The lease is noncancelable and has a term of 8 years. • The annual rentals are $28,900, payable at the beginning of each year. • The interest rate implicit in the lease is 12%. • Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for $1 at the end of the lease term, December 31, 2026. • The cost of the equipment to the lessor is $144,000, and the fair value is approximately $160,800. • Ballieu incurs no material initial direct costs.

The lease is noncancelable and has a term of 8 years. • The annual rentals are $28,900, payable at the beginning of each year. • The interest rate implicit in the lease is 12%. • Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for $1 at the end of the lease term, December 31, 2026. • The cost of the equipment to the lessor is $144,000, and the fair value is approximately $160,800. • Ballieu incurs no material initial direct costs.

Chapter10: Financial Statements And Reports

Section: Chapter Questions

Problem 2.3C

Related questions

Question

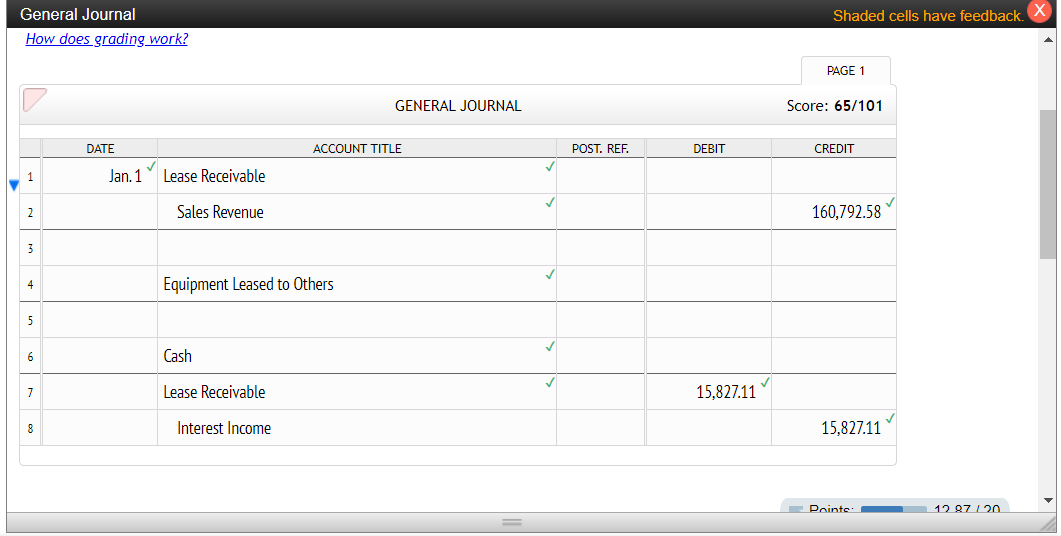

On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions:

| • | The lease is noncancelable and has a term of 8 years. |

| • | The annual rentals are $28,900, payable at the beginning of each year. |

| • | The interest rate implicit in the lease is 12%. |

| • | Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for $1 at the end of the lease term, December 31, 2026. |

| • | The cost of the equipment to the lessor is $144,000, and the fair value is approximately $160,800. |

| • | Ballieu incurs no material initial direct costs. |

| • | It is probable that Ballieu will collect the lease payments. |

| • | Ballieu estimates that the fair value is expected to be significantly greater than $1 at the end of the lease term. |

Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of $28,900 discounted at 12% is $160,792.58 (the $1 purchase option is ignored as immaterial).

Required

Prepare all the journal entries for Ballieu for the years 2019

Transcribed Image Text:General Journal

Shaded cells have feedback. X

How does grading work?

PAGE 1

GENERAL JOURNAL

Score: 65/101

DATE

ACCOUNT TITLE

POST. REF.

DEBIT

CREDIT

1

Jan. 1

Lease Receivable

2

Sales Revenue

160,792.58

3

4

Equipment Leased to Others

5

6

Cash

7

Lease Receivable

15,827.11

8

Interest Income

15,827.11

Points:

12 87 120

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L