Find the book value for the asset shown in the accompanying table, assuming that MACRS depresiing is being used: View the table attached: Asset Installed Cost Recovery Period (Years) Elapsed time since purchase (Years) A $902,000 5 3

Find the book value for the asset shown in the accompanying table, assuming that MACRS depresiing is being used: View the table attached: Asset Installed Cost Recovery Period (Years) Elapsed time since purchase (Years) A $902,000 5 3

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 7BCRQ

Related questions

Question

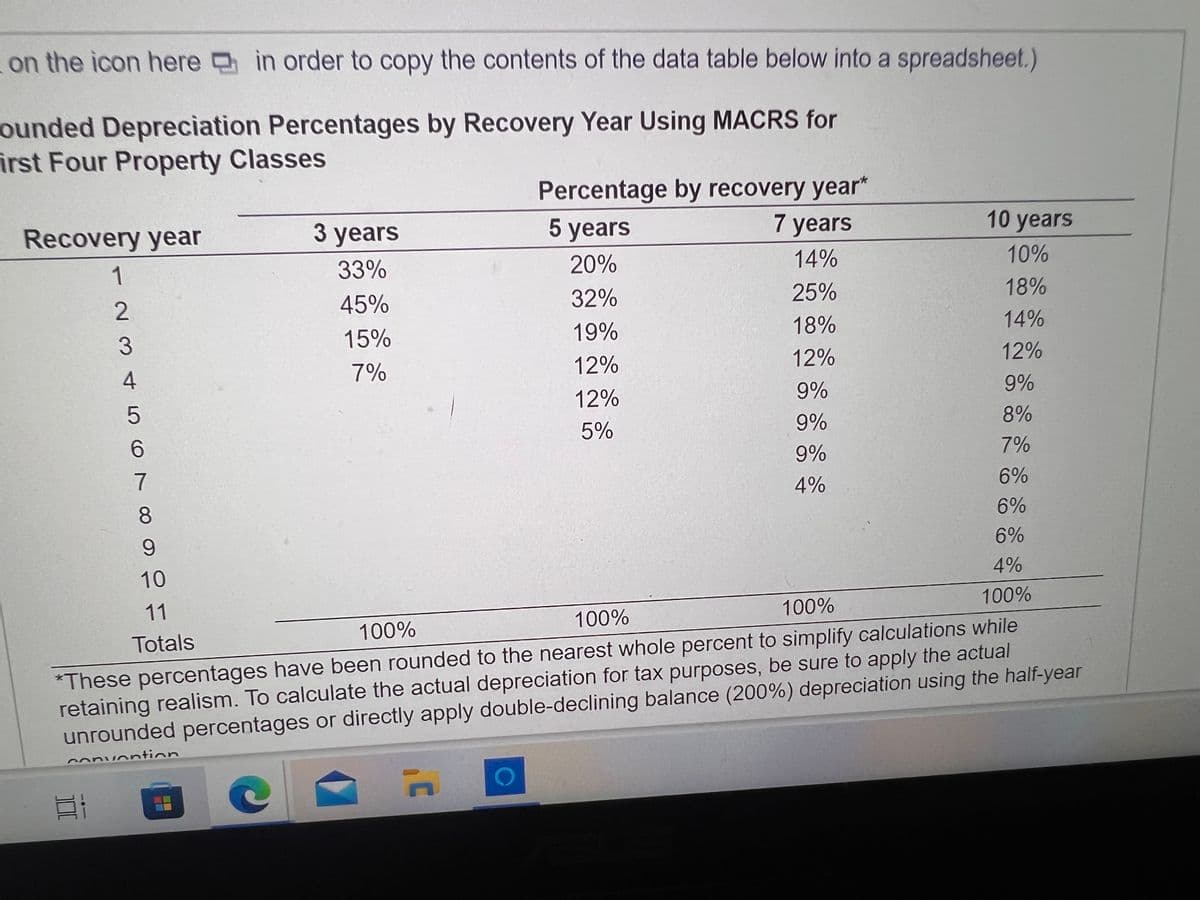

Find the book value for the asset shown in the accompanying table, assuming that MACRS depresiing is being used:

View the table attached:

| Asset | Installed Cost | Recovery Period (Years) | Elapsed time since purchase (Years) |

| A | $902,000 | 5 | 3 |

Transcribed Image Text:on the icon here in order to copy the contents of the data table below into a spreadsheet.)

ounded Depreciation Percentages by Recovery Year Using MACRS for

irst Four Property Classes

Percentage by recovery year*

7 years

Recovery year

3 years

5 years

10 years

20%

14%

10%

33%

25%

18%

45%

32%

2.

14%

19%

18%

15%

12%

12%

7%

12%

4

9%

12%

9%

8%

5%

9%

7%

9%

7

4%

6%

6%

8.

6%

4%

10

100%

11

100%

100%

*These percentages have been rounded to the nearest whole percent to simplify calculations while

retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual

unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year

100%

Totals

convontion

1.

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT