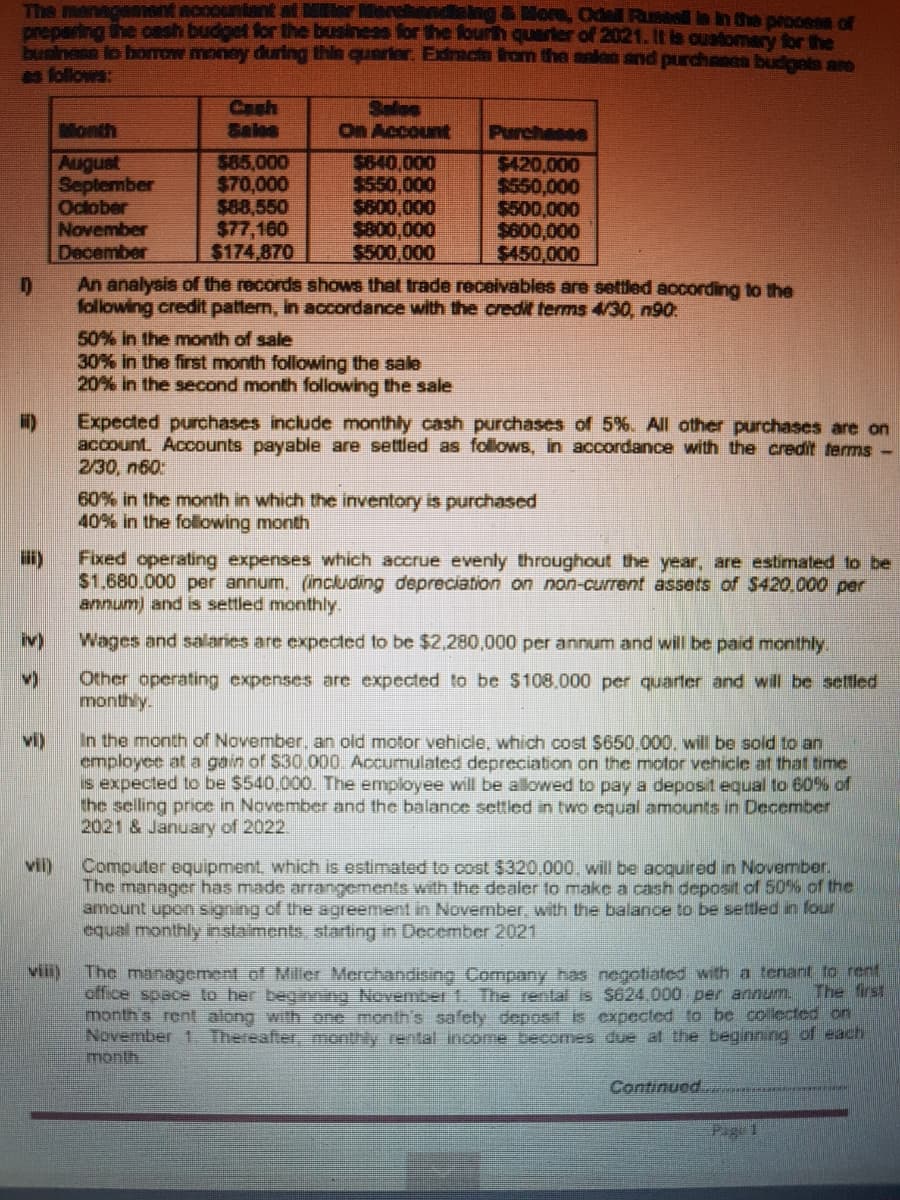

The menagament nooountant at preparing the cash budget for the business for the fourth quarier of 2021. It is Customery for the business lo borrow money during thin quarler. Exdracts Irom the anlon snd purchanaa budgets am es follows: Miler Merehen deing & More, Odell Runeel i in the process of Cash Sales On Account Month Sales Purchases August September October November December $85,000 $70,000 $88,550 $77,160 $174,870 $640,000 $550,000 $600,000 $800,000 $500,000 $420,000 $550,000 $500,000 $600,000 $450,000

The menagament nooountant at preparing the cash budget for the business for the fourth quarier of 2021. It is Customery for the business lo borrow money during thin quarler. Exdracts Irom the anlon snd purchanaa budgets am es follows: Miler Merehen deing & More, Odell Runeel i in the process of Cash Sales On Account Month Sales Purchases August September October November December $85,000 $70,000 $88,550 $77,160 $174,870 $640,000 $550,000 $600,000 $800,000 $500,000 $420,000 $550,000 $500,000 $600,000 $450,000

Chapter8: Budgets And Bank Reconciliations

Section: Chapter Questions

Problem 4.1C

Related questions

Question

100%

Can you please assist.

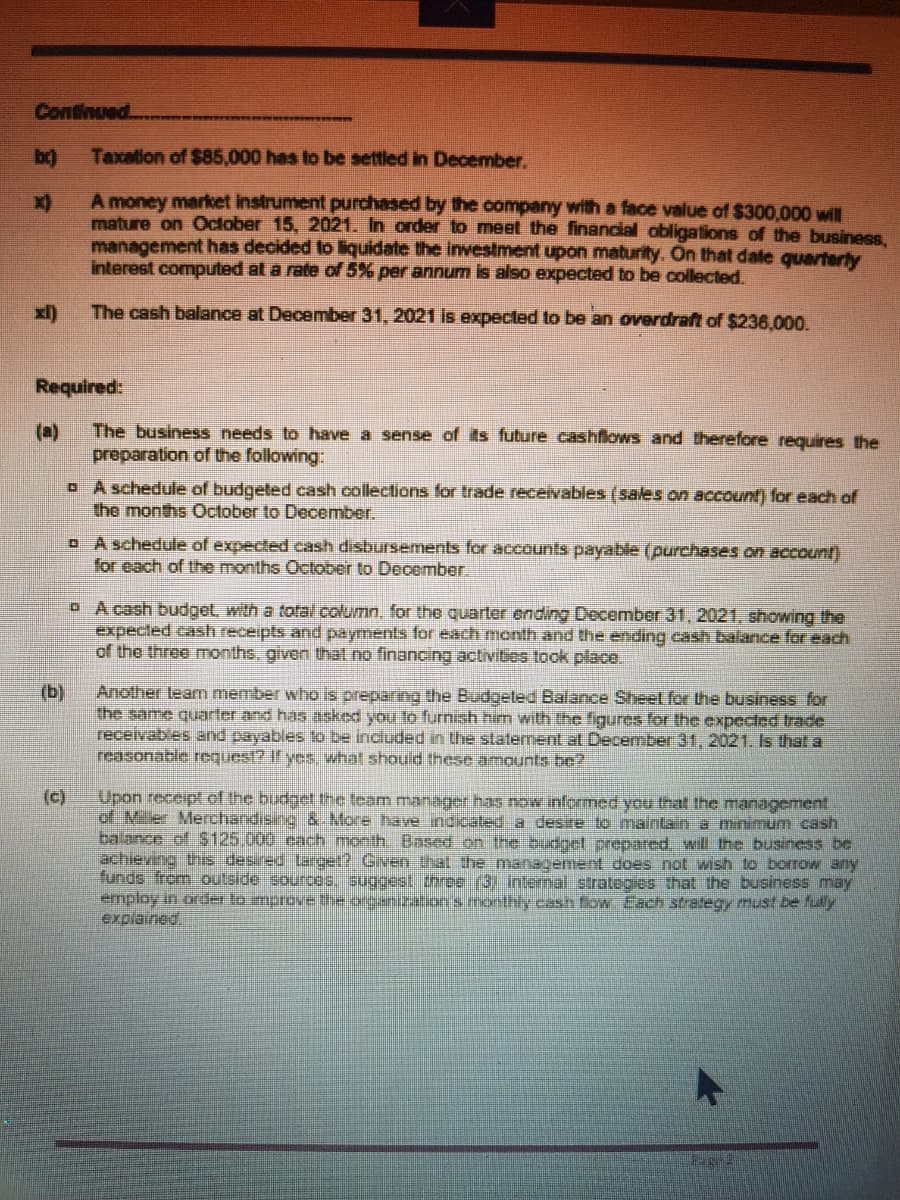

Transcribed Image Text:Continued

Taxation of $85,000 has to be settled in December.

A money market instrument purchased by the company with a face value of $300,000 will

mature on October 15, 2021. In order to meet the financial obligations of the business,

management has decided to liquidate the investment upon maturity. On that date quarterty

interest computed at a rate of 5% per annum is also expected to be collected.

xl)

The cash balance at December 31, 2021 is expected to be an overdraft of $236,000.

Required:

(a)

The business needs to have a sense of its future cashflows and therefore requires the

preparation of the following:

o A schedule of budgeted cash collections for trade receivables (sales on account) for each of

the months October to December.

o A schedule of expected cash disbursements for accounts payable (purchases on account)

for each of the months October to December.

O A cash budgel, with a total column, for the quarter ending December 31, 2021, showing the

expected cash receipts and payments for each month and the ending cash balance for each

of the three onths, given that no financing activitios took place.

(b)

Another team member who is preparing the Budgeted Balance Sheet for the business for

the same quarter and has asked you to furnish him with the figures for the expected trade

receivables and payables to be included in the statement at December 31, 2021. Is that a

reasonable request? If yes, what should these amounts be?

(c)

Upon receipt of the budget the team manager has now informed you that the management

of Miler Merchandising & More have ndicated a desire to maintain a minimum cash

balance of S125.000 cach month. Based on the budget prepared. will the business be

achieving this desired Larget? Given that the management does not wish to borrow any

funds from outside sources. suggest three (3) intenal strategies that the business may

employ in order to mprovethe oreanizaton's monthly cash fow Each strategy must be fully

explained

Transcribed Image Text:The managament nooountant at Mler Maret

preparing the oash budget for lthe business for the fourth quarier of 2021. It is oustomery for the

usiness lo borrow money during thin quarler. Exracts Irom the anlan and purchanas budgeta aro

es follows:

eing & More, Odel Rusee a in the procen of

Cash

Sales

Sales

On Account

Month

Purcheses

August

September

October

November

December

$640,000

$550,000

$600,000

$800,000

క00,000

An analysis of the records shows that trade receivables are settled according to the

following credit pattern, in accordance with the credit terms 4/30, n90.

585,000

$70,000

$88,550

$77,160

$174,870

$420,000

$550,000

$500,000

S600,000

450,000

50% in the month of sale

30% in the first month following the sale

20% in the second month following the sale

Expected purchases include monthly cash purchases of 5%. All other purchases are on

account. Accounts payable are settled as follows, in accordance with the credit terms -

2/30, n60:

60% in the month in which the inventory is purchased

40% in the foliowing month

Fixed operating expenses which accrue evenly throughout the year, are estimated to be

$1.680.000 per annum, (including depreciation on non-current assets of S420,000 per

annum) and is settled monthly.

iv)

Wages and salaries are expected to be $2,280,000 per annum and will be paid monthly.

v)

Other operating expenses are expected to be $108.000 per quarter and will be settled

monthly.

In the month of November, an old motor vehicle, which cost $650.000, will be sold to an

employee at a gain of S30.000 Accumulated depreciation on the motor vehicle at that time

is expected to be $540.000. The employee will be allowed to pay a deposit equal to 60% of

the selling price in November and the balance settled in two cqual amounts in December

2021 & January of 2022.

vi)

Computer equipment, which is estimated to cost $320.000, will be acquired in November.

The manager has made arrangements with the dealer to make a cash deposit of 50% of the

amount upon sgning of the agreement in November, with the balance to be settled in four

equal monthly instaiments, starting in December 2021

vii)

The management of Miller Merchandising Company has negotiated with a tenant to rent

office space to her begimg Nevember 1 The retal is $624.000 per annum.

month's rent along with one month's safety depost is expected to be colected on

November 1. Thereafter, monthly rental income becomes due at the beginning of each

month.

viii)

The first

Continued.

Page 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning