost or market (LCM) rule to units of ending inventory? Product Cost Replacement cost A $ 40 $ 35 B 80 70 C 40 55 D 100 70 E 20 28 NRV NRV minus NP Market Per Unit Inventory Value

The inventory of Royal Decking consisted of five products. Information about ending inventory is as follows: Per Unit Replacement Product Cost Cost Selling Price A $ 40 $ 35 $ 60 B 80 70 100 C 40 55 80 D 100 E 20 70 28 130 30 Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal profit is 30% of selling price. Required: What unit value should Royal Decking use for each of its products when applying the lower of cost or market (LCM) rule to units of ending inventory? Product Cost Replacement cost A $ 40 $ 35 B 80 70 C 40 55 D 100 70 E 20 28 NRV NRV minus NP Market Per Unit Inventory Value

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 2RE: Black Corporation uses the LIFO cost flow assumption. Each unit of its inventory has a net...

Related questions

Topic Video

Question

Haresh

Transcribed Image Text:The inventory of Royal Decking consisted of five products. Information about ending inventory is as follows:

Per Unit

Replacement

Product

Cost

Cost

Selling

Price

A

$ 40

$ 35

$ 60

B

80

70

100

C

40

55

80

D

100

E

20

70

28

130

30

Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal profit is

30% of selling price.

Required:

What unit value should Royal Decking use for each of its products when applying the lower of cost or market (LCM) rule to units of

ending inventory?

Product

Cost

Replacement

cost

A

$

40 $

35

B

80

70

C

40

55

DE

100

70

20

28

NRV

NRV minus NP

Market

Per Unit

Inventory

Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College