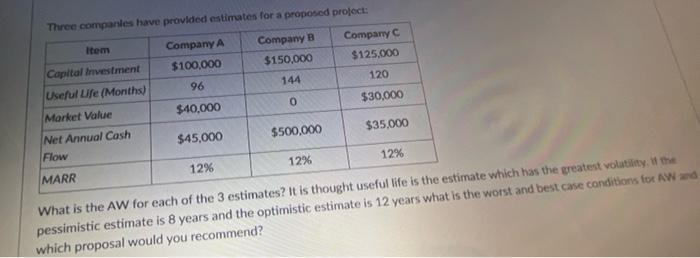

Three companies have prov Item Company A Company B Company C Capital Investment $100,000 $150,000 $125,000 Useful Life (Months) 96 144 120 Market Value $40,000 0 $30,000 Net Annual Cash $45,000 $500,000 $35,000 Flow 12% MARR 12% 12% What is the AW for each of the 3 estimates? It is thought useful life is the estimate which has the greatest volatility. If the pessimistic estimate is 8 years and the optimistic estimate is 12 years what is the worst and best case conditions for AW and which proposal would you recommend?

Three companies have prov Item Company A Company B Company C Capital Investment $100,000 $150,000 $125,000 Useful Life (Months) 96 144 120 Market Value $40,000 0 $30,000 Net Annual Cash $45,000 $500,000 $35,000 Flow 12% MARR 12% 12% What is the AW for each of the 3 estimates? It is thought useful life is the estimate which has the greatest volatility. If the pessimistic estimate is 8 years and the optimistic estimate is 12 years what is the worst and best case conditions for AW and which proposal would you recommend?

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 17E

Related questions

Question

Transcribed Image Text:Three companies have provided estimates for a proposed project:

Item

Company A

Company B

Company C

Capital Investment

$100,000

$150,000

$125,000

Useful Life (Months)

96

144

120

Market Value

$40,000

0

$30,000

Net Annual Cash

$45,000

$500,000

$35,000

Flow

12%

MARR

12%

12%

What is the AW for each of the 3 estimates? It is thought useful life is the estimate which has the greatest volatility. If the

pessimistic estimate is 8 years and the optimistic estimate is 12 years what is the worst and best case conditions for AW and

which proposal would you recommend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT