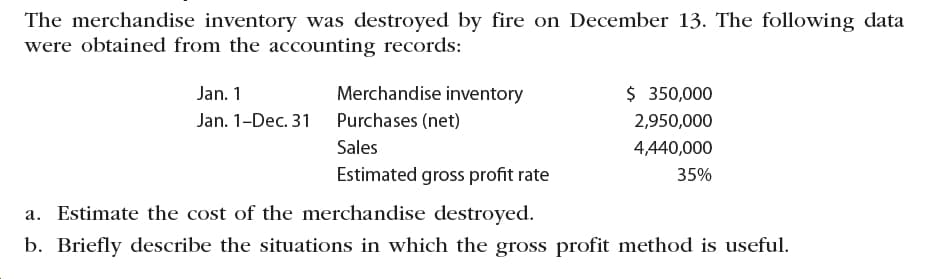

The merchandise inventory was destroyed by fire on December 13. The following data were obtained from the accounting records: Merchandise inventory $ 350,000 Jan. 1 Jan. 1-Dec. 31 Purchases (net) 2,950,000 Sales 4,440,000 Estimated gross profit rate 35% a. Estimate the cost of the merchandise destroyed. b. Briefly describe the situations in which the gross profit method is useful.

The merchandise inventory was destroyed by fire on December 13. The following data were obtained from the accounting records: Merchandise inventory $ 350,000 Jan. 1 Jan. 1-Dec. 31 Purchases (net) 2,950,000 Sales 4,440,000 Estimated gross profit rate 35% a. Estimate the cost of the merchandise destroyed. b. Briefly describe the situations in which the gross profit method is useful.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 7PB: Selected data on merchandise inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as...

Related questions

Question

Transcribed Image Text:The merchandise inventory was destroyed by fire on December 13. The following data

were obtained from the accounting records:

Merchandise inventory

$ 350,000

Jan. 1

Jan. 1-Dec. 31

Purchases (net)

2,950,000

Sales

4,440,000

Estimated gross profit rate

35%

a. Estimate the cost of the merchandise destroyed.

b. Briefly describe the situations in which the gross profit method is useful.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning