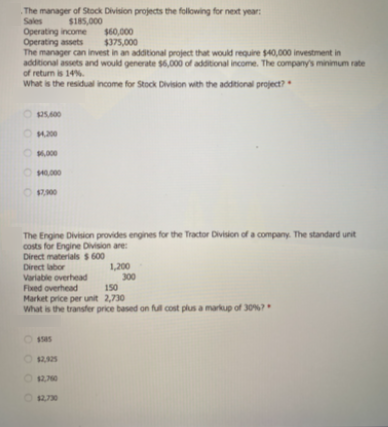

The manager of Stock Division projects the following for next year: Sales $185,000 $60,000 $375,000 Operating income Operating assets The manager can invest in an additional project that would require 40,000 investment in additional assets and would generate s6,000 of additional income. The company's minimum rate of return is 14%. What is the residual income for Stock Division with the additional project? O M00 O ML0 O 00

The manager of Stock Division projects the following for next year: Sales $185,000 $60,000 $375,000 Operating income Operating assets The manager can invest in an additional project that would require 40,000 investment in additional assets and would generate s6,000 of additional income. The company's minimum rate of return is 14%. What is the residual income for Stock Division with the additional project? O M00 O ML0 O 00

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 102.3C

Related questions

Question

Transcribed Image Text:The manager of Stock Division projects the following for next year:

Sales

$185,000

Operating income

Operating assets

The manager can invest in an additional project that would require $40,000 investment in

additional assets and would generate $6,000 of additional income. The company's minimum rate

of return is 14%.

What is the residual income for Stock Division with the additional project?

$60,000

$375,000

O .000

O 000

O 900

The Engine Division provides engines for the Tractor Division of a company The standard unit

costs for Engine Division are:

Direct materials $ 600

Direct labor

Variable overhead

1,200

300

150

Fixed overhead

Market price per unit 2,730

What is the transfer price based on ful cost plus a markup of 30%?

O ssas

O 1270

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning